It looks like the trade negotiations between the US and China imploded. China backed out of the previous deal. Some believe China is stalling in hopes that Trump will lose the 2020 election so they can negotiate with a different president.

Precious metals and miners have been grinding lower for about three months. I think we are close to the next 6-month low. My cycle work supports a turning point during the last week of May. The odds favor a bottom at that time. Gold would have to break cleanly above $1310 to suggest otherwise.

Bitcoin surged above resistance near $6500. I think we will find out within the next few days if it was a legitimate breakout or a volatile spike high. Closing back below $6500 would recommend a top.

-US DOLLAR- The dollar is stuck in no man’s land – it’s not breaking higher nor is it breaking lower. It would take progressive closes below the 200-day MA to support an intermediate decline. For a bullish course, prices would have to close progressively above 98.00.

-GOLD WEEKLY- The weekly chart of gold appears to be forming a bullish consolidation or flag pattern. A weekly close above $1310 will establish a breakout. Downside support arrives around $1250.

-GOLD DAILY- The daily chart of gold remains in a prolonged wedge formation. It’s hard to say how much longer this will drag on. The next cycle turning point arrives at the end of May and could time the next low.

-SILVER WEEKLY- There is strong weekly support and silver around $14.70. Prices have been grinding lower, and I believe we are approaching the next six-month low. A weekly close above $15.10 would support a bottom.

-SILVER DAILY- The daily chart of silver reveals a slow grind lower. I think we will see a tradable bottom within the 1-3 weeks.

-HUI- The HUI mining index finished the week at new 2019 lows. Prices are oversold. I expect the next tradable bottom within the next one to three weeks.

-XAU- The XAU junior mining index also finished at new 2019 lows. The next 45-day cycle arrives May 31st.

-GDX- The GDX mining ETF is diverging slightly from the XAU & HUI. For the moment, prices remain above last week’s $20.14 low. I think we will see a bit more downside before bottoming at the end of May.

-GDXJ- Unless gold breaks cleanly above $1310, I think we will see a bit more downside and a bottom at the end of May.

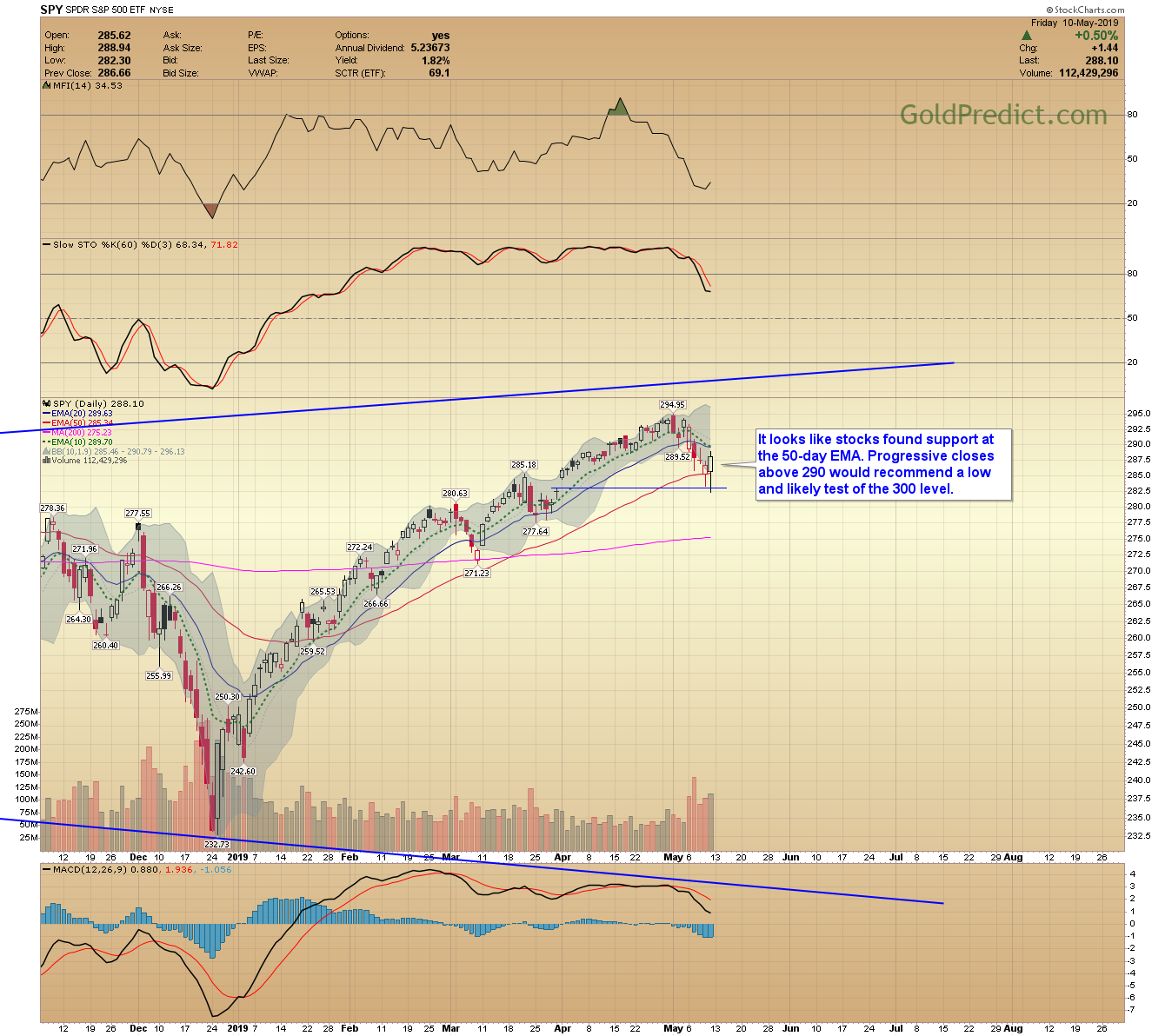

-SPY- It looks like stocks found support at the 50-day EMA. Progressive closes above 290 would recommend a low and likely test of the 300 level.

-WTIC- Oil remains a tight consolidation zone just below $62.00. It looks like prices are preparing for a sharp move, my guess would be lower.

-BITCOIN- Prices broke above resistance at $6500 and quickly rallied to just over $7000. Bitcoin is relatively illiquid, and it’s pretty easy to push prices around. For that reason, I’m hesitant to believe the move above $6500. Progressive closes back below $6500 would indicate a top and false breakout. To register additional upside, this rally would have to persist above $8000.

Have a great weekend.