The price action remains crazy before the midterm elections. Metals and miners have endured several explosive days up and down over the last 2-months. Significant follow-through lacked in every case. Will this time be different or was this another convincing trader trap? Whatever the case, I think things will get easier after next weeks elections.

For the record – I still favor the seasonal model of November/December weakness.

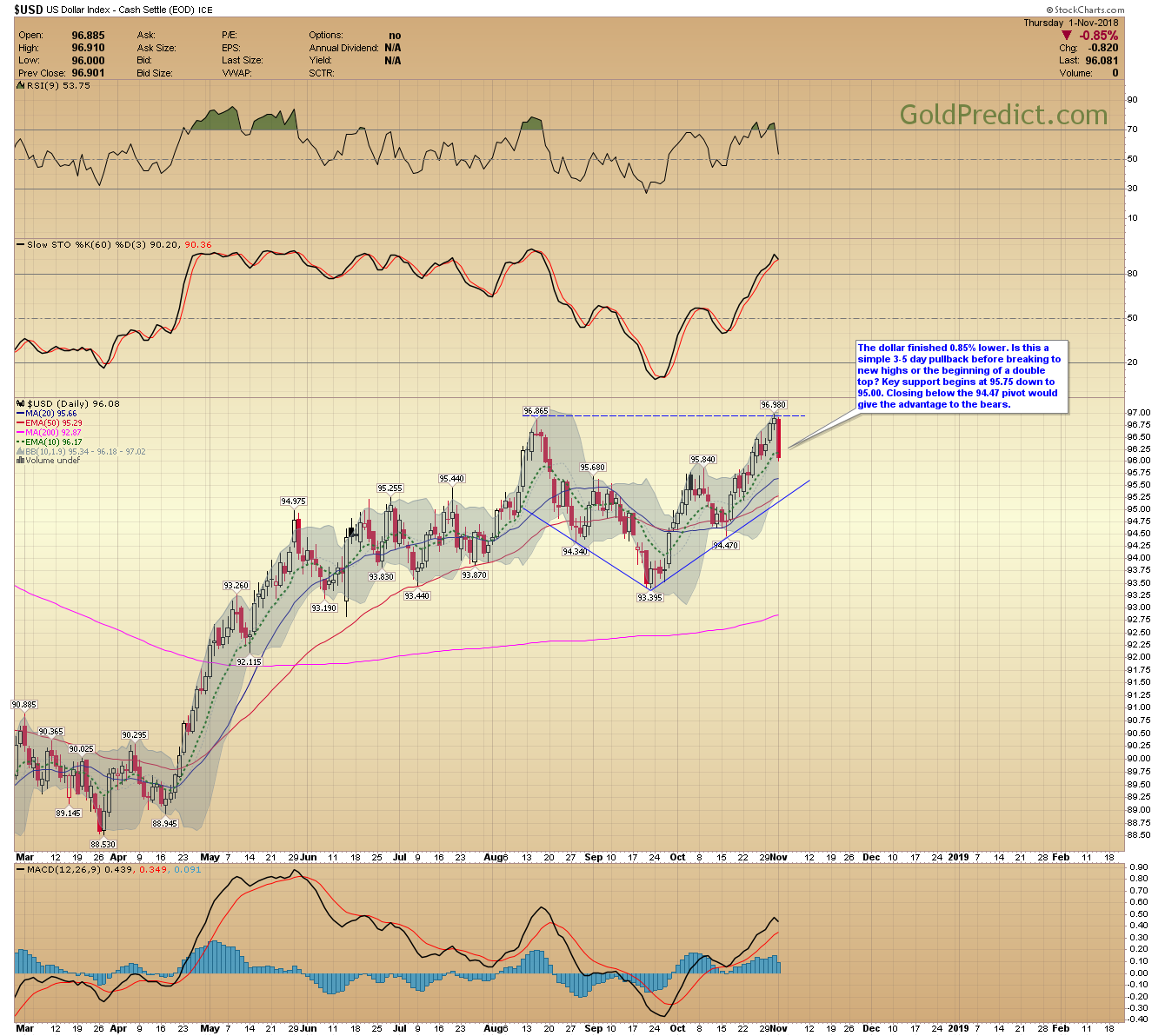

-US DOLLAR- The dollar finished 0.85% lower. Is this a simple 3-5 day pullback before breaking to new highs or the beginning of a double top? Key support begins at 95.75 down to 95.00. Closing below the 94.47 pivot would give the advantage to the bears.

-GOLD- Prices blasted higher on today’s dollar weakness. I thought yesterday’s lack of bearish conviction could lead to a rebound but nothing this sharp. I’m not sure what to make of it. Is this just pre-election jitters or the beginning of a larger-degree rally? Will prices follow-through higher or is this another convincing fakeout. I don’t know what to believe before the elections. All we can do is wait and see what prices do tomorrow.

-SILVER- The price action in metals is making me dizzy. Silver decisively broke the lower trendline then exploded back to the upper breakout line. I don’t know what to believe. It wouldn’t surprise me to see a repeat of the May/June pattern. Wake me up after the elections – this is getting ridiculous.

-GDX- If this is just a 1-3 day rebound after filling the October 11th gap and testing the trendline, then prices should remain below $20.51. There is still heavy resistance around the $21.00 level where prices broke down from an 18-month consolidation. Miners would have to explode through $21.00 after the elections to promote a bullish breakout.

-GDXJ- Juniors opened a morning gap, but prices look a bit weaker and failed to finish above the 10-day EMA.

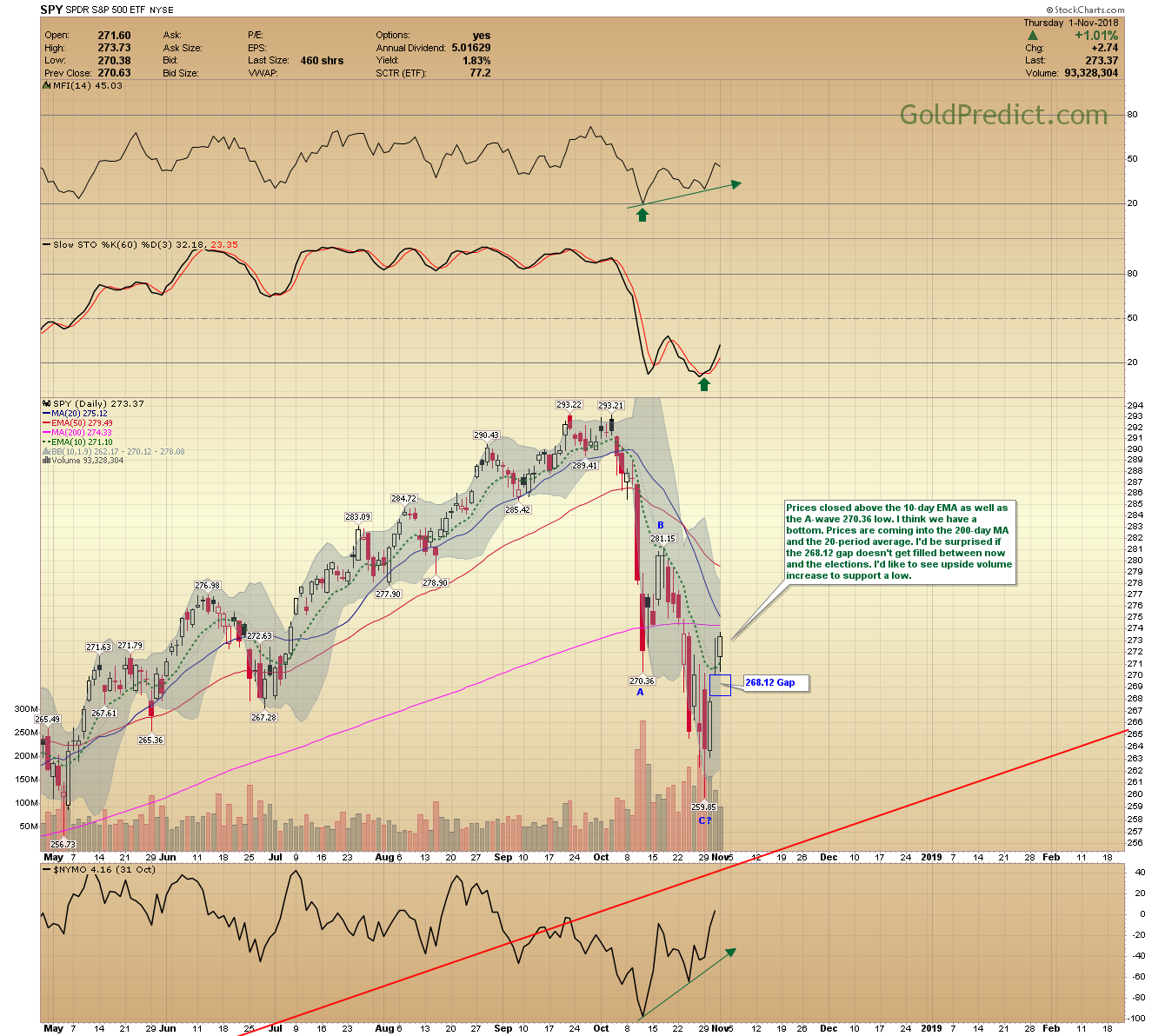

-SPY- Prices closed above the 10-day EMA as well as the A-wave 270.36 low. I think we have a bottom. Prices are coming into the 200-day MA and the 20-period average. I’d be surprised if the 268.12 gap doesn’t get filled between now and the elections. I’d like to see upside volume increase to support a low.

-TVIX- Prices closed well-below the 10-day EMA supporting a bottom in stocks.

-WTIC- The flag eventually did break lower. Prices are testing the June low. We should be getting close to a bounce. The Iran sanctions should begin to put a floor under the price.

Let’s see what happens tomorrow; the 8:30 AM employment report could make things interesting.