The stock market has been a little easier to forecast lately than gold and silver. I’m not sure why…maybe it’s because metals are so easily manipulated. Nevertheless, I think the market provided some clues today. Tomorrow’s price action could confirm. It looks like the stock market is heading higher and precious metals are about to break lower.

Gold and silver ended the day slightly lower- nothing unusual. However, the closing action in GDXJ may be signaling an imminent breakdown.

-GOLD- Prices formed a Doji candle. Nothing remarkable.

-SILVER- Silver formed a Doji type indecision candle as well.

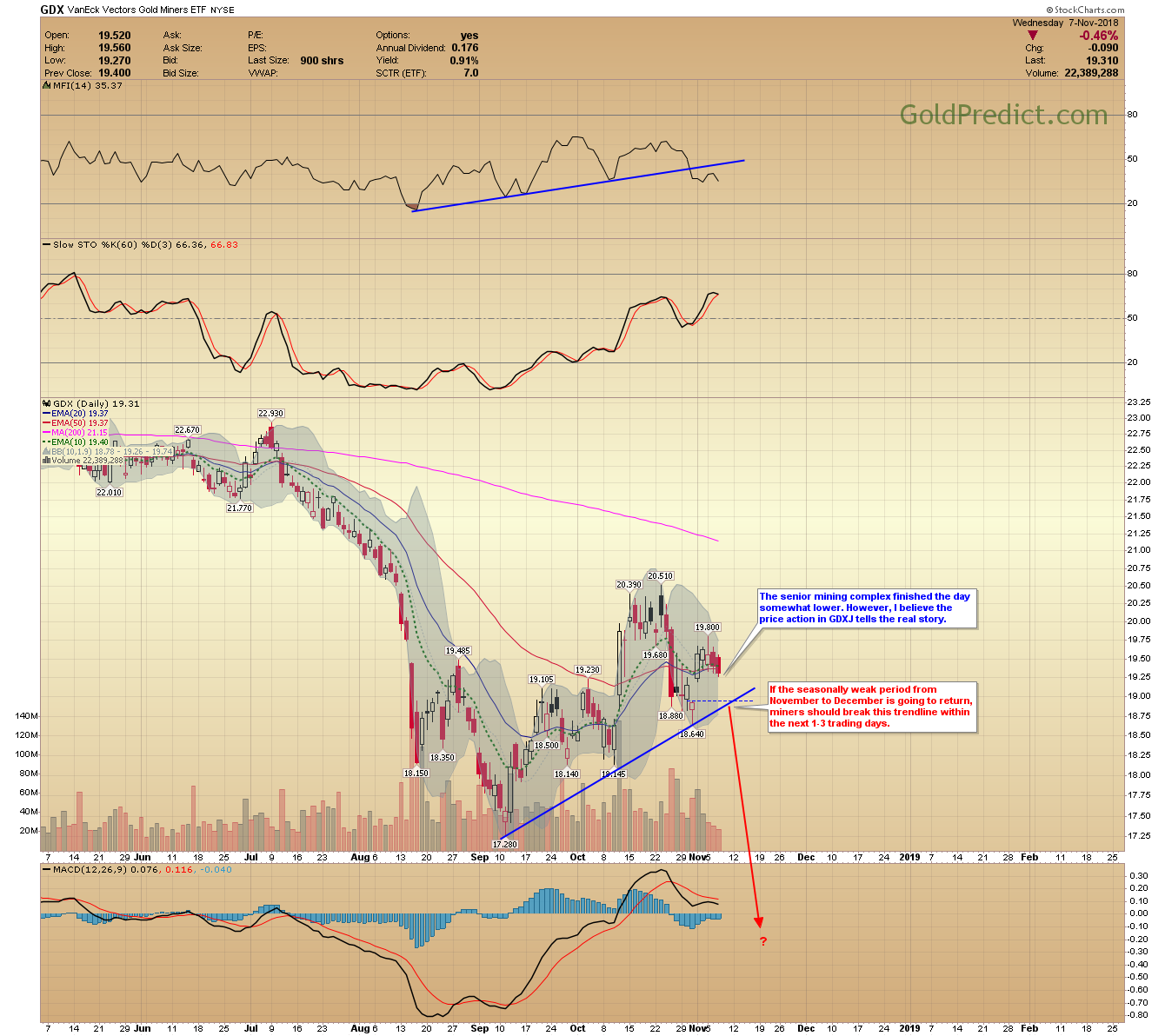

-GDX- The senior mining complex finished the day somewhat lower. However, I believe the price action in GDXJ tells the real story.

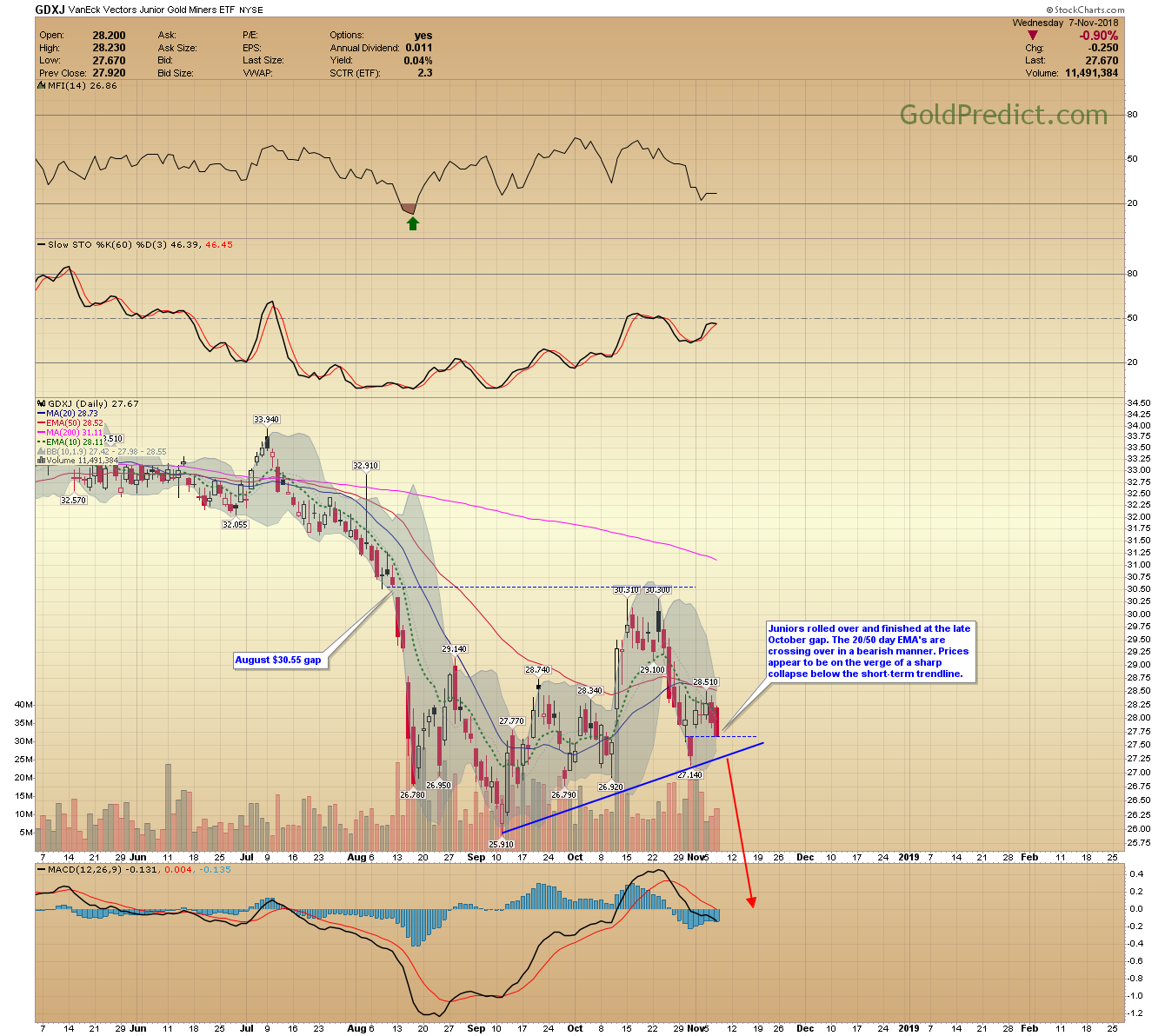

-GDXJ- Juniors rolled over and finished at the late October gap. The 20/50 day EMA’s are crossing over in a bearish manner. Prices appear to be on the verge of a sharp collapse below the short-term trendline.

-SPY- Apparently big money was happy with the election results. Prices are testing the B-wave high. A pullback seems reasonable at some point, but it’s not guaranteed.

-SSO- The SSO positions from October 11th and 23rd are in the money with an average profit of 6%.

Let’s see what tomorrow’s 2:00 PM Fed decision brings but it feels like precious metals are rolling over. If prices collapse in November, we should get a meaningful bottom in mid to late December.