Our outlook for another decline in precious metals and miners will likely be confirmed or rejected next week.

The minutes from the May 3rd FED meeting will be released Wednesday at 2:00 PM. From that, we can calculate the likelihood of a June rate hike (currently at 78.5%).

On May 25th, OPEC will attempt to extend production cuts. If they are successful, oil and energy stocks will rally. A breakout in energy stocks (see XLE chart) should award the stock market with new highs.

PRECIOUS METALS

Gold has not met the standard conditions to form a 6-month low; silver has. Which metal should we follow? Well, the gold sector is much bigger, and trades like a currency, whereas silver is viewed as an industrial metal (I disagree). Therefore, we regard gold as the principal driver behind the sector. The current gold cycle supports lower prices in June.

POTENTIAL OUTCOME

If OPEC successfully prolongs or reduces production, general stocks and energy should advance. We could see sector rotation into energy stocks and a breakout in the SPY. Precious Metals could lose interest if the stock market rallies to new highs. That would blend nicely with our forecast for lower prices into June. Conversely, a negative OPEC result or dovish FED minutes could strengthen the metals.

-US DOLLAR- The dollar fell even further on Friday. That was the 38th day of this cycle, if prices are going to bottom, they need to do so early next week. The next swing low should mark a bottom.

-GOLD WEEKLY- The May 2016 6-Month Low was abnormally shallow, registering only one red candle close beneath the 10-Week EMA (two or more is standard). Nonetheless, prices closed lower four week’s consecutively and declined below the previous low at $1,206. That was enough to enable the 6-Month low.

Currently, there has only been one red candle close beneath the 10-Week EMA. Prices declined for just two weeks before reaching $1,214.30. Furthermore, prices didn’t breach the prior daily cycle low. Consequently, it is highly unlikely gold reached the 6-Month low in May.

-GOLD DAILY- I’d like to say prices reached a top at $1,265 but they are yet to form a swing high. It’s our opinion that prices need to break the daily cycle trendline and decline below $1,214 (prior daily cycle low) before registering a 6-Month low.

-SILVER WEEKLY- The COT numbers improved even more for silver with just 57,377 commercial net shorts. Prices have met the requirements for a 6-month low, but gold prices haven’t. Gold is the cyclical driver behind precious metals. Consequently, we should see lower silver prices as gold slides into the 6-Month low.

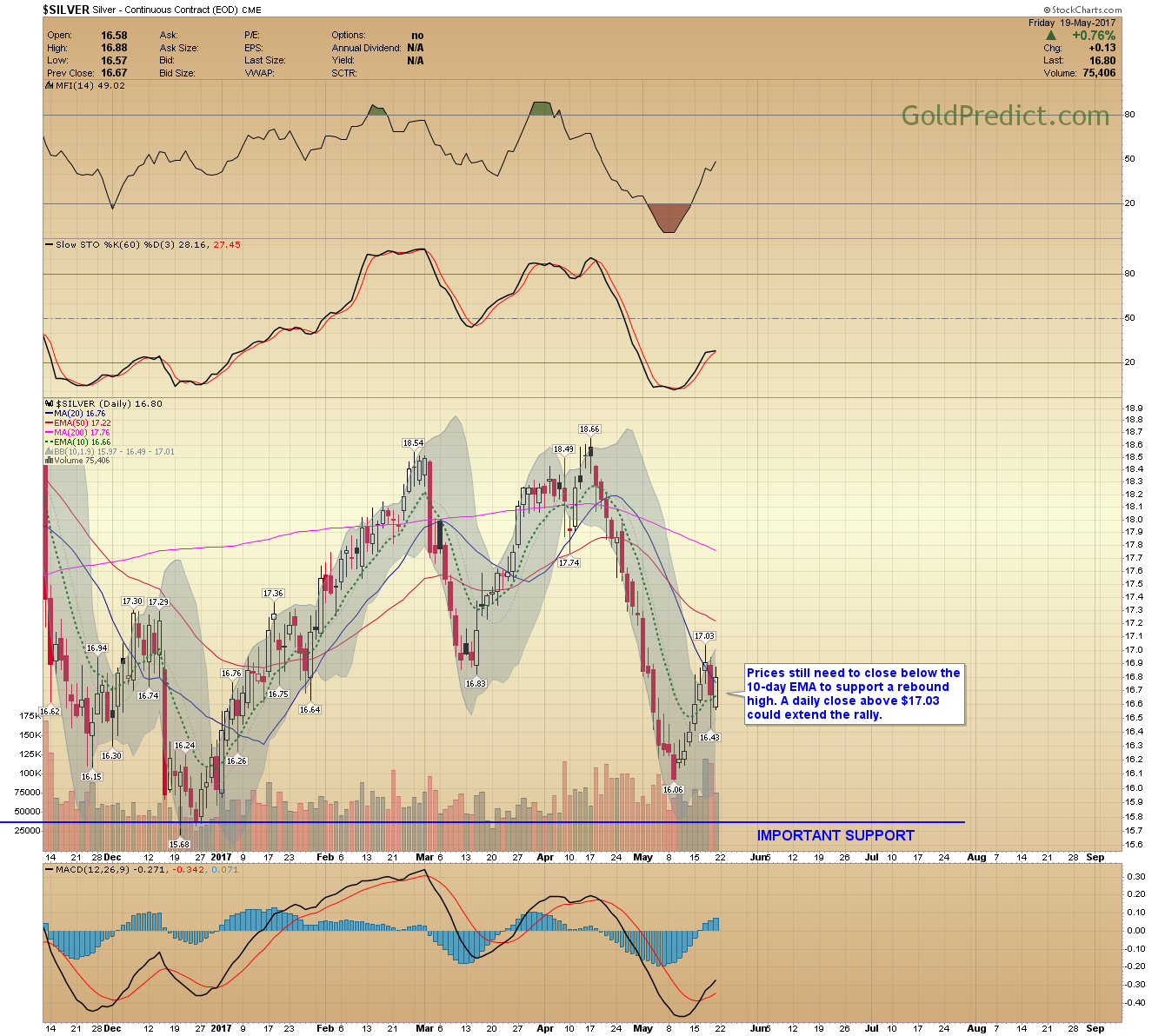

-SILVER DAILY- Prices still need to close below the 10-day EMA to support a rebound high. A daily close above $17.03 could extend the rally.

-GDX- Prices rebounded to the maximum level I expected. If our forecast is correct, prices should decline below the May $20.89 low. However, closing above Wednesday’s $23.67 high would severely challenge our outlook.

-GDXJ- Junior miners need to close below the 10-day EMA and then beneath the $32.00 level to confirm an interim peak.

-SPY- Stocks recovered the majority of Wednesday’s losses. This decline can still be viewed as the handle portion of a “cup-with-handle” continuation pattern…if prices remain above the 235.43 low. Closing back above 240 would support the possibility of a breakout.

-WTIC- Next week is the make-or-break week for oil prices. If OPEC fails to extend production cuts, then prices will rollover and decline below $40.00. If they strike a deal, then prices will breakout above the trendline and head to $60.00 this summer.

-XLE- If OPEC strikes a deal, the XLE will breakout above the 5-Month trendline. A strong oil sector would be enough to generate a breakout of the cup-with-handle pattern in SPY.

We are entering a pivotal week. Expect multiple updates as the action unfolds. Trading could be volatile through Friday. We should be able to narrow our focus by the end of next week. In the meantime, I’m anticipating lower metals prices, but I’m mentally preparing for the unexpected.