Metals and Miners are bouncing as the dollar finishes what appears to be a small inverse head and shoulder bottoming pattern. If our analysis is correct, the rebound in precious metals should end next week. A daily close above 97.50 in the US Dollar will establish a breakout.

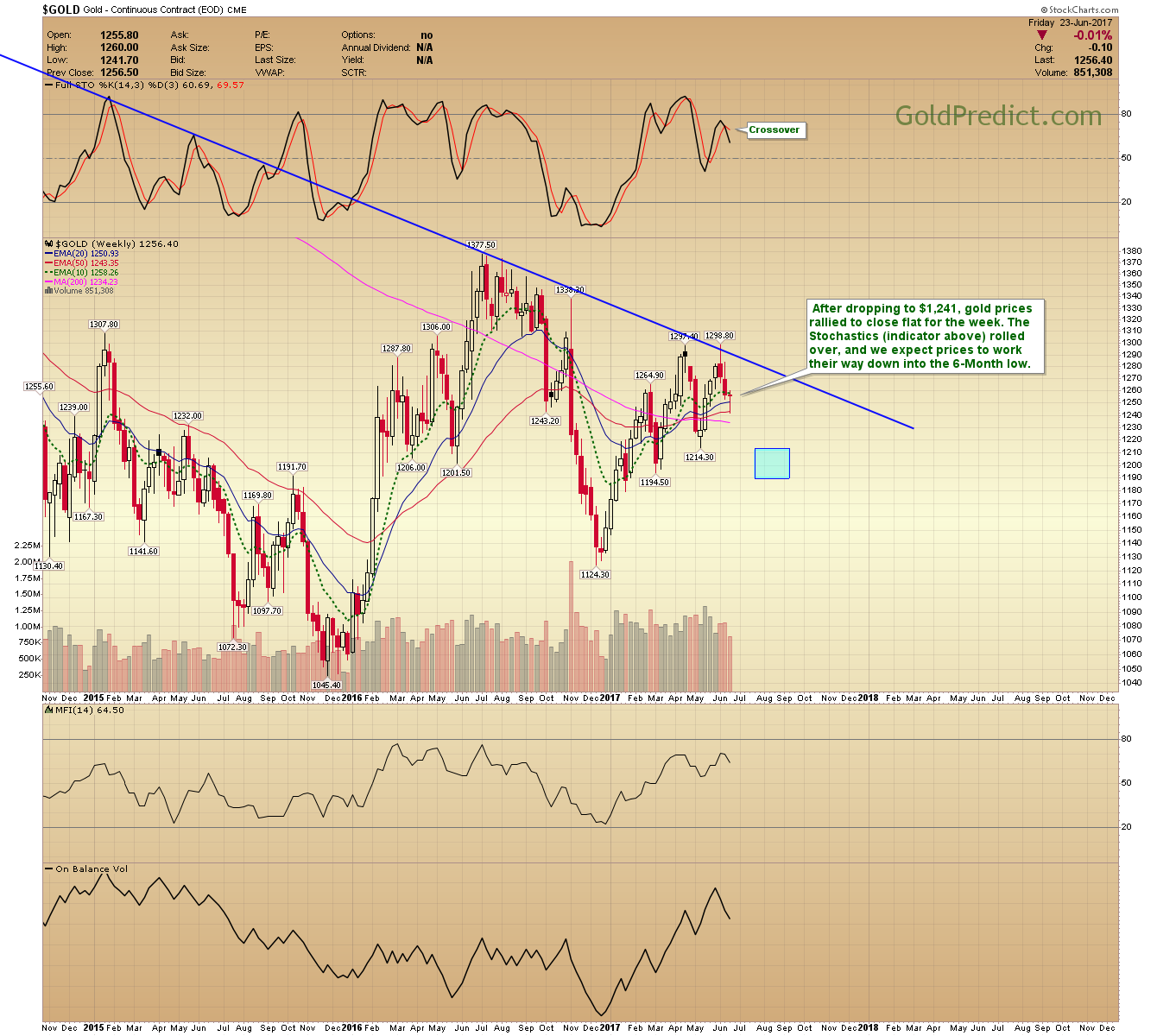

A breakout in the dollar should lead to a 1-3 month rally. Precious Metals and Miners are expected to descend into their 6-Months lows as this occurs. The lengthy bottoming process in the dollar produced an expanded double top in gold.

-US DOLLAR- The bottoming process continues. The 96.30 low should hold, and a daily close above the trendline/neckline (97.50) will imply a breakout. One could argue a small inverse head and shoulder pattern.

-GOLD WEEKLY- After dropping to $1,241, gold prices rallied to close flat for the week. The Stochastics (indicator above) rolled over, and we expect prices to work their way down into the 6-Month low.

-GOLD DAILY- Prices are rebounding after touching the 200-day MA; they failed to strike the intermediate trendline. Prices could rally a bit more, but the bounce should finish next week. Once complete, we should see a breakdown below the intermediate trendline. A rally above $1,300 would invalidate our forecast for a 6-Month low.

-SILVER WEEKLY- Silver prices ended flat after sinking to $16.31. Once the intervening bounce is complete, we should see prices test the critical support zone.

-SILVER DAILY- Prices are bouncing, and we could see a brief rally to the 20/50 day moving average crossover (around $17.10). Once complete, prices should decline to critical support at $15.68.

-GDX- There was more selling into strength (220-Million) in GDX. We expect the bounce to conclude sometime next week between $23.00 and $23.50.

-GDXJ- Junior miners could test the $35.00 level and perhaps the 200-day MA before rolling over. We should then see a decline below the May trendline.

-DUST- I may consider buying DUST if prices reverse next week and maintain the short-term trendline.

-JDST- I’d like to see prices hold the lower trendline. A daily close above the upper boundary would register a breakout.

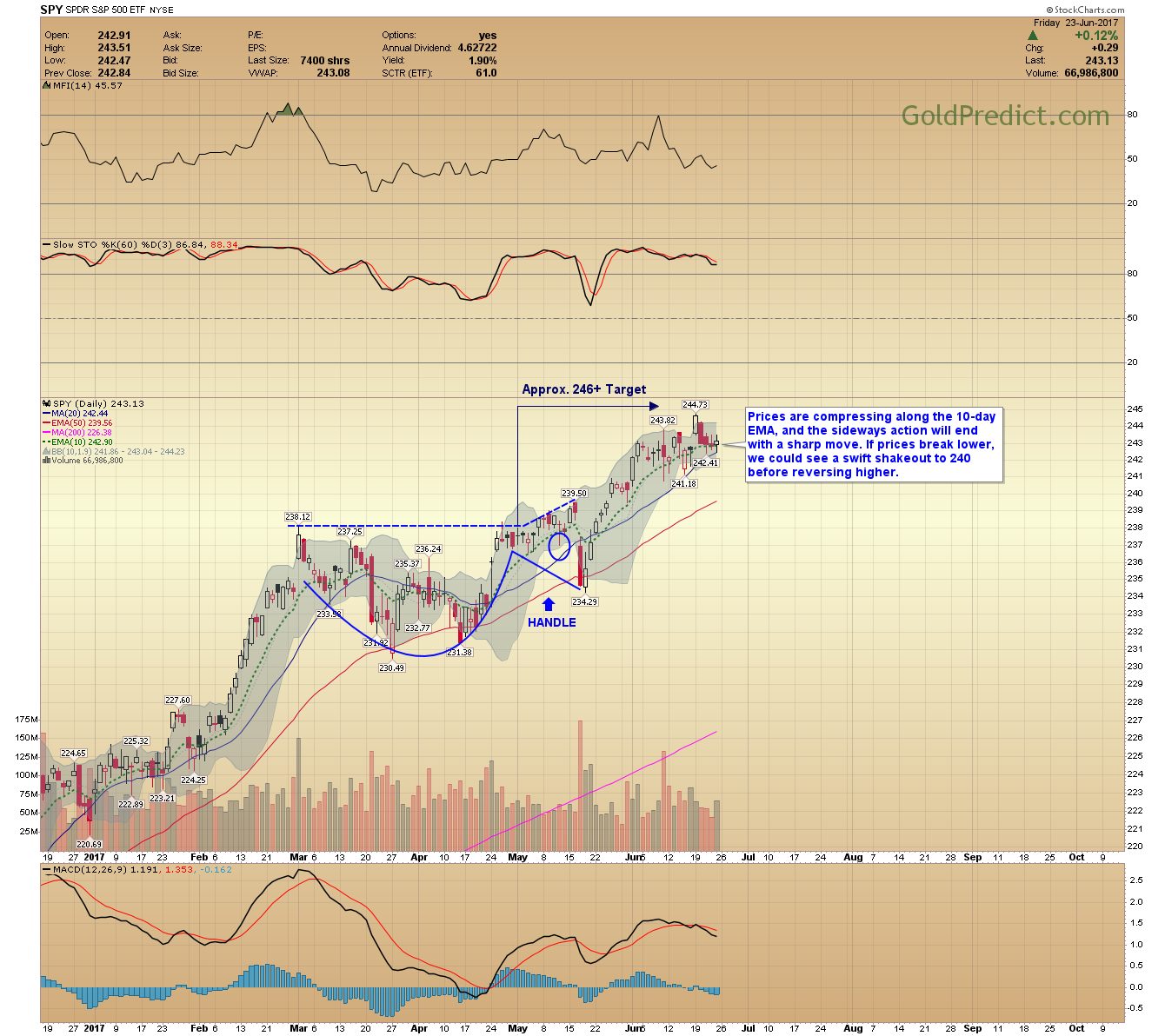

-SPY- Prices are compressing along the 10-day EMA, and the sideways action will end with a sharp move. If prices break lower, we could see a swift shakeout to 240 before reversing higher.

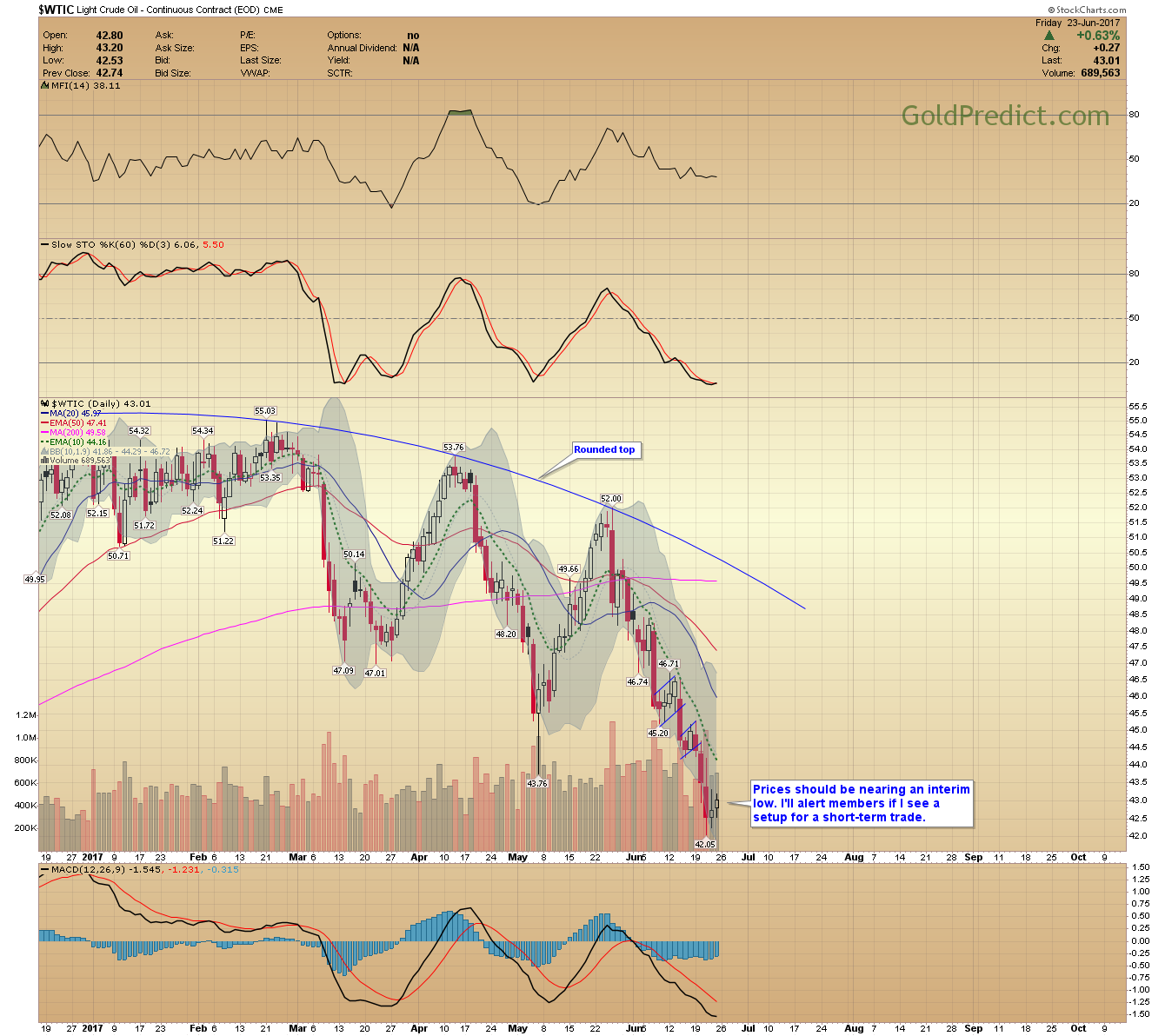

-WTIC- Prices should be nearing an interim low. I’ll alert members if I see a setup for a short-term trade.

We are entering a decisive week. If prices follow our expectations, I’ll consider shorting miners and perhaps silver. I’ll post brief updates throughout the week as the action unfolds.

Have a pleasant weekend.