First, let’s get the disclaimer out of the way. I’m not a licensed financial advisor. Investing is risky. A catastrophic financial loss is possible. Precious metals are incredibly volatile assets. Don’t risk anything you’re not willing to lose.

LONG-TERM STRATEGY

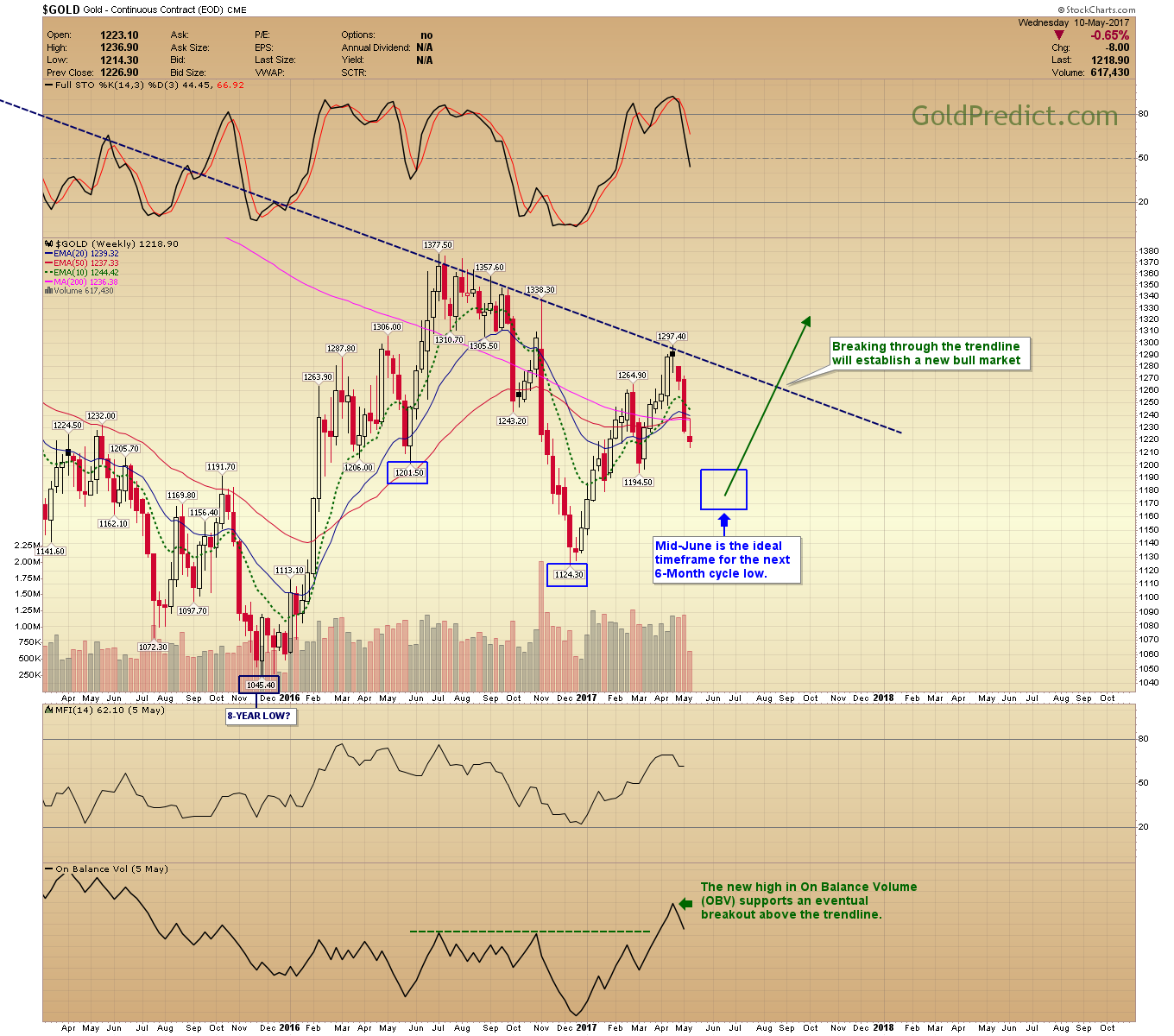

There are several ways to make money in the markets. One of the easiest strategies is to buy and hold as a budding trend develops. I believe gold meets that condition as prices trade below the 5-year trendline. A new bull market will be acknowledged once prices break above the trendline.

Core Position

Consider keeping a core position. This can be in physical bullion, ETF’s or mining shares. Some physical bullion is a good idea. I prefer silver over gold. Investment demand is currently depressed, and premiums are favorable.

The idea behind the core position is to not sell until the final stages of the bull market (best guess: 3-5 years from now). Attempting to time the 6-Month cycles will become increasingly difficult as the bull market advances (see next chart). Many traders will try to sell and get back in at lower prices. A powerful bull market doesn’t allow that. The premature seller is faced with having to buy back at higher prices or stand idly on the tracks as the train continues without them. The concept of the core position is to remain on the train as long as possible.

-PARABOLIC TOP- Aggressive Bull Markets usually end with a parabolic increase. The majority of the gains are made in the final blowoff phase. In this case, gold prices rallied nearly 400% in 12-Months, and values doubled 8-weeks before topping.

The 6-Month Cycle

Consider keeping some funds available for trading the 6-Month Cycle. Timing the exact top/bottom is nearly impossible. Novice traders tend to overleverage their accounts and enter/exit everything at once. That is a recipe for disaster.

Dollar-Cost-Averaging: Divide the funds you’ve set aside according to your risk tolerance. For this example, we will distribute $20,000 into four $5,000 tranches. Enter the first tranche when prices are oversold, and it looks like a bottom may be approaching (essentially trying to pick the 6-Month bottom). Enter the second tranche when a swing low forms. The third entry is assigned once prices close progressively above the 10-day EMA. The final portion is reserved for pullbacks once a 6-Month low is confirmed.

Try not to be fully invested. Keep some cash in reserves for unexpected opportunities.

If we are correct, gold prices should bottom within the next 4-6 weeks. Appropriate retracement levels range from $1,160 – $1,200. Mid-June is the ideal timeframe for the next 6-Month cycle low. Breaking above the trendline will establish a new bull market.

IS HISTORY A GUIDE? It took gold 72-Months to finally breakout above the long-term trendline in 2002. 72-Months from the 2011 top equals September 2017.

Gold is the primary driver behind the precious metal cycles. Silver and Miners follow or sometimes lead gold, but they have a tendency to overshoot their price objectives. Consequently, I won’t be able to narrow-down price targets until gold nears the 6-Month low.

Consider buying long-term (core positions) and short-term trading positions around the time of the next 6-Month low. Averaging in is prudent. If prices rally and break above the 5-year trendline, keep the long-term core positions.

Waiting to buy after prices breakout above the 5-Year trendline is a reasonable strategy. Investing before the breakout carries considerable risk.

I believe silver around $16.00 is a bargain. For the price of a cheap steak dinner, you can buy 1-ounce of an incredibly valuable and strategic precious metal. The current gold-to-silver ratio is 75:1. It’s possible to see a ratio of 20:1 or better during the final stages of a bull market.

The material on or distributed by goldpredict.com has no regard to the specific investment objectives, financial situation or the particular needs of any visitor or subscriber. This site and any material distributed or published by it or its affiliates are solely for informational and educational purposes and are not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity or their related securities. We recommend you consult with a licensed and qualified professional before making any investment decisions.