Metals and Miners followed through higher and gold closed above $1300, 6-month lows are likely. I’d like to see gold rally a bit further and close above $1,309 next.

If gold bottomed at $1281 as I suspect, this next cycle should finally take prices above $1400 and establish a bull market breakout.

Silver and miners diverged positively from gold. Silver held above $16.00 when gold collapsed below $1300 and Miners bottomed back in March. Perhaps this is the change leadership I’ve been expecting. If so, then silver and miners should continue to strengthen and break free from their prolonged consolidations.

I’m overweight JNUG and USLV; I completed my buying yesterday. Gold should rally for at least 6-8 weeks, and I expect a breakout above $1400. Silver and miners should outpace gold during this advance.

-US DOLLAR- The dollar is yet to confirm a top, but I think gold bottomed. Prices should start working their way lower.

-GOLD- It looks like the 6-month low arrived Monday at $1,281.20. Prices formed a swing low and closed back above $1300. To complete the bottom, I’d like to see prices close above the short-term trendline and the 200-day MA ($1309). If gold bottomed at $1281, then this cycle should take gold above $1400 and confirm a breakout.

-SILVER- It appears silver diverged and bottomed 3-weeks ahead of gold. Holding $16.00 while gold broke down below $1300 is a bullish development. I expect a significant rally/breakout in the coming weeks as prices work their way above the trendline.

-GDX- Volume is increasing, and prices rallied into the close. A significant advance may unfold. Miners diverged bullishly from gold and bottomed in March. The 16-month consolidation phase is likely ending.

-GDXJ- Juniors closed above the May 15th down gap signaling a bottom. Closing above the April high ($34.36) will thrust miners back to the resistance zone and ultimately to fresh 2018 highs.

-JNUG- I’m overweight JNUG. I completed my buying yesterday.

-USLV- I’m overweight USLV. I completed my buying yesterday. Rallying above $11.25 will establish a breakout.

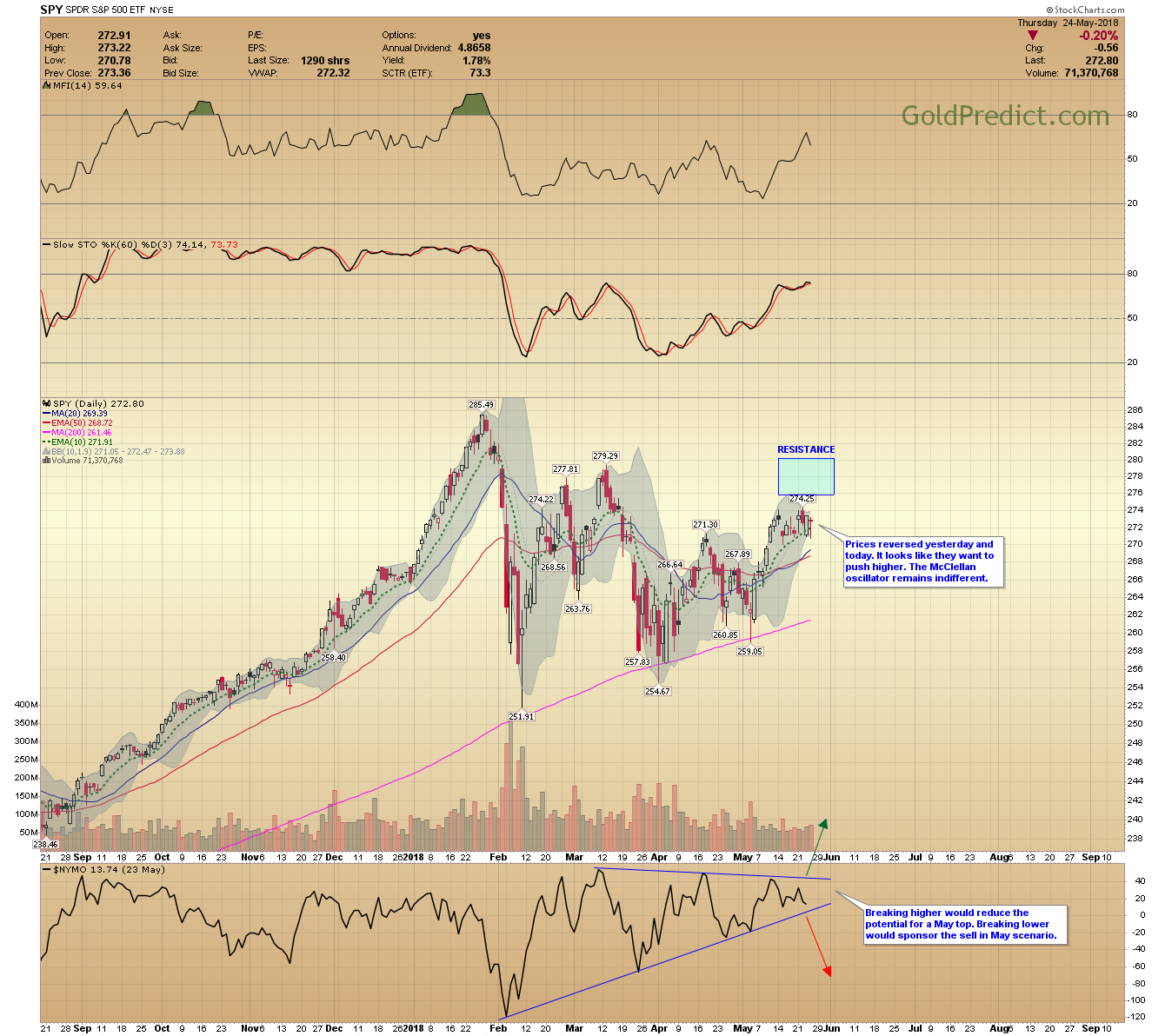

-SPY- Prices reversed yesterday and today. It looks like they want to push higher. The McClellan oscillator remains indifferent.

-WTIC- Prices confirmed a swing high and the cycle likely peaked May 22nd. I expect a correction to at least the $66.50 breakout level, however, a deeper correction is indeed possible.

-ERY- I entered a small position at the open. Execution price $33.20. Initial stop just below $30.25. However, I’d consider exiting if prices closed below $32.00. Minimum target $36.60. Primary objective between $39.50 – $43.50.

It took a while, but I think metals and miners bottomed. I’m expecting significant gains in JNUG and USLV. Ideally, gold will rally and breakout above $1400 during this 6-month cycle advance.

Have a great night.