Several factors support February tops in both metals and miners. A 2 to 4 week correction into the March 20th Fed meeting seems fitting. There is significant support in gold between $1300 and $1310 that may prove challenging. Breaking that critical level would imply a March $1260 target.

-US DOLLAR- The dollar has been declining with gold over the last week or so. Prices tried to reverse a bit today. It would take a close up of 96.40 to support an interim bottom.

-GOLD- I think the odds favor a cycle top at $1349.80, but we’ve only had one close beneath the 10-day EMA, so it’s a bit early to know for sure. There is significant support between $1300 and $1310. If that area fails, I suspect gold will drop to the 200-day MA around $1255 in March. If that area holds, then prices may enter a sideways grind between $1300 – $1360.

-SILVER- Closing below the short-term blue trendline would recommend a decline back to support near $14.80.

-GDX- I was a little surprised by the resilience in miners as gold slipped below $1315. I would have expected GDX to have been down 2% or more instead of today’s 0.49%. Nevertheless, multiple factors support a top at $23.70. The minimum and the most logical target is the 200-day MA and prior gap around $20.50.

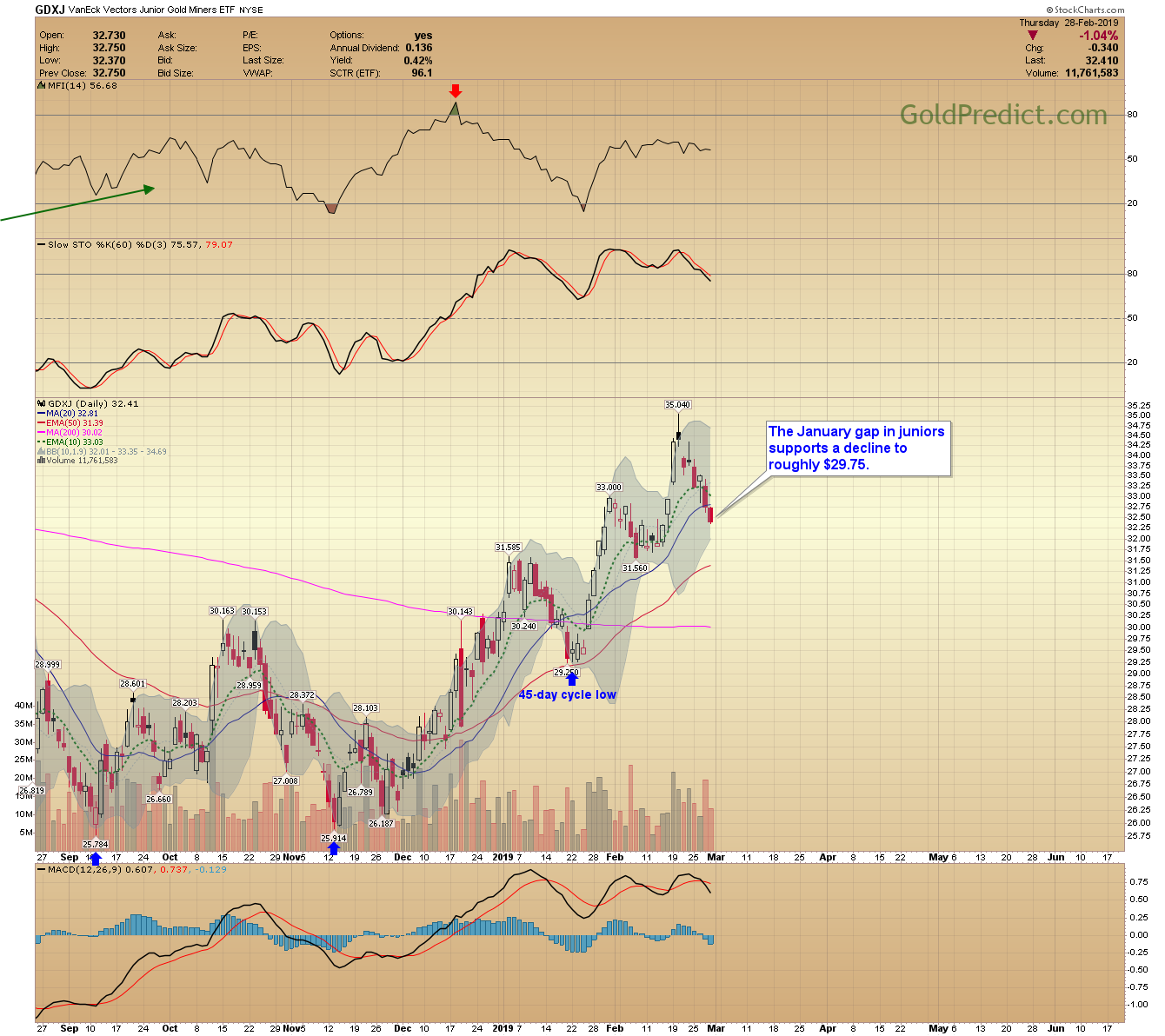

-GDXJ- The January gap in juniors supports a decline to roughly $29.75.

-DUST- If GDX slips to $20.50, that should equate to a rally in DUST to the $24.00 gap.

-UGAZ- The UGAZ position is stalling a bit just above the 10-day EMA. I’d like to see a close above $35.67 relatively quickly to maintain the short-term upward momentum.

Have a wonderful night.