Tomorrow is FED day, and we need to be on our toes. Timing wise, I expected gold to reach a 6-month low about now. A decline to around $1,200 seemed logical after breaking the October low, but we are $45.00 above our target. Prices would have to decline sharply tomorrow and (or) Thursday to meet our price objective within the allotted timeframe.

Price wise, the COT numbers are still a little too high to support a low at this level. A decline to $1,200 would allow commercial shorts an opportunity to cover their positions. Furthermore, a left translated cycle should meet or exceed the previous intermediate cycle low ($1,204).

So, in a nutshell, I think we are approaching a low, but I’d feel more comfortable buying if gold was closer to $1,200. If prices reach our target, I’ll enter a partial position (probably silver and miners). Otherwise, we will have to wait and see how the structure/timing unfolds.

-US DOLLAR- The dollar is at resistance. Prices would have to rally and stay above 94.10 for a few days to neutralize the downtrend. If established, prices should stop around the 200-day MA.

-GOLD- The FED announces their decision tomorrow at 2:00 PM. A press conference will follow at 2:30. I’m not sure what to expect. However, a test of the July low ($1,204) and (or) blue trendline line seems logical before this left translated cycle bottoms. Gold would have to rally and close consecutively above the 200-day MA ($1,268) to support an immediate low. I’ll update members after tomorrow’s announcement. I may try to pick a bottom if gold spikes below $1,215 sometime this week.

-SILVER- Silver is inching its way lower on decreasing volume. Momentum is slowing, but there is no evidence of a bottom.

-GDX- Miners are close to significant support. If gold spikes down to support around $1,200, I may attempt to pick a bottom in miners. Otherwise, we need to wait and see if $21.00 holds.

-GDXJ- Juniors remained above last Thursday’s low, and GDX didn’t. A modest example of relative strength. I’m not sure if it means anything just yet, but I’m paying attention.

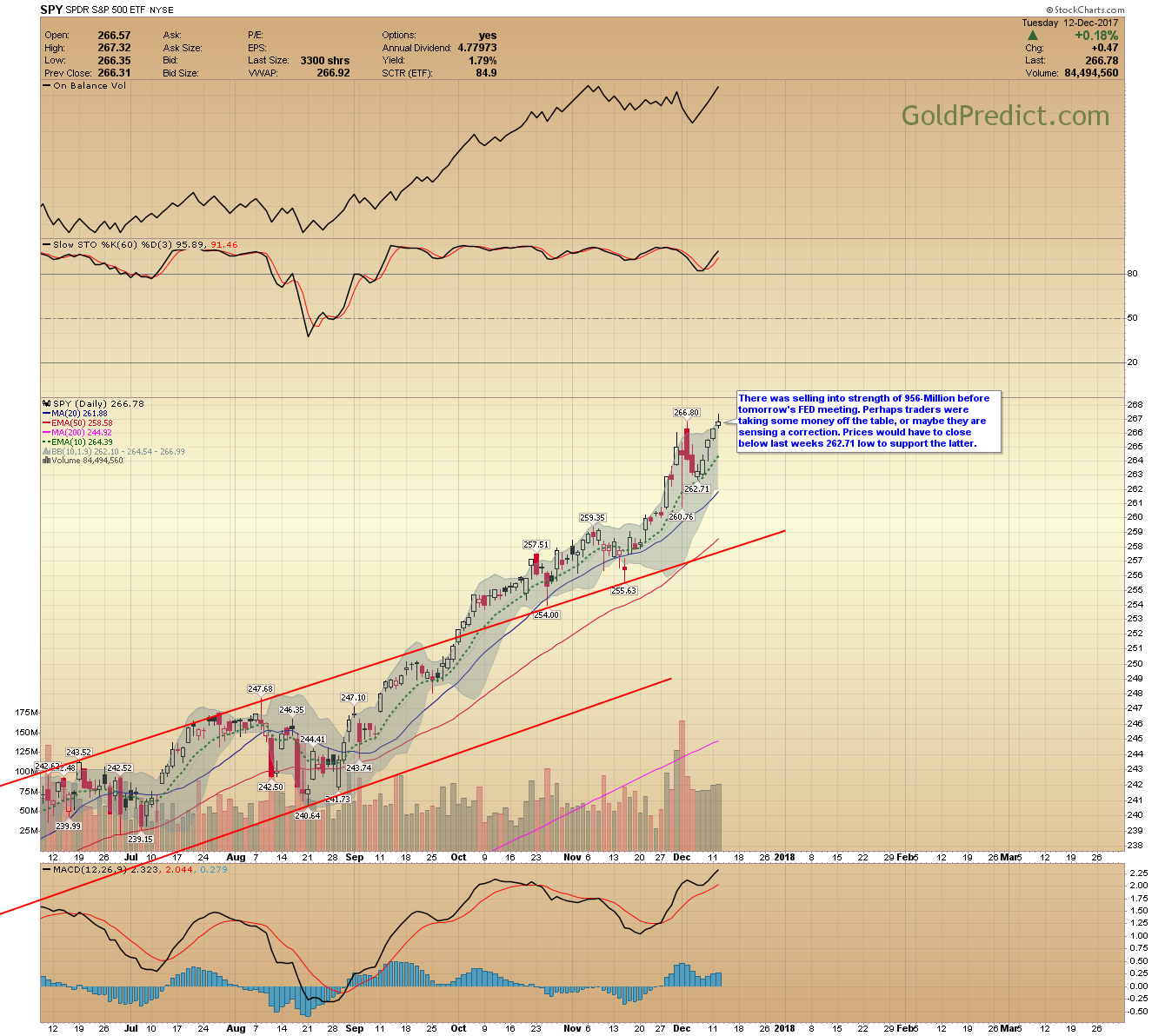

-SPY- There was selling into strength of 956-Million before tomorrow’s FED meeting. Perhaps traders were taking some money off the table, or maybe they are sensing a correction. Prices would have to close below last weeks 262.71 low to support the latter.

-WTIC- Still no verdict in oil. However, I find it odd that the MFI has already dropped below 40. It could be suggesting a shortened correction if/when it does come.

-ERX- There is little to add to energy stocks. This could be turning into a triangle pattern.

I’ll update after tomorrow’s FED announcement. Expect increased volatility. I’ll do my best to keep up with the action. Have a great night.