Commercial gold hedgers reduced their short holdings by nearly 25% last week – a sharp reduction. Their combined positions (futures and options) dropped an astonishing 37%. Speculative shorts remain at or near record highs. For example, managed money is short 153,108 gold contracts. During the July 2017 low, their shorts reached 100,397 contracts (see below).

The commitment of traders is now even more bullish. Unfortunately, these reports don’t time the exact bottom…they merely tell us when the conditions are ripe for a reversal. The sharp reduction in commercial shorts last week and throughout July suggest we are very close to a bottom.

Monday will mark the 53rd day of golds common or daily cycle. The average in 2018 has been about 55-trading days. This too suggests we are very close to a low. If prices didn’t bottom Friday, then they should sometime next week.

Friday’s rally faded into the close, and we didn’t get the strong follow-through often associated with a low. The price action Monday and Tuesday will tell us where we stand.

- If metals and miners rally on Monday or Tuesday and close above Friday’s highs, then prices probably bottomed.

- If prices continue to weaken on Monday and Tuesday, then we will presumably see new lows and a bottom sometime next week.

I’ll watch the price action closely and post multiple updates.

-US DOLLAR- Prices could top here or continue to the upper boundary (6). A breakdown below the lower border is needed to confirm a top.

-GOLD WEEKLY- Gold formed another outside reversal; prices exceed both the high and the low of the previous week. Commercials reduced their shorts from -65,668 to -47,918 (a 25% reduction). Their combined futures and options dropped from -49,820 to -31,738 (a sharp 37% reduction). Speculative shorting remains at or near record levels. The ingredients are there for a bottom and explosive rally…all we need is a spark.

-SHORT POSITIONS- Y-Charts shows managed money short positions at a record 153,108 contracts. In contrast, they were short just 100,397 contracts last July when gold bottomed and rallied $150 in 8-weeks. They were short 110,836 contracts in December 2015 when gold bottomed at $1,045. A sharp turn in gold could ignite a short-covering feeding frenzy.

-GOLD DAILY- Gold is 52-days into a cycle that has been averaging about 55-days. Prices may have bottomed Friday. Closing above the 10-day EMA early next week will support this view. Otherwise, we will likely see a couple more down days before setting a low next week.

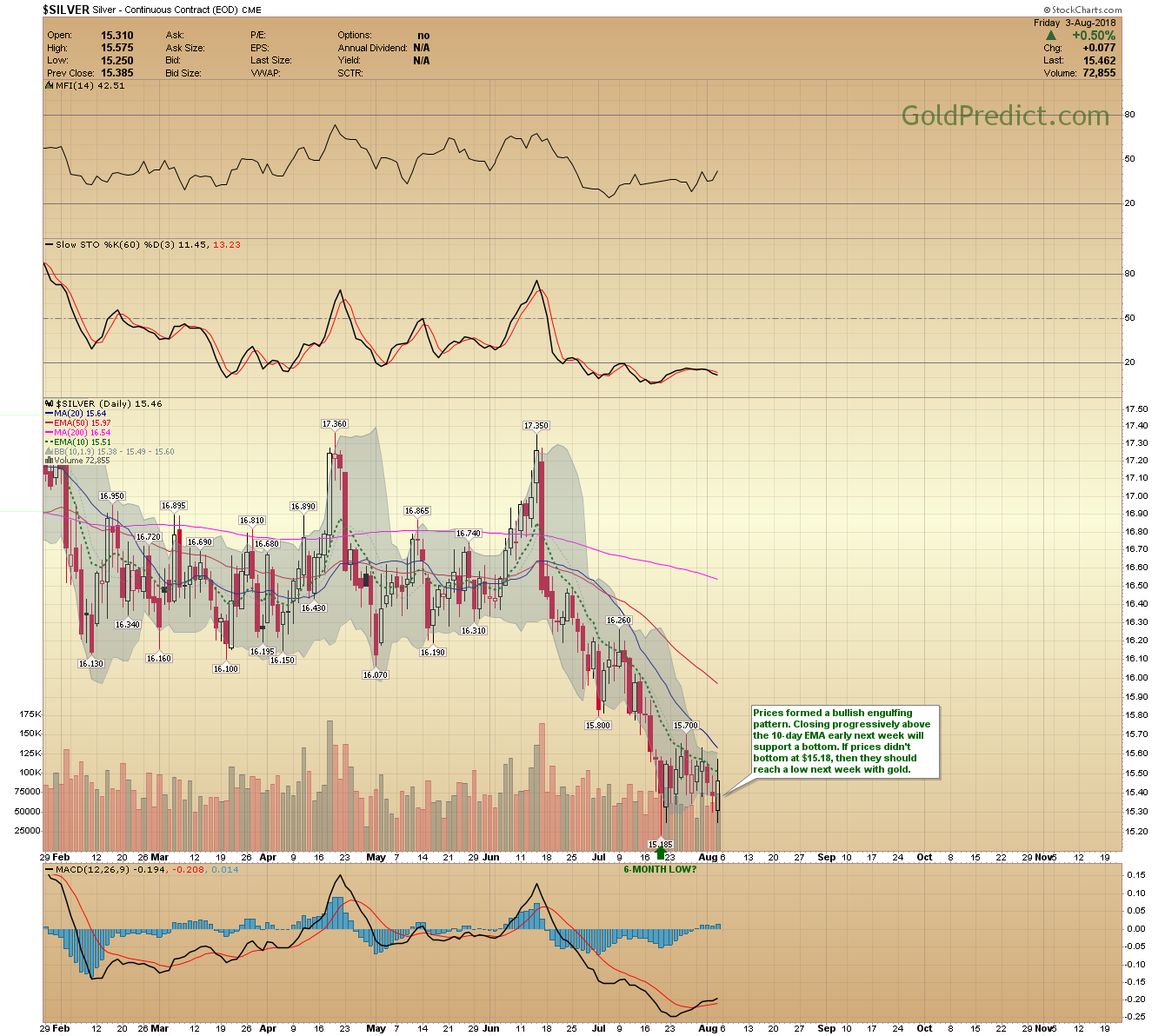

-SILVER WEEKLY- Technically, prices closed lower for the 8th consecutive week. A Doji cross formed. Prices managed to hold the $15.18 low.

-SILVER DAILY- Prices formed a bullish engulfing pattern. Closing progressively above the 10-day EMA early next week will support a bottom. If prices didn’t bottom at $15.18, then they should reach a low next week with gold.

-GDX- Unfortunately, the miners failed to sustain Friday’s rally. Prices need to close above Friday’s high ($21.32) to recommend a bottom. Failing to do so early next week could lead to another drop. I think gold is very close to a low (if it didn’t bottom on Friday), so any additional weakness in miners should be temporary (3-5 days).

-GDXJ- There was a bad tick in GDXJ, prices didn’t rally to $32.91 on Friday. If gold postpones its bottom until next week, the bears may try to push juniors down to the lower support level around $30.50. Otherwise, GDXJ would have to close progressively above the 10-day EMA to establish a bottom.

-JNUG- Attempting to exit and re-enter at lower prices sounds good but is extremely difficult to do in real time. If you exit and prices rally – now you’re chasing prices. If you exit…miss the bottom and prices explode higher – again your chasing. When the bottom comes, I suspect prices will reverse sharply. If gold hasn’t bottomed, it should be very close (3-5 days). If JNUG dips a little further, I’ll use some of my dry powder to buy another tranche (fourth and final).

-USLV- Prices could dip a little further before bottoming. Perhaps sometime next week if gold makes one more low. In the meantime, prices would have to close above the short-term trendline ($8.18) to prescribe a bottom.

-SPY- Stocks are poised to make new highs. I’ll be watching volume and breadth for clues as prices rally above 284.37.

-WTIC- I think oil will head higher with the stock market and at least test the 75.27 high in August. I’ll look to buy ERX on Monday.

-ERX- Prices have been consolidating since May. A breakout in the stock market and higher oil prices should send ERX higher. I’ll look to buy on Monday and use a close below the lower trendline as my stop.

Have a great weekend.