Next week is critical for metals and miners

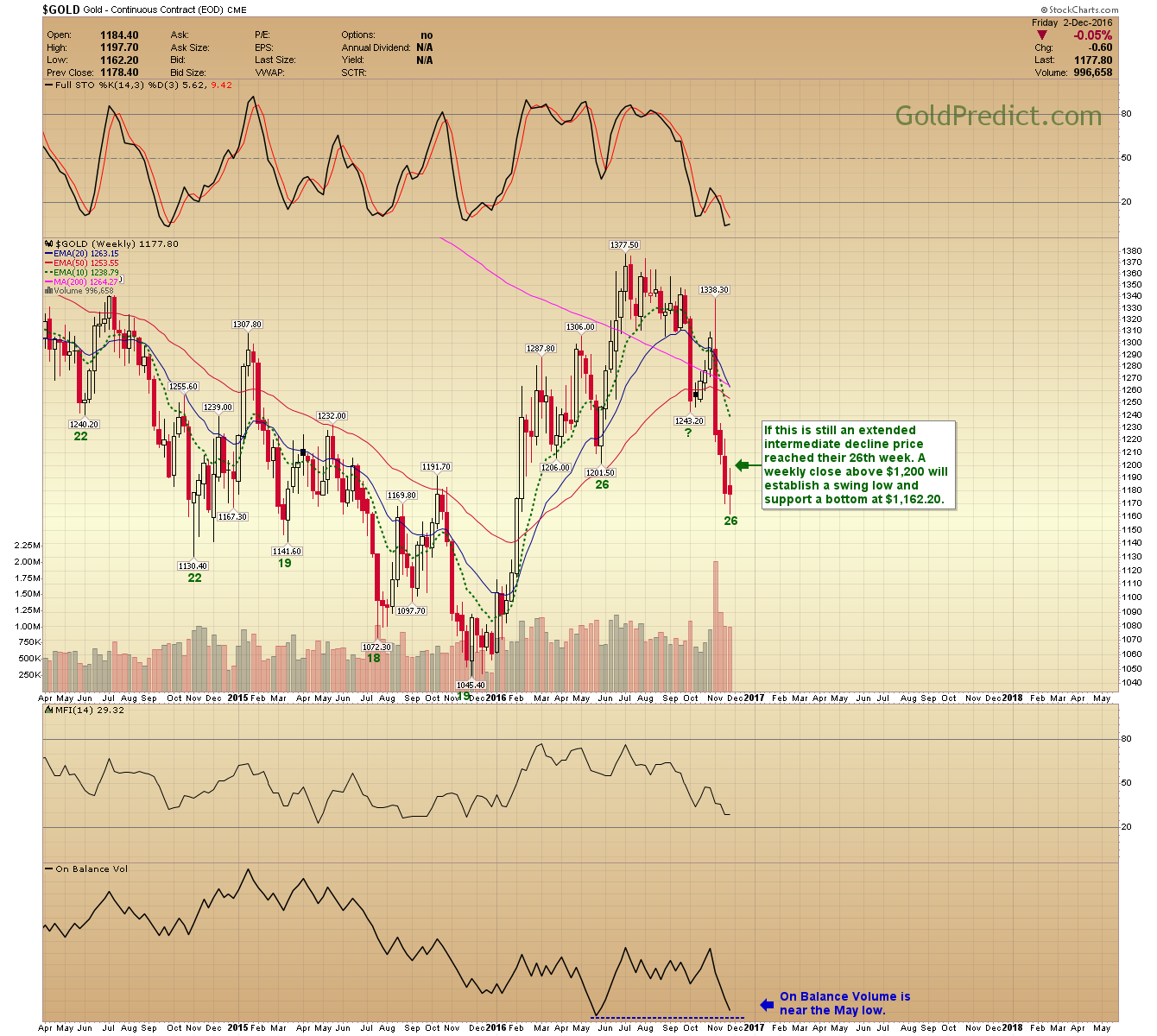

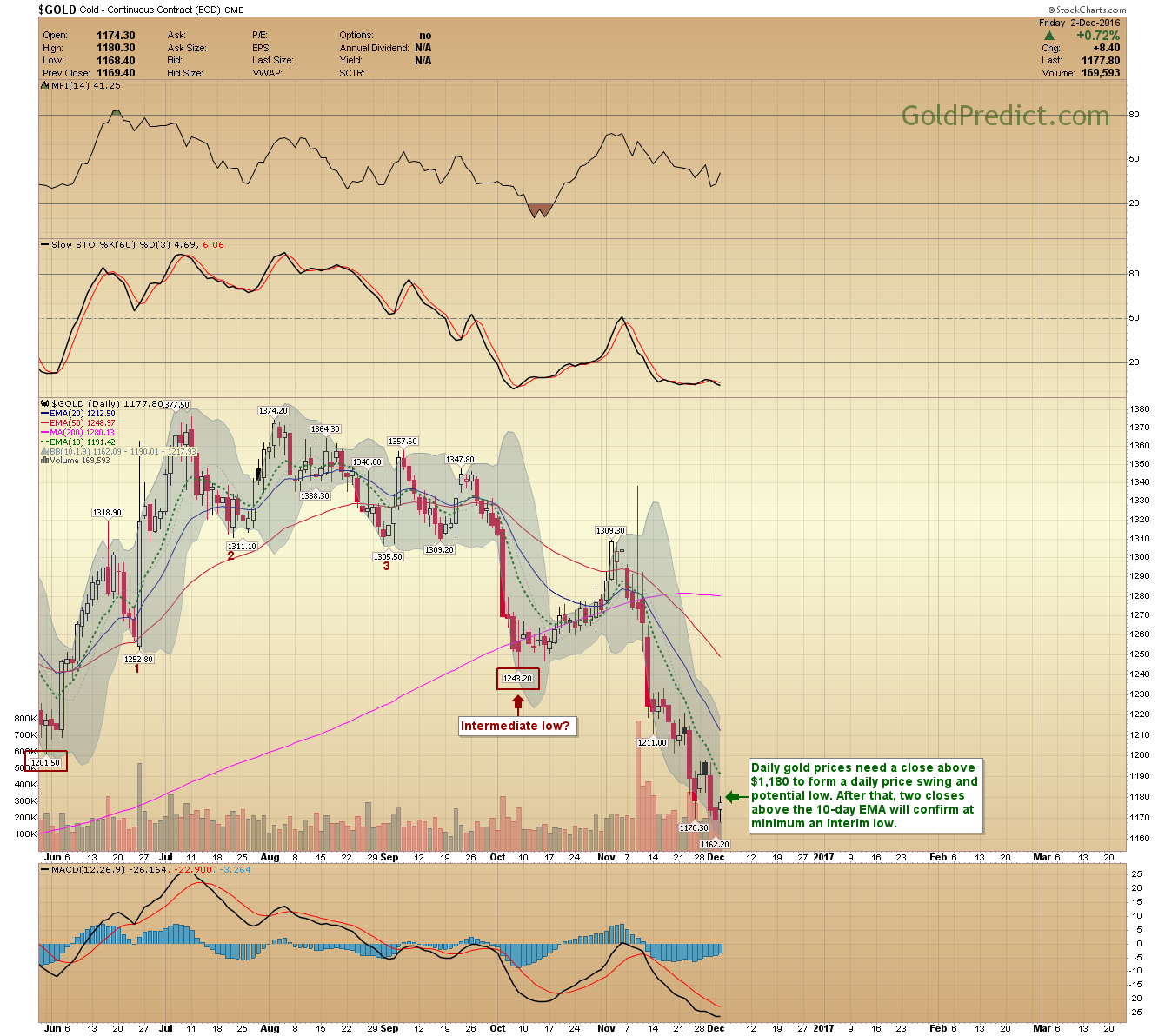

Gold prices have been at a major inflection point for several weeks. There are two ways to interpret the current cycle count, one bullish and one temporarily bearish. The first suggests prices made an intermediate low Thursday at $1,162.20 and that the bull market is about to resume. The second scenario is bearish, suggesting that we are 8-weeks into a failed intermediate cycle and that prices may fall back to the $1,000 level.

Everything is lining up, and we should be able to eliminate one of the scenarios by the end of next week. Expect multiple updates throughout the week as key levels are tested.

-US DOLLAR- The dollar closed beneath the 10-day EMA, and a correction is underway. Prices should find support between 99 and 100.

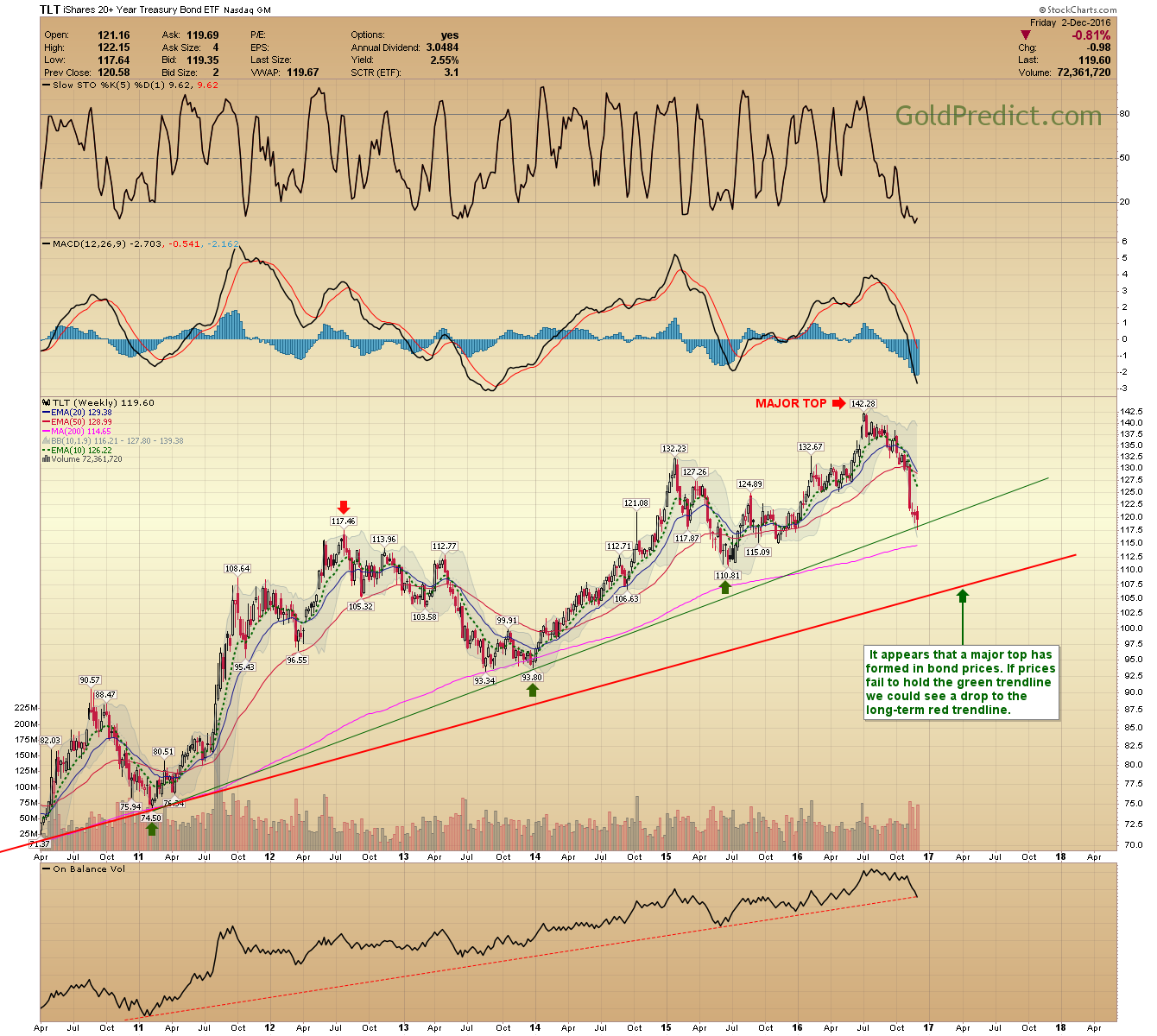

-TLT- It appears that a major top has formed in bond prices. If prices fail to hold the green trendline we could see a drop to the long-term (red) trendline.

-YEN- The Yen is bouncing off the 61.8% retracement level. The drop from 97-87 registered extremes in momentum. When a low arrives in these conditions, it will often be tested or surpassed.

-GOLD WEEKLY- If this is still an extended intermediate decline price reached the 26th week. A weekly close above $1,200 will establish a swing low and support the bottom at $1,162.20.

-GOLD DAILY- Daily gold prices need a close above $1,180 to form a daily price swing and possible low. After that, two closes above the 10-day EMA will confirm an interim low.

-SILVER WEEKLY- Weekly silver prices need to close above $16.90 to form a price swing and potential intermediate low. Prices are maintaining the May $15.83 low, breaching that level would be technically damaging.

-SILVER DAILY- There is a congestion zone between $17.70 and $17.20. It would take a strong move through this resistance to convince me that a trending advance has begun.

-HUI:GOLD RATIO- A divergence has formed in the HUI to GOLD ratio. A close above the 50-week EMA (0.162) would indicate to me that the correction in gold is complete.

-HUI- It’s Make-or-Break time for miners. Prices are ready to test the underside of the neckline. If they do not successfully retake the 195 level, prices will drop to the head-and-shoulder target of 133 or lower.

-GDX- I will be watching the $22.50 level carefully. A strong move through that level implies a double bottom at $20.13 and that the bull market has resumed. If the rally fails, then we will see a drop to $16.00 or lower.

-GDXJ- Here is the resistance zone for junior miners. A sharp move through this level will confirm an intermediate low.

-SPY- Stocks settled right at the 10-day EMA once again. A solid close below it will confirm that a correction is underway.

-WTIC- A weekly close above $53.00 will invert the intermediate-term cycle and rather than bottoming in January, prices would form an interim top between $60.00 and $70.00.

I will defer entering long positions in metals and miners until I see sufficient evidence of a trend change. The strong dollar is a headwind, and that could make it difficult for gold to advance. If prices are unable to retake their critical levels, I’ll remove the excellent buy rating and transition to price neutral.