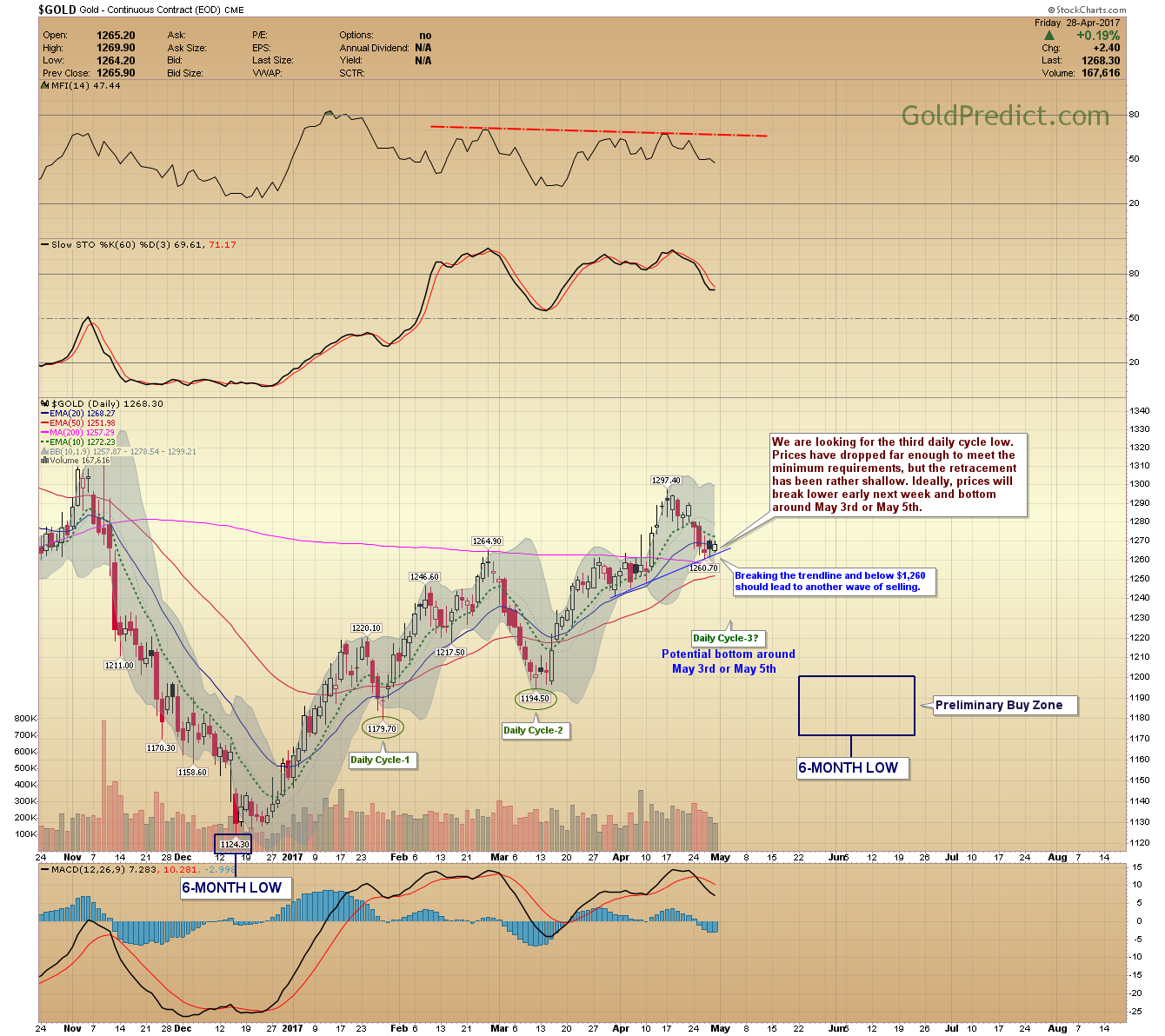

Gold prices are moving down into their third daily cycle low. Prices have met the minimum requirements for a cycle bottom, but the structure looks incomplete. Breaking below $1,260 next week should lead to another wave of selling.

Miners have dropped significantly from their April highs. Prices are oversold on a short-term basis, but they should drop a bit further if gold breaks below $1,260. I present potential prices targets using a gap measuring technique (see charts).

I will be looking to the May 3rd FED meeting or the May 5th employment report for possible bottoms in precious metals and miners. The French election is Sunday, May 7th. The results of that contest could influence stock markets, currencies and precious metals significantly.

We’re anticipating interim lows in precious metals and miners next week. From there, prices should bounce or consolidate for 1-3 weeks. Once the rebound is complete, prices should start the final descent into their 6-month lows, likely bottoming around the June 14th FED meeting.

Each day’s price action produces another piece of the puzzle. As the picture becomes clear, we should be able to narrow down the 6-Month targets for Metals and Miners.

-US DOLLAR- Prices are near the lower boundary of a possible falling wedge pattern. A close above 99.25 would from a swing low and potential bottom. However, the structure looks incomplete, and it may demand another lower low next week before terminating. Initially, I expected a cycle high in early May. It appears we will get a low instead (sequence inversion).

-GOLD WEEKLY- Prices formed a weekly swing high. The 6-Month cycle probably topped but it won’t be confirmed until there is a weekly close beneath the 10-week EMA ($1,255.24). The daily cycle rules also apply to the 6-Month Cycle (swing high, close below 10-period EMA, etc.). The Full Stochastics indicator is still above 80. At a minimum, it should drop below 50 before attempting the next 6-Month cycle low. Mid-June seems like an ideal timeframe.

-GOLD DAILY- We are looking for the third daily cycle low. Prices have dropped far enough to meet the minimum requirements, but the retracement has been rather shallow. Ideally, prices will break lower early next week and bottom around May 3rd or May 5th. Breaking the trendline and below $1,260 should lead to another wave of selling.

-SILVER WEEKLY- The Commercial net short position dropped to 108,089 contracts last week. Prices closed below the 10-week EMA. The Slow Stochastics indicator should drop below 20 before reaching the 6-month cycle low. Prices should hold above the critical support of $15.68 in June.

-SILVER DAILY- We could see the $16.83 low tested before this daily cycle low bottoms.

-GDX- It has been 3-days since the R-Day. Prices should find a low sometime next week. Typically, you can use the gap that formed the morning of the R-day as a rough short-term target. It usually marks the half-way-point of a larger move. In this case, targeting between $21.25 and $21.00. This is a rough estimate; miners often over or undershoot.

-SOS- There was selling on strength numbers for GDX. Data provided by the WSJ.

-GDXJ- The underlying shares issue may skew the measured gap target for the junior mining ETF. Nevertheless, the current short-term price objective arrives around $29.50.

-DUST- If GDX reaches its measured gap target, DUST should reach approximately $37.30.

-JDST- The measured gap target in junior miners translates to roughly $26.00 in JDST.

-SPY- It looks like prices are forming a rounded bottom or a cup-with-handle formation. Prices are consolidating below the 239.30 resistance level. They need to hold above the 20-day EMA to sustain the pattern. Breaking out above the 239.53 high projects a potential target between 246 and 248 in May.

-CUP WITH HANDLE PATTERN- Provided by StockCharts.

-WTIC- Prices bounced off the trendline. Failing to hold the trendline and closing below $47.00 could send prices back down to around $42.00 before the May 25th OPEC meeting. If OPEC delivers a plan to extend the production cuts through 2017, prices will rally. If they fail to extend production cuts, prices will probably drop below $40.00. The Saudis intend to take Saudi Aramco public in 2018. It is in their best interests to broker further production cuts.

The key levels to watch in gold are $1,260 and $1,280. Breaking below $1,260 will lead to another decline. Breaking above $1,280 could mark a shallow daily cycle low. I will update as prices progress toward or away from these levels.