After a 6-month advance, it looks like the stock market may be rolling over into an intermediate decline. Downside follow-through next week will confirm.

Algo-trading makes up approximately 90% of daily trading activity. Occasionally, when all the stars align, these systems flood the market with sell orders and trigger a 1-3 day flash crash. I don’t know if that will happen this time, but I have a position in TVIX in case it does.

Oil blasted by the $74.08 target and beyond my 29-31 day cycle series. Prices may have topped on day 33, but it’s too soon to tell. Closing below the 10-day EMA would support a top.

I’ve been under the impression that oil and stocks would decline together in October. The setup is there – let’s see what happens next.

Metals and Miners are consolidating after reaching their August/September lows. Overall, I think they could reach better lows by year-end, but I can’t rule out an extended rebound into mid-late October. I highlight key levels to monitor in each.

-US DOLLAR- The dollar stopped at the B-wave high. If prices pullback here, they need to hold at the support box. A sustained move below the support box would prescribe a failed cycle and lower prices.

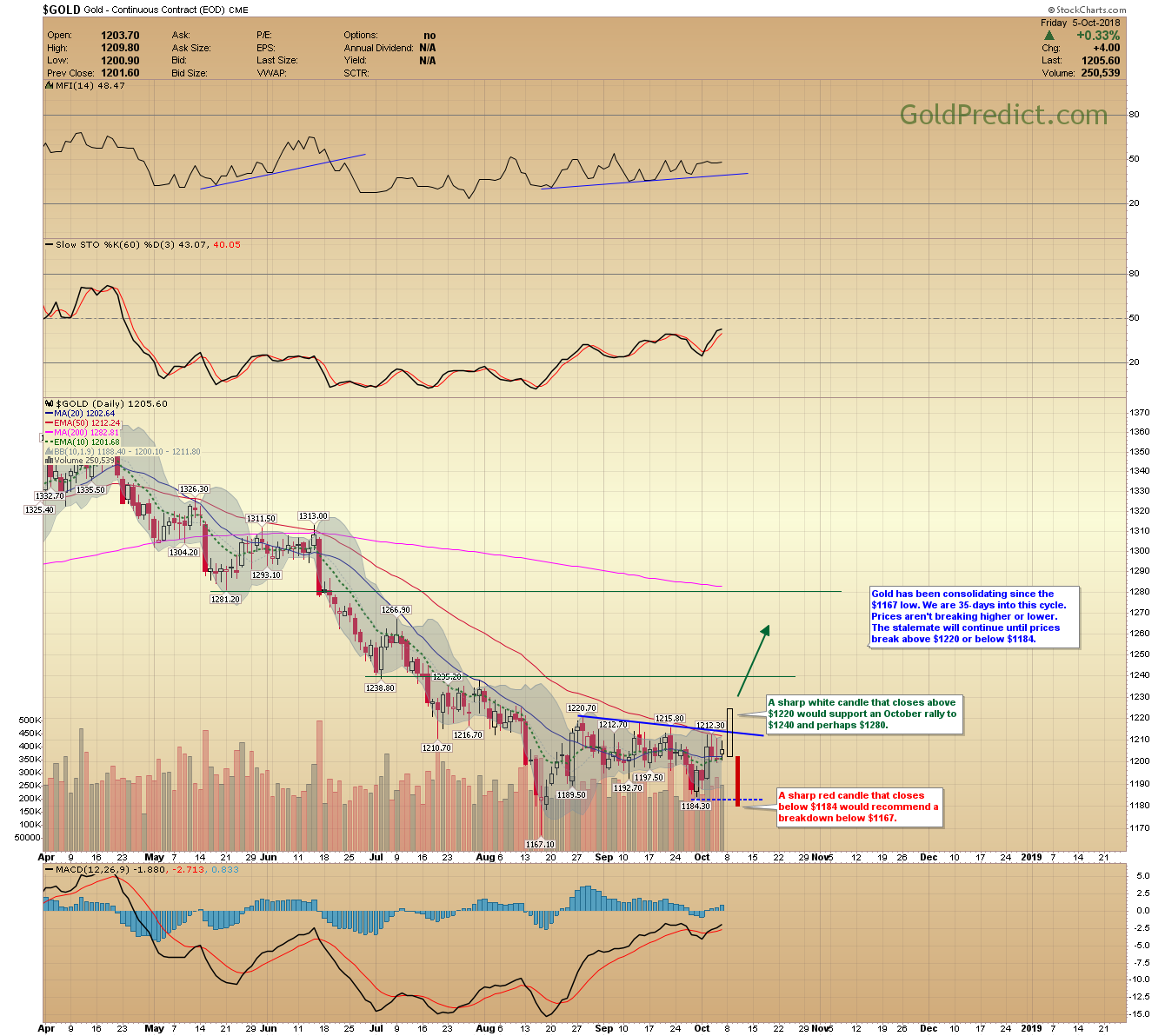

-GOLD- Gold has been consolidating since the $1167 low. We are 35-days into this cycle. Prices aren’t breaking higher or lower. The stalemate will continue until prices break above $1220 or below $1184. A sharp white candle that closes above $1220 would support an October rally to $1240 and perhaps $1280. A cutting red candle decline that closes below $1184 would recommend a breakdown below $1167.

-SILVER- Silver needs to close decisively above $15.00 or below the short-term trendline for its next range.

-GDX- There is stiff resistance around the $19.75 level. Prices would have to close above the potential reversal box to support a rally to $20.50 – $21.00. Whereas, closing below $18.14 would presumably trigger another sharp decline.

-GDXJ- The same analysis applies to juniors. Prices would have to close above the reversal box to extend the rebound. Closing below $26.79 would signal a breakdown.

-SPY- Prices rallied off the 50-day EMA. However, the odds still favor an intermediate-term decline. Closing below the blue trend line will confirm. If correct, we should see significant downside follow-through next week (possibly sharp). Depending on the intensity of the decline the correction could last anywhere from 1-3 weeks. The 200-day MA is a likely target. Of course, if algo-selling takes over, we could see an even deeper pullback.

-TNX- 10-year yields rose 5.53% last week breaking out to levels not seen since 2011. I think this may be spooking stocks into an October correction.

-TVIX- Prices could jump next week if stocks selloff sharply. We had record and near-record volume Thursday and Friday. I’ll watch the stock market closely and determine what to do with the remainder of my holdings. If we see another mini flash crash in stocks, TVIX could target the 200-day MA quickly.

-WTIC- Oil needs to close below the 10-day EMA to support a cycle top. Sometimes we see a failed bounce off the 10-day EMA before declining sharply into a cycle low. I’ll be watching the 10-day EMA and $76.00 level next week for clues.

Have a safe and pleasant weekend.