The markets are spooked over escalating trade tensions between the US and China. Gold jumped to over $1300 yesterday as global stock markets tanked. If this was just a fear-driven reaction, gold may begin to rollover and slip back below $1290. Holding $1290 and closing progressively above $1310 in the coming days would support more upside and a possible bottom.

My cycle work supports a turning point during the last week of May. I think it will time a bottom, but I can’t be sure. I’ll continue to monitor for evidence of a low and watch for a possible buying opportunity within the next 1 to 2 weeks.

-US DOLLAR- The dollar is testing the 50-day EMA. Closing above 97.50 in the coming days would support an upside breakout. Closing progressively below 97.00 would infer further downside.

-GOLD- Prices jumped to $1300 yesterday as global stock markets plunged. Little to no follow-through today. Slipping back below $1290 would be negative. To support a possible bottom, gold would have to close progressively above $1310. I expect the next cycle turning point at the end of May.

-SILVER- Silver prices would have to close progressively above $15.10 to recommended bottom.

-GDX- Prices are likely consolidating between $20.20 and $21.50. It would take a sustained move above $21.50 to recommend a 6-month low. The next cycle should turning point should arrive during the last week of May.

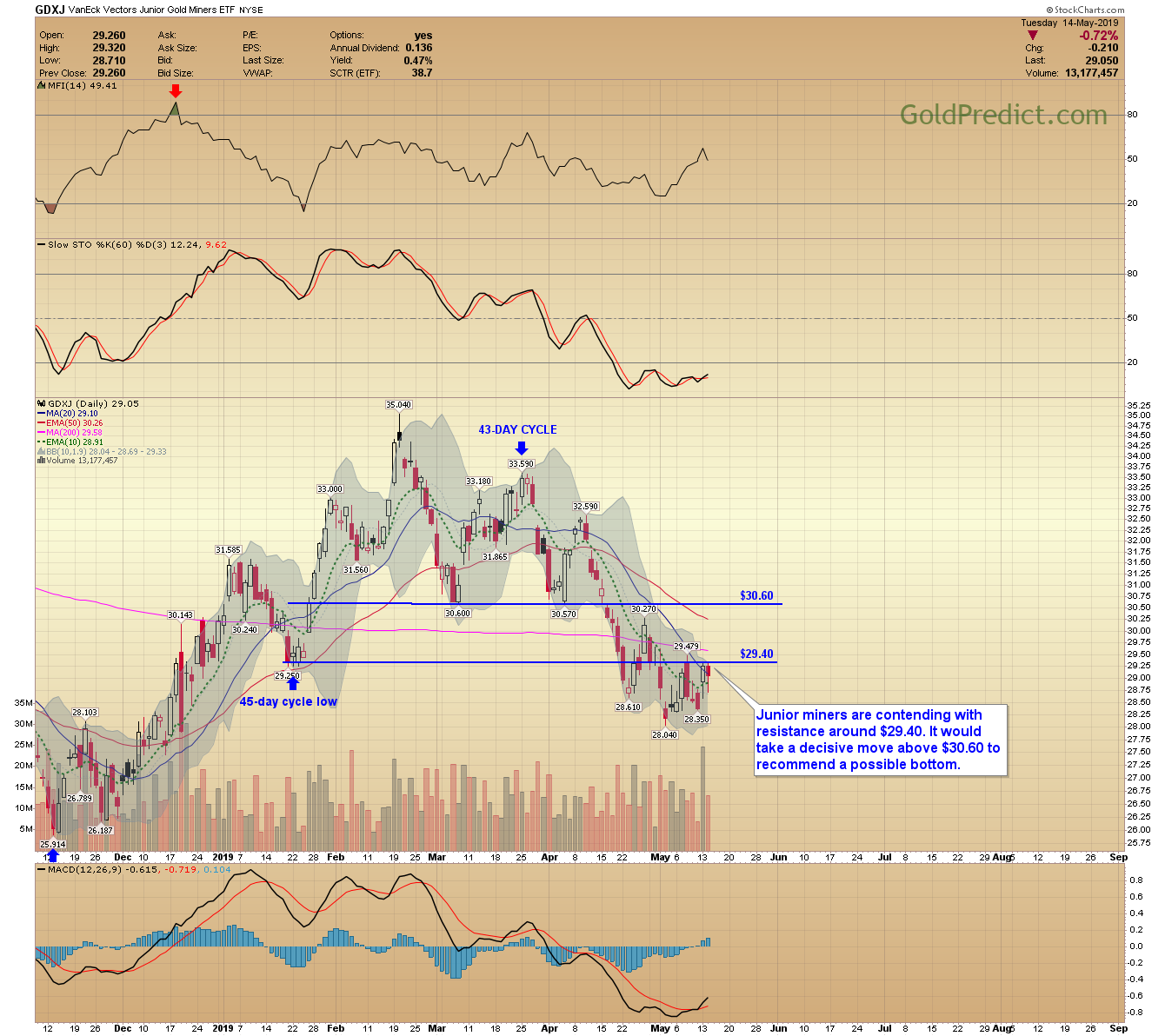

-GDXJ- Junior miners are contending with resistance around $29.40. It would take a decisive move above $30.60 to recommend a possible bottom.

-SPY- I think we will find out within the 1-3 days if this is just a quick pullback or the beginning of a sharper decline. Markets are spooked over the escalating US/China trade war.

-WTIC- Oil is still consolidating just below $62.00. Prices are hugging the 200-day MA. I suspect they will break lower, but I’m not sure.

Have a great night.