The big news today was gold’s inability to rally significantly despite an extremely weak dollar. Today’s action supports a maturing and fatigued gold cycle. However, prices still need to close below $1,283 to form a swing high and then beneath the 10-day EMA to reinforce a top.

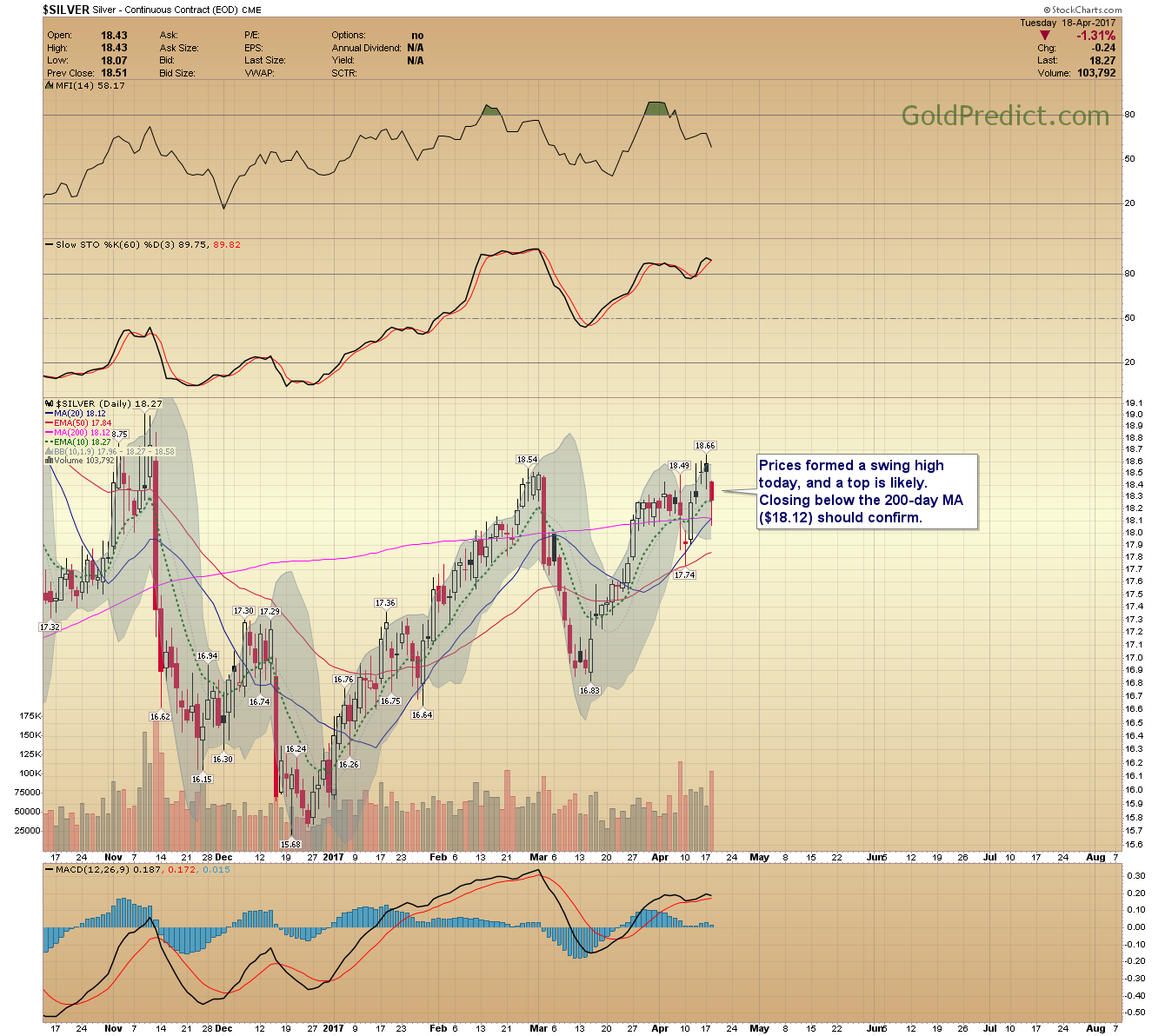

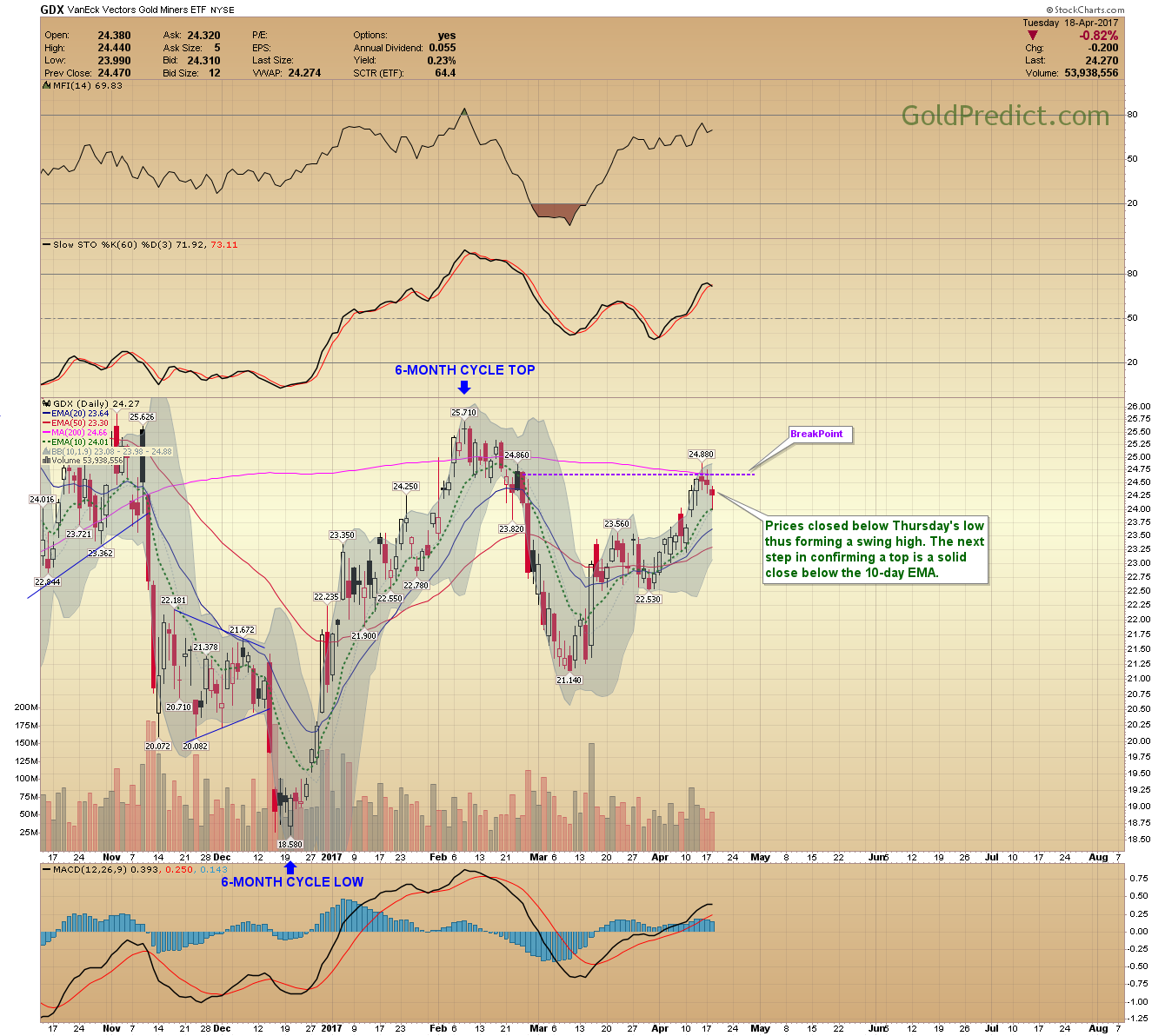

Silver and Miners made swing highs, completing the first step in confirming a top. Next, we need to see daily closes below their 10-day EMA’s.

Oil has bounced off the $52.50-$52.70 level five times since last Tuesday. Decisively defeating that level should lead to selloff.

-US DOLLAR- The Dollar was down sharply today and is approaching the 200-day MA quickly. Gold should have traded markedly higher during today’s sharp decline. The disparity supports gold prices rolling over.

-GOLD- Prices formed another Doji on Monday. A close below $1,283 will form a swing high and a solid close beneath the 10-day EMA should be enough to confirm a top at this point in the cycle.

-SILVER- Prices formed a swing high today, and a top is likely. Closing below the 200-day MA ($18.12) should confirm.

-GDX- Prices closed below Thursday’s low thus forming a swing high. The next step in confirming a top is a solid close below the 10-day EMA.

-DUST- Prices closed above Thursday’s high and made a swing low. The next step in confirming a low is to close above the 10-day EMA.

-GDXJ- Prices closed for the second day below the trendline. The fund suspended orders to create new shares citing that the proper underlying assets were unavailable. It is unclear how they will correct the dilemma.

-JDST- Prices are above the trendline and ended above the 10-day EMA. Closing above Monday’s high ($15.23) will fully confirm the low.

-SPY- Prices are rangebound and need to trade back above the 10-day EMA (234.44) or risk sinking below support at 231.61.

-WTIC- Prices formed a swing high on the Monday close, and a top is likely. Prices found support on an intraday basis around $52.60. Decisively breaking below that level should lead to a discernable selloff.

-XLE- The energy ETF continues to weaken, closing below the $69.00 support level.

-COPPER- Prices are breaking down, and I’d expect other commodities to follow suit.

Metals and Miners appear to be slowly rolling over. Our analysis, though strained, still anticipates a decline into May. The ideal timeframe for this low arrives between May 18th and May 26th.