Gold and Silver performed well after their October 6th reversals. Gold finished the week above $1,300 and produced a weekly morning star pattern (bullish candle formation). Silver rallied 3.70% closing back above its 200-week MA.

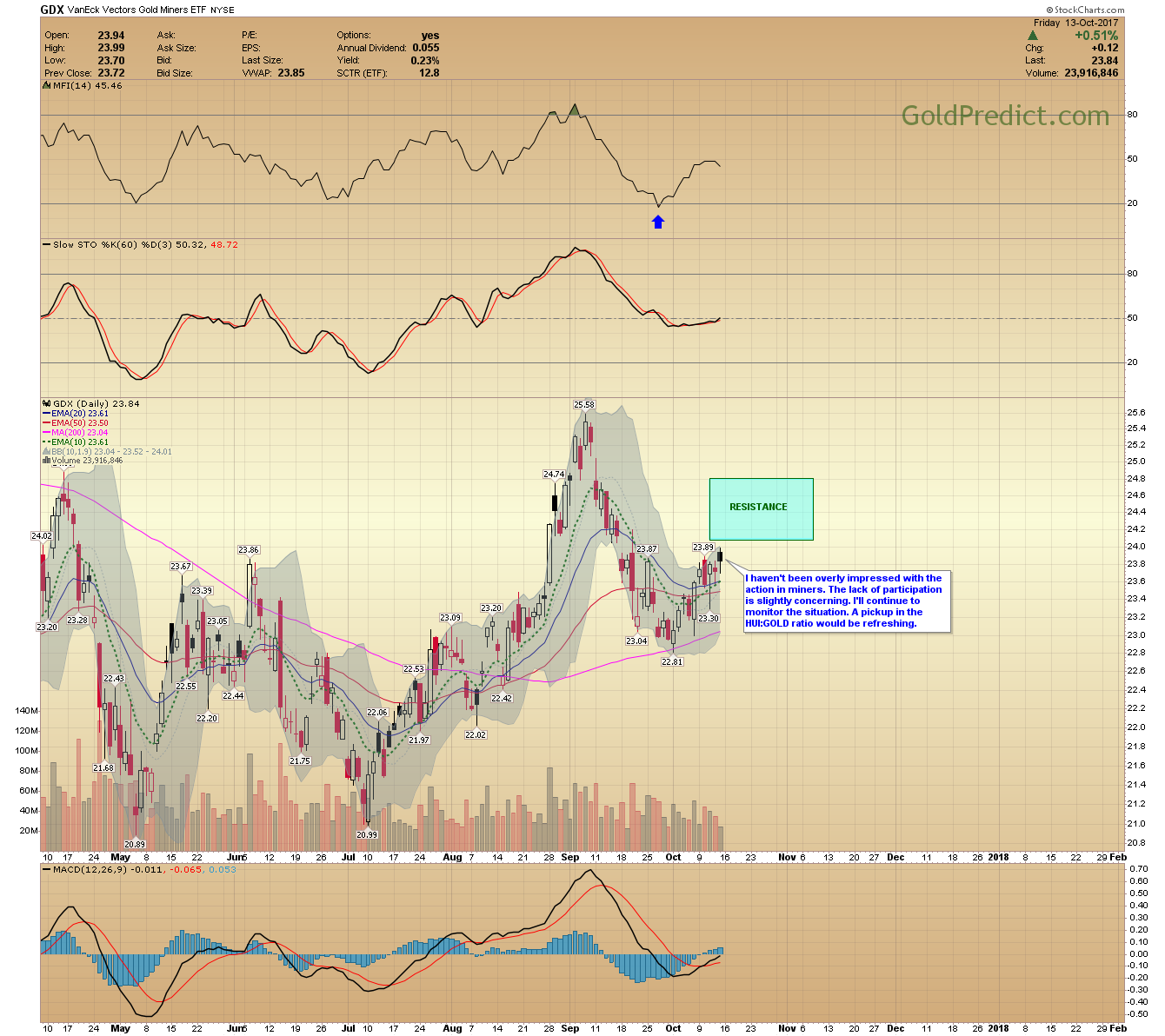

Last weeks rally was encouraging but not enough to confirm meaningful lows. Miners were weak relative to gold and silver. Their lack of participation is concerning. They must pick up the pace if gold is going to test $1,400 by year-end.

We are in a holding pattern as the cycle and price structure develops. The vetting process could take another 1-3 weeks. Nevertheless, I’ll expect another buying opportunity in November if the October lows hold.

-US DOLLAR WEEKLY- After four consecutive up weeks, the dollar sank back to the 10-week EMA. Technically speaking, prices have met the minimum requirements for an intermediate-term rebound. However, a 4-week rally seems brief after an 8-month decline, so prices could trade sideways or bounce a little higher. Whatever the case, our analysis supports another drop in 2018.

-GOLD WEEKLY- The weekly chart provided additional evidence of a bottom. Prices formed a bullish morning star pattern and closed above $1,300. Closing higher next week would support a run to $1,400 by year-end. If confirmed, we could see $1,425-$1,440 in January before descending into the next 6-Month low.

-GOLD DAILY- Prices ended the week above $1,300. Rallying through the resistance box would carry the rally to $1,400 by year-end. Support continues between $1,290 and $1,295. Closing below $1,290 would be negative.

-SILVER WEEKLY- Prices closed above the 200-week and 10-week moving averages. Closing higher again next week will support a test of the $21.22 high.

-SILVER DAILY- Prices are in the resistance box. Rallying above $17.80 would support a test of the $21.22 high. Closing back below $17.00 would be detrimental.

-HUI:GOLD RATIO- The HUI:GOLD ratio has been consolidating for months. Rallying above the 0.1631 September high would support a breakout in miners. Dropping below 0.1495 would register a breakdown.

-GDX- I haven’t been overly impressed with the action in miners. The lack of participation is slightly concerning. I’ll continue to monitor the situation. A pickup in the HUI:GOLD ratio would be refreshing.

-GDXJ- The action in juniors is disconcerting. Prices ended flat for the week even as gold closed back above $1,300. To erase the disparity, prices need to rally and close above $35.23. Dropping below $34.00 and then the trendline would propose an additional decline.

-JNUG- The action in JNUG is displeasing. I may exit the trade if prices continue to underperform. Closing above $21.00 would be reassuring.

-USLV- Prices were up over 11% last week. If silver tests the $21.22 high, USLV could reach $20.00+ in December or January.

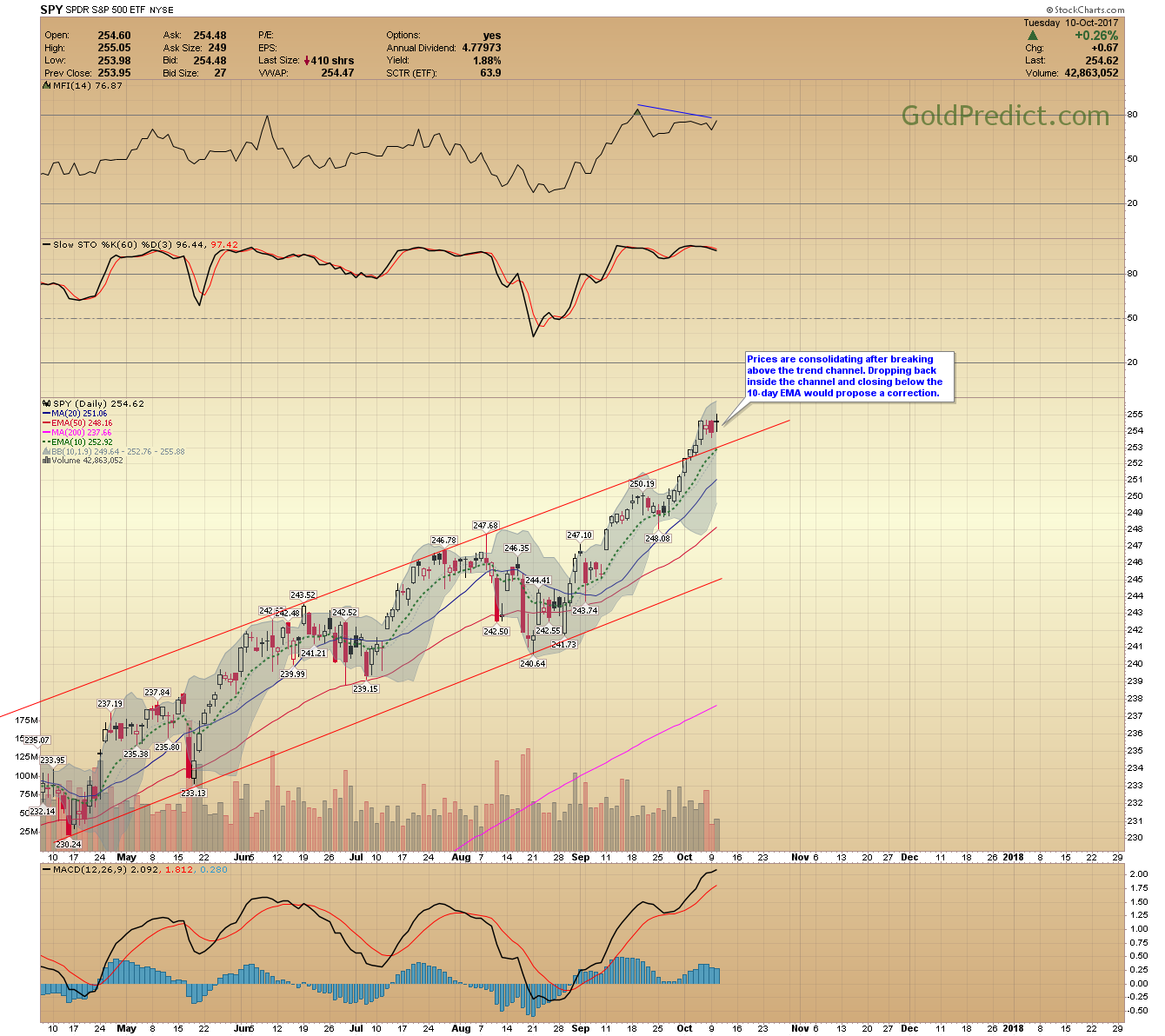

-SPY- Nothing new. Prices are consolidating after breaking above the trend channel. Dropping back inside the channel and progressive closes below the 10-day EMA would indicate a correction.

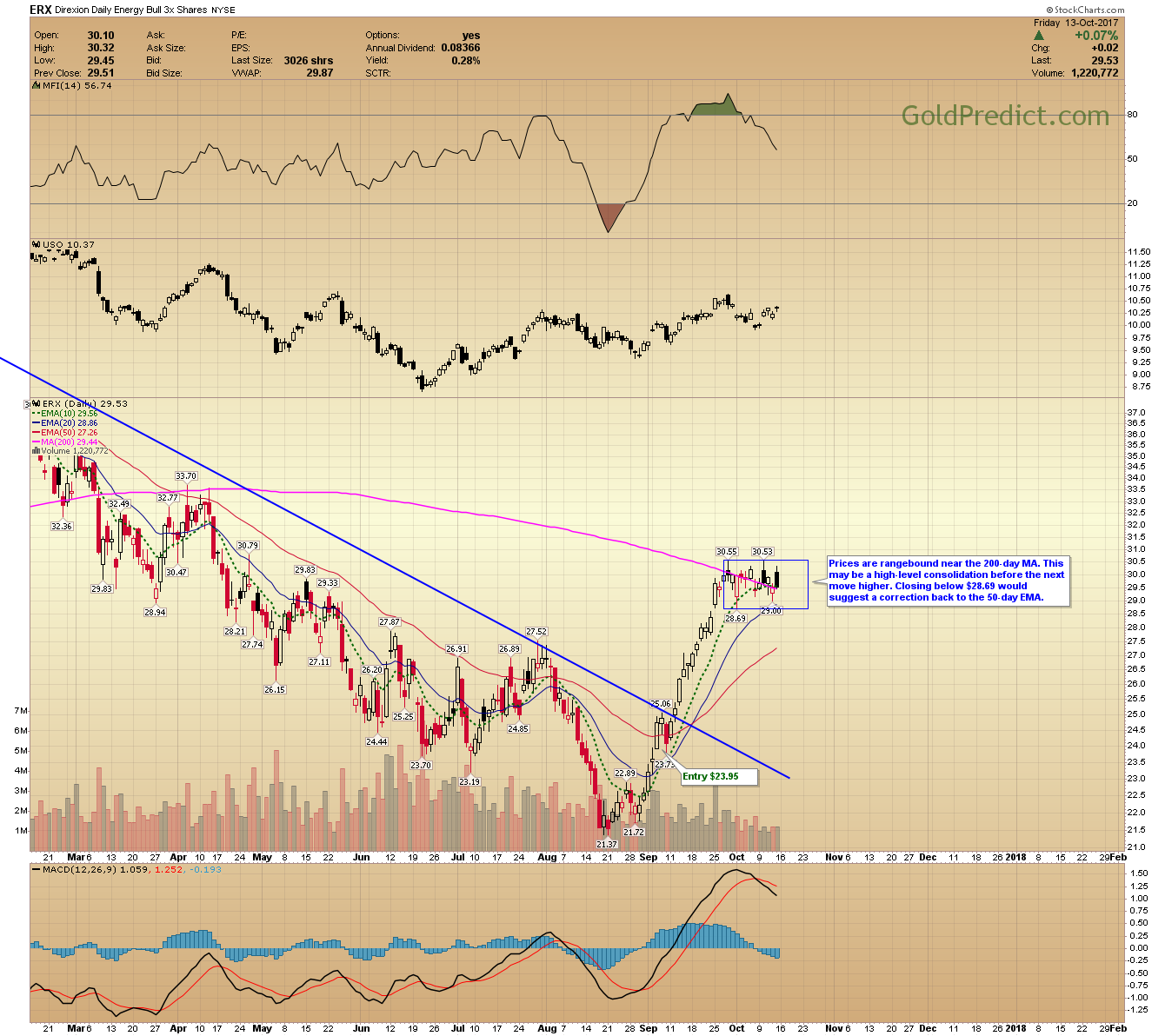

-WTIC- Price rallied on Friday reversing the recent swing high. A test of resistance between $54.00-$55.00 is likely if prices stay above $50.00. Closing below $50.00 would summon a backtest of the blue trendline.

-ERX- Prices are rangebound near the 200-day MA. This may be a high-level consolidation before the next move higher. Closing below $28.69 would suggest a correction back to the 50-day EMA.

Have a safe and pleasant weekend.