This report will cover our medium-term outlook for precious metals as well as gold’s longer-term forecast.

Our analysis suggests Metals and Miners probably topped last Friday. If correct, prices should drop for the rest of April and into May. We will monitor the decline for momentum, and strength of trend. If prices move powerfully lower into May, we could see additional downside into the June FED meeting.

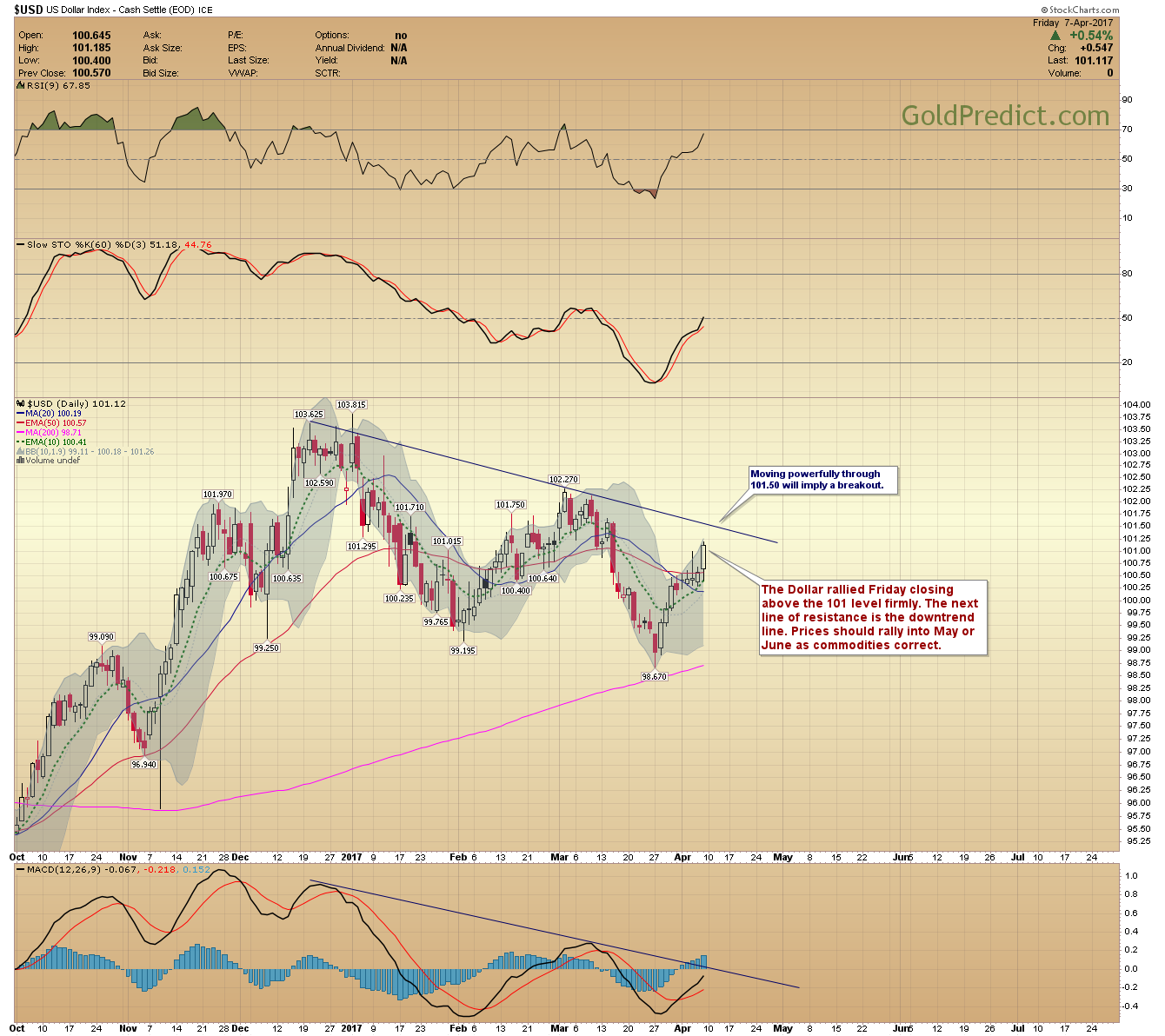

The dollar bottomed March 27th and prices may breakout. Commodities, in general, should correct as the dollar rallies…possibly to fresh highs.

SHORT-TERM CHARTS

-US DOLLAR- The Dollar rallied Friday closing above the 101 level firmly. The next line of resistance is the downtrend line. Moving strongly through 101.50 will imply a breakout. Prices should rally into May or June as commodities correct.

-GOLD- Prices made a large shooting star reversal candle on the 20th trading day. Though prices spiked to $1,273.30 on Friday, they never made a new closing high. A close below the 20-day EMA ($1,245) will confirm a top.

-SILVER- The price data is incorrect. Silver closed at $18.00 on Friday, and below the 10-day EMA. I believe prices topped with gold. We should see a drop below $17.00 by May. Breaking below $15.68 could lead to a rapid selloff.

-GDX- Prices likely topped Friday. To be certain, we need to see follow-through lower next week. Closing below the 10-day EMA ($23.22) and then below the trendline will confirm the next down leg. How sharply prices decline below the trendline will determine the May/June target. Prices should bottom around the May 5th employment report or the June 14th FED meeting.

-GDXJ- Junior Miners were unable to reach a new high with GDX. Closing below the trendline should send prices below the March $32.66 low.

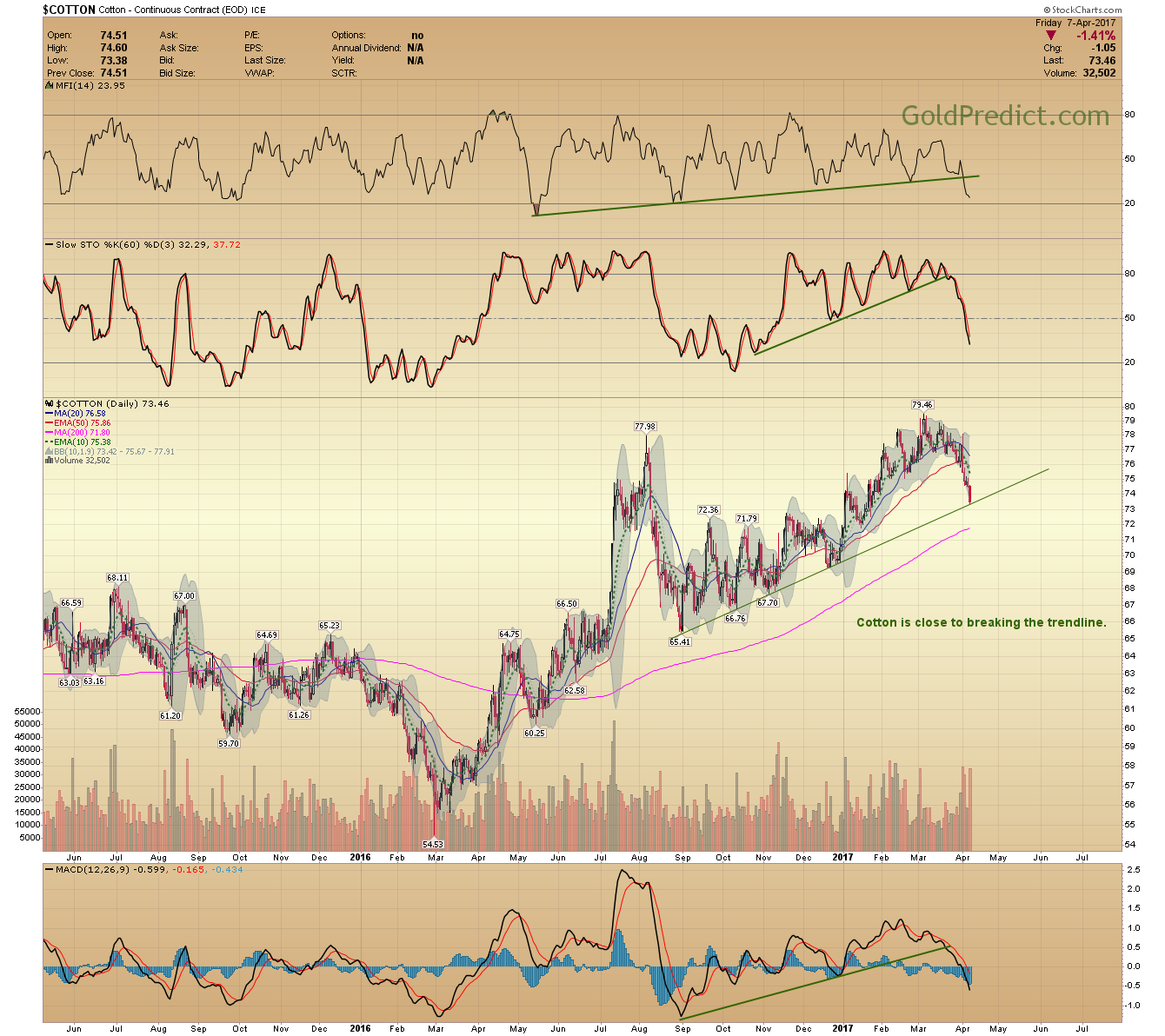

COMMODITIES CORRECTING- Most commodities bottomed in 2016. The initial wave higher is complete, prices should correct into May or June.

-COPPER- Copper is at trendline support and nearing completion of a head and shoulder top. Breaking below the trendline/neckline would target between 2.38 and 2.30. A daily close below 2.59 will confirm the breakdown.

-COTTON- Cotton is close to breaking the trendline.

-CORN- Corn prices already broke down.

-WTIC- Prices spiked up to touch the bottom of the previous trendline. The missile strikes in Syria extended this bounce. Crude should move lower with other commodities. I’d prefer not to see prices close above $53.00.

GOLD’S BIG PICTURE

Our Primary scenario calls for a low in May or June that remains above the December $1,124 low. Once grounded, prices should enter a strong wave 3 advance during the second-half of 2017. However, breaking the trendline could lead to a deeper wave (2) retracement between $1,100 and $1,050.

GOLD TESTING $2,000

Gold should test the $1,900-$2,000 level between August 2018 and April 2019. The US (global economy) should enter a recession around that time. The stock market will top a few months before gold. Higher commodity prices will drive the consumer lead recession in 2019. Gold will probably consolidate for 12-Months during the recession, and after testing $2,000. Prices are expected to breakout above $2,000 in 2020 and reach a parabolic top in 2022 or 2023.

Gold likely topped last Friday. Prices should reach an important low in May or June. The price action over the next few weeks will help us narrow down targets and timing. The May 5th unemployment report may clock the next low. However, prices could produce an additional down swing and bottom closer to the June 14th FED meeting. Once bottomed, prices should rally significantly during the second half of 2017.