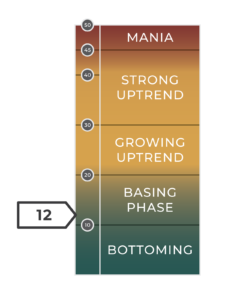

45-50 MANIA PHASE– The trend is exploding higher, and prices are reaching new all-time highs. Fear is intensifying; there is a palpable alarm to buy precious metals. Strangers are overheard talking about gold in restaurants and at the supermarket. Buying digital versions of precious metals in cryptocurrencies is easy and widespread, that drives prices higher. Towards the end of the speculative mania, the trend accelerates to near-vertical levels, and prices double in a few short weeks.

45-50 MANIA PHASE– The trend is exploding higher, and prices are reaching new all-time highs. Fear is intensifying; there is a palpable alarm to buy precious metals. Strangers are overheard talking about gold in restaurants and at the supermarket. Buying digital versions of precious metals in cryptocurrencies is easy and widespread, that drives prices higher. Towards the end of the speculative mania, the trend accelerates to near-vertical levels, and prices double in a few short weeks.

30-45 STRONG UPTREND– During this phase, the surprises in the trend are to the upside. Investors arriving late to the show begin to pile in at much higher prices. Corrections are infrequent and shallow. Our Gold Cycle Indicator rarely dips into Maximum Bottoming territory. Finding quality bullion products at reasonable premiums is challenging, shortages abound. Growth in gold-backed cryptocurrencies is exploding as an alternative. Counterfeit investment products and scams begin to surface.

30-45 STRONG UPTREND– During this phase, the surprises in the trend are to the upside. Investors arriving late to the show begin to pile in at much higher prices. Corrections are infrequent and shallow. Our Gold Cycle Indicator rarely dips into Maximum Bottoming territory. Finding quality bullion products at reasonable premiums is challenging, shortages abound. Growth in gold-backed cryptocurrencies is exploding as an alternative. Counterfeit investment products and scams begin to surface.

20-30 GROWING UPTREND– This phase is defined by a modest but steady trend higher. Pullbacks are common and somewhat uniform. Higher highs are accompanied by higher lows. Money flows increase as hedge funds and institutions improve their positions; individual investors slowly enter the market. Momentum intensifies as confidence in traditional assets wane. Buying pullbacks into the 6-month cycle low is ideal and should produce satisfactory returns as the bull market gains traction.

20-30 GROWING UPTREND– This phase is defined by a modest but steady trend higher. Pullbacks are common and somewhat uniform. Higher highs are accompanied by higher lows. Money flows increase as hedge funds and institutions improve their positions; individual investors slowly enter the market. Momentum intensifies as confidence in traditional assets wane. Buying pullbacks into the 6-month cycle low is ideal and should produce satisfactory returns as the bull market gains traction.

10-20 BASING PHASE– Few investors are interested in precious metals and their related securities. Quality bullion products are abundant, and premiums on graded numismatic coins are low. Precious metal investors should use this time to cost-dollar-average into a long-term core position in anticipation of a growing uptrend and new bull market.

10-20 BASING PHASE– Few investors are interested in precious metals and their related securities. Quality bullion products are abundant, and premiums on graded numismatic coins are low. Precious metal investors should use this time to cost-dollar-average into a long-term core position in anticipation of a growing uptrend and new bull market.

0-10- BOTTOMING PHASE– A score below 10 doesn’t necessarily indicate prices are bottoming. Instead, it represents an excessive decline in speculative investor interest. Nobody outside of the usual circles is interested in gold. Prices are carving out a real and psychological bottom. This process can take years.

0-10- BOTTOMING PHASE– A score below 10 doesn’t necessarily indicate prices are bottoming. Instead, it represents an excessive decline in speculative investor interest. Nobody outside of the usual circles is interested in gold. Prices are carving out a real and psychological bottom. This process can take years.