The seasonal pattern in gold supports an October high, a November decline, and a December Bottom. It looks like we got the October high at $1246. Next, we should see a November decline. I figured Tuesday’s elections or today’s Fed statement could trigger a potential selloff. If prices aren’t heading lower tomorrow, then we could be stuck with more consolidation.

All we can do is take this one day at a time. Sometimes these patterns take longer than I expect. Nevertheless, as long as gold remains below the $1246 October high, I’ll continue to look for a November breakdown and December bottom.

-US DOLLAR- The dollar bounced off the support line and finished today with a swing low. Prices have adhered to a 10-day (+/- 1_day) advance/decline followed by a 3-5 day correction. If that progression endures, then this pullback may be over, and we could see another 10-day advance to new highs.

-GOLD- Since 2011 gold tends to peak in October, decline in November and bottom in December. I believe $1246 is the October high; the first benchmark of the seasonal pattern. The next benchmark is breaking November support. For this to occur, gold needs to first break the $1213.40 low and then the cycle trendline near $1200. If met then we can expect a quality buying opportunity in December. Sometimes these things (breakdowns/breakouts) take longer than I expect. Nevertheless, I’d like to see gold below $1213 within the next 1-3 trading days.

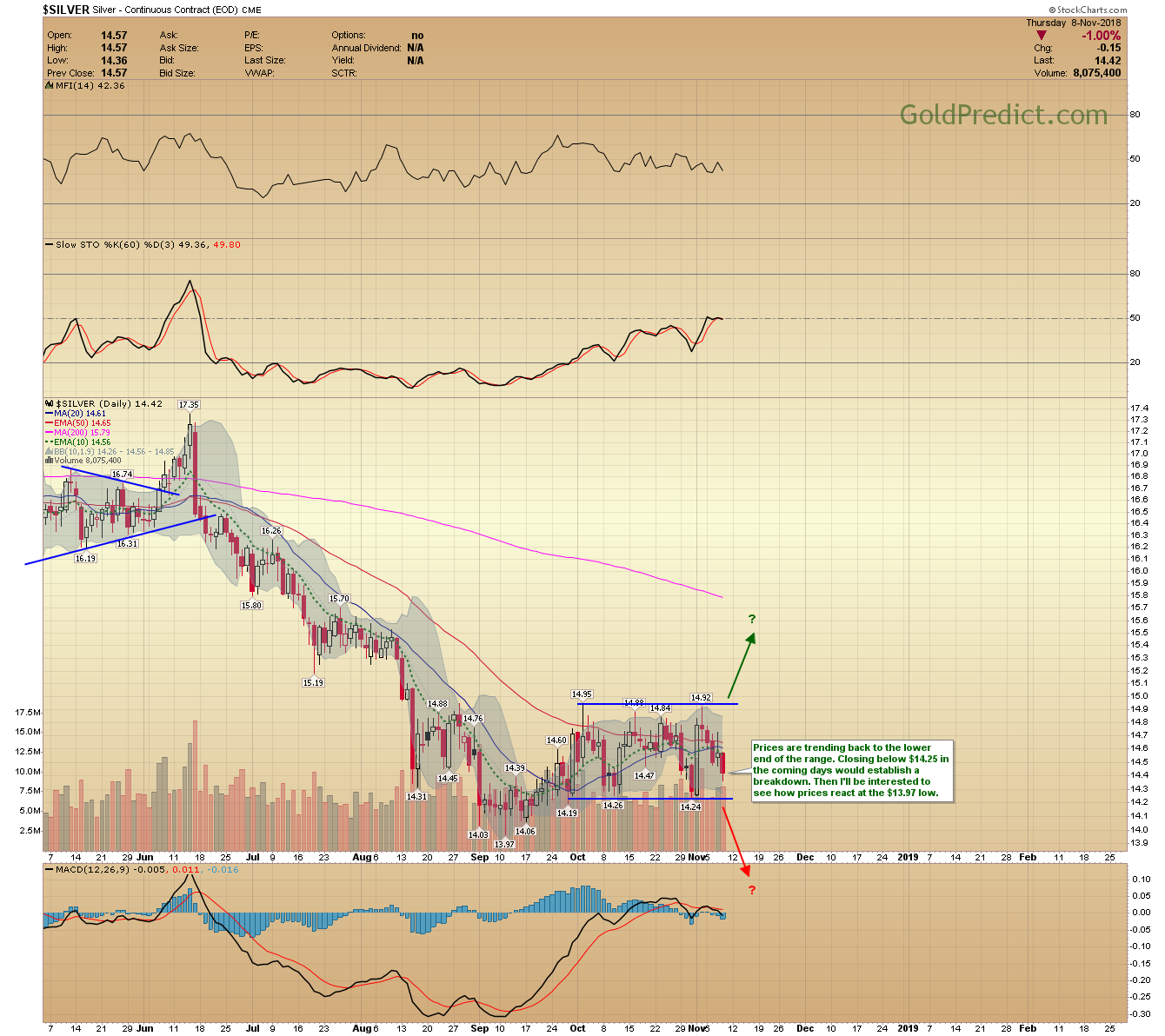

-SILVER- Prices are trending back to the lower end of the range. Closing below $14.25 in the coming days would establish a breakdown. Then, I’ll be interested to see how prices react at the $13.97 low.

-GDX- Buyers arrived 2-minutes before the close and pushed GDX back into positive territory. If we are going to see a sharp collapse, as described in the bull trap update, prices should break lower at any moment. Let’s see what Friday brings.

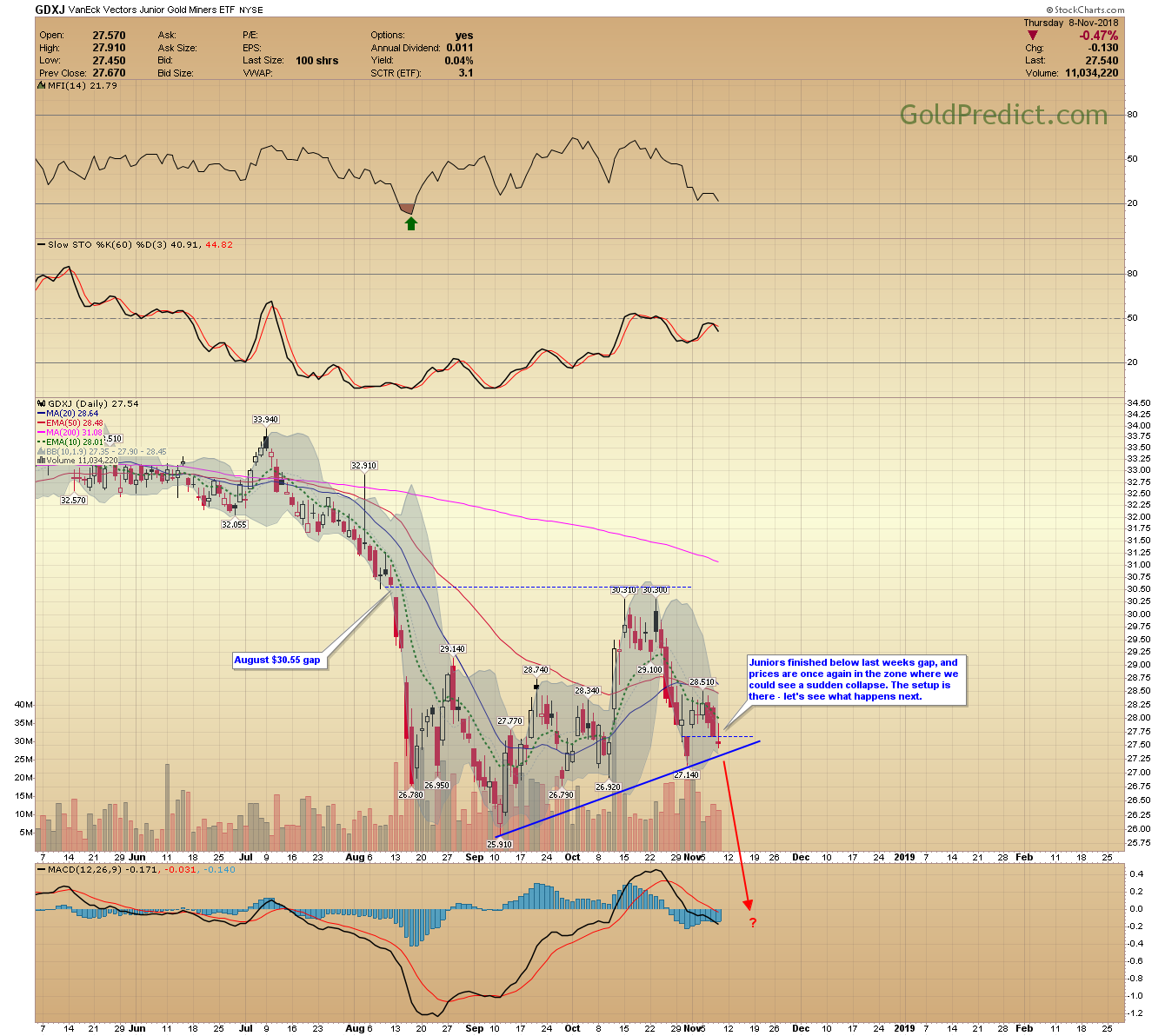

-GDXJ- Juniors finished below last weeks gap, and prices are once again in the zone where we could see a sudden collapse. The setup is there – let’s see what happens next.

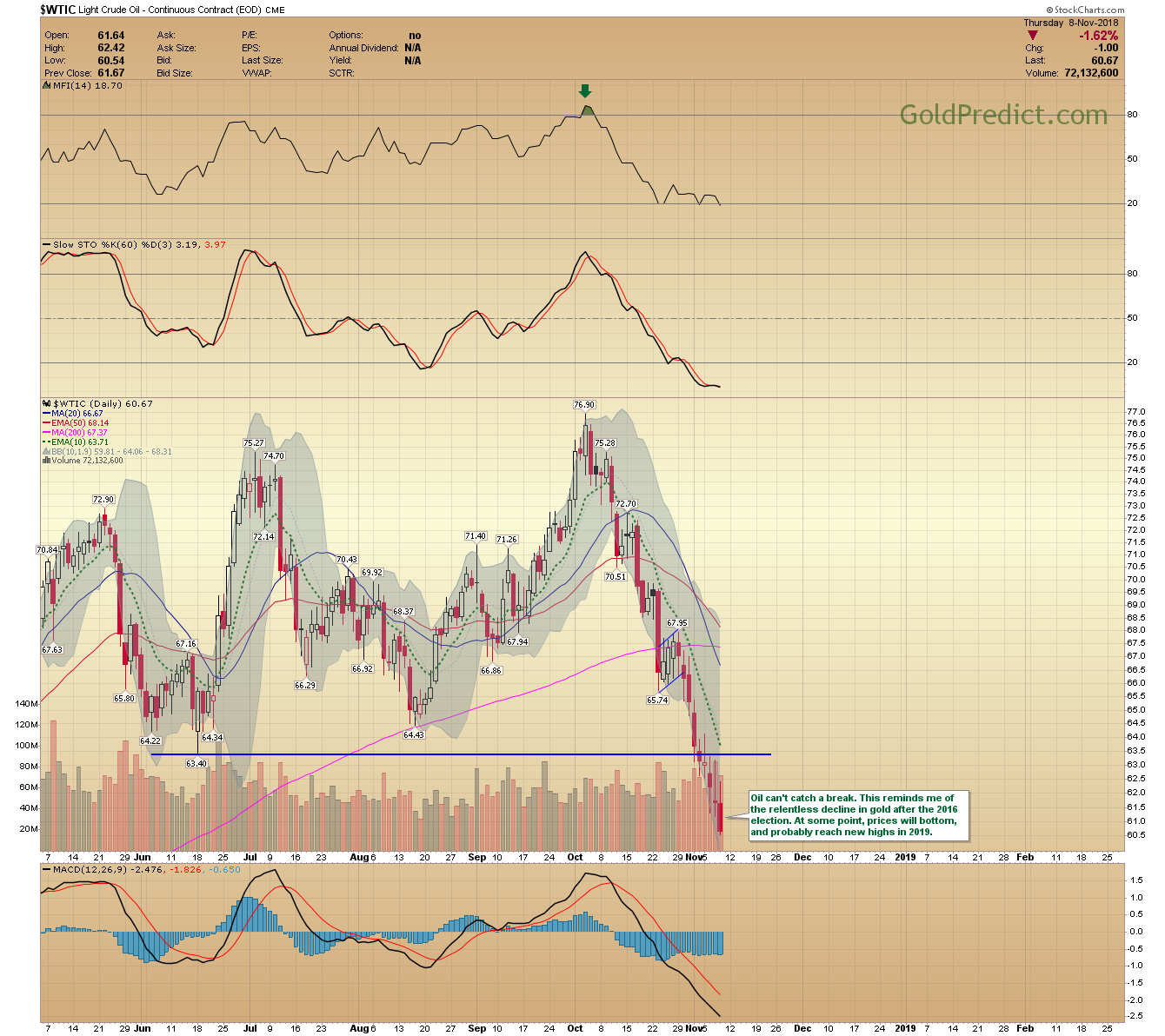

-WTIC- Oil can’t catch a break. This reminds me of the relentless decline in gold after the 2016 election. At some point, prices will bottom, and probably reach new highs in 2019.

Have a wonderful evening.