We are in the worry stage surrounding 6-month lows. Prices may have bottomed, but it’s unconfirmed. If metals and miners remain buoyant next week, I’ll give the all clear and confirm the 6-month lows. If prices weaken and close below key support, we may see one more dip.

Miners are diverging positively from gold (see GDX). Miners remained well-above their March lows while gold fell marginally below it. The underlying health points to a change in leadership that should result in significant gains.

Silver is also setup for a nice rally higher. Investors have endured a prolonged consolidation. Breaking above the upper trendline (near $17.25) should inspire an aggressive rally.

-US DOLLAR WEEKLY- The Dollar formed a bearish shooting star reversal candle at the 50-week EMA. Closing below 92.24 next week would create a swing high and possible top. Note: The Slow Stochastics is overbought and consistent with rebound highs.

-US DOLLAR DAILY- The next step in confirming a top is closing progressively below the 10-day EMA. Consecutive closes decisively below the 200-day MA would recommend a significant top.

.

-GOLD WEEKLY- We needed a close above $1325.90 to form a weekly swing low and likely 6-month bottom. Prices rallied to $1326.30 on Friday before retreating. A 6-month low is probable but unconfirmed. Nevertheless, an uptrend is developing with each 6-month cycle making higher highs and higher lows. Once this bottom is confirmed, prices should breakout above $1400 and enter the advancing phase of a bull market.

-GOLD DAILY- Prices tested and reversed at the 20/50-day crossover; we could see a brief pullback. Closing below $1310 would renew the potential for final decline into a 6-month low. Whereas, closing above Friday’s $1,326.30 high would validate $1302.30 as the 6-month low.

-SILVER WEEKLY- Prices closed above the 10-day EMA and formed a weekly swing low. I’ve been expecting a powerful move higher. Breaking decisively above the upper boundary (currently $17.25) should trigger a sustained rally.

-SILVER DAILY- Prices met resistance at the 200-day MA. We could see a pause or consolidation. It would take a daily close below $16.34 to reverse the short-term uptrend. Unless that occurs, the odds favor higher prices and bullish breakout above upper trendline in the coming weeks.

-GDX- Prices pulled back on light volume but remained above the trendline. To advance the bullish case miners need to close above $23.15 and then $23.31. Miners are diverging from gold: Gold broke marginally below its March 1st low while miners remained well-above their March $20.94 low.

-GDXJ- Prices fell back below the upper trendline. I’ll maintain a bullish outlook as long as prices don’t close below last weeks $32.92 low.

-JUNG- I’d like to see prices remain (not close below) $15.00 next week. However, it would take a daily close below $14.31 to reverse the short-term uptrend and propose more downside.

-USLV- A significant low remains likely as long as prices don’t close below last weeks $9.67 low.

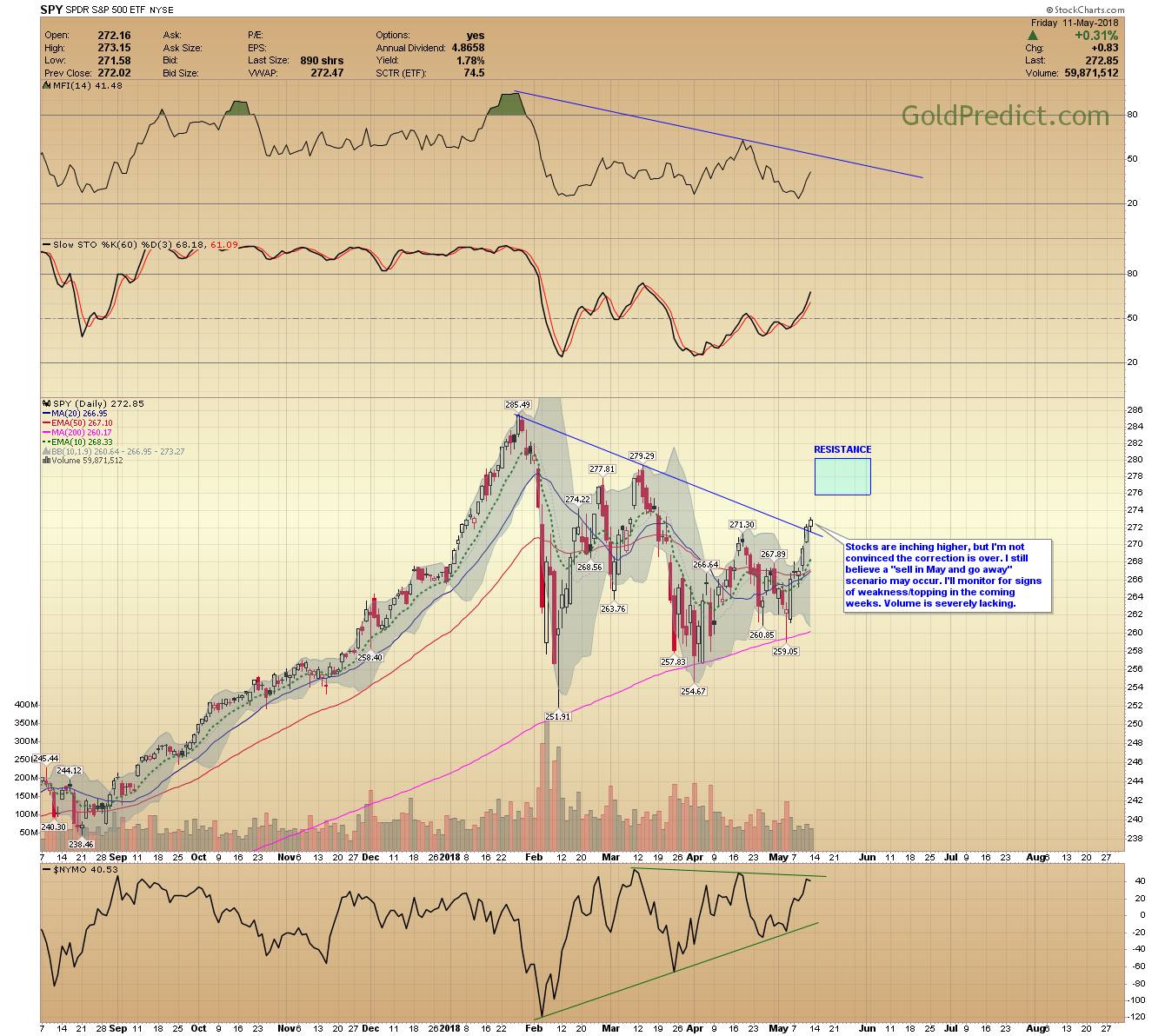

-SPY- Stocks are inching higher, but I’m not convinced the correction is over. I still believe a “sell in May and go away” scenario may occur. I’ll monitor for signs of weakness/topping in the coming weeks. Volume is severely lacking.

-WTIC- Nothing new in Oil. Prices could top around May 23rd.

Metals and Miners need to hold last weeks lows to remain bullish and establish their 6-month lows.

Have a great weekend.