- Gold prices broke higher on Friday over stock market fears. Prices closed above $1310, and it looks like the 6-month low bottomed in May.

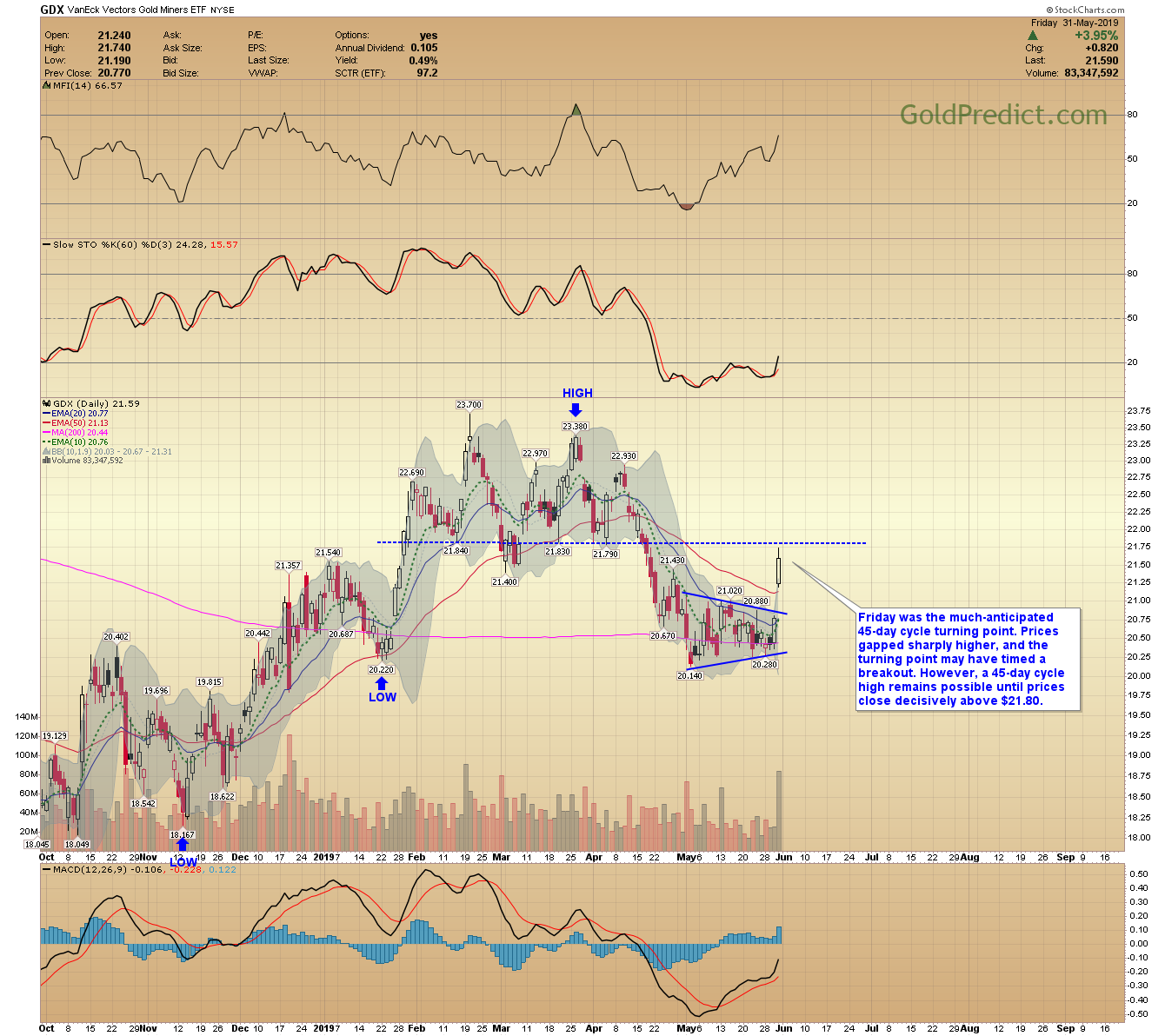

- Gold miners broke higher from their triangle consolidations at the 45-day cycle turning point. A little upside follow-through next week will support a new advance.

- Silver and Platinum are lagging but may catch up early next week.

-GOLD DAILY- On the surface, it appears the 45-day cycle timed a breakout in gold instead of the usual top or bottom. I’d like to see some upside follow-through and progressive closes above $1315 to confirm. If established, then it appears the 6-month low arrived in early May and bottomed above the 200-day MA (a good sign for the bulls). A daily close below $1295 next week would imply a false breakout.

-GOLD WEEKLY- If gold’s 6-month cycle bottomed at $1267, then prices should challenge multi-year resistance near $1370 in June or July. From there I suspect gold will either break decisively above $1400 or stumble and slip back towards the lower boundary near $1200 in Q4. The outcome will likely depend on the stock market and recession expectations.

10 YEAR TREASURY YIELD: One concern I have regarding gold is the 10-year treasury yield. After peaking last October yields have dropped sharply. The weekly RSI (bottom) is deeply oversold. Similar conditions in the past led to a multi-month peak in gold prices (top).

-SILVER WEEKLY- Silver remains in a multi-year basing pattern similar to 1997 – 2003. Prices should continue to find support around $14.00. I try to add to my long-term physical holdings when prices reach this level. When silver finally breaks higher (probably 2019 or 2020) the initial burst should carry prices swiftly to $25.00.

-SILVER DAILY- Silver did not confirm Friday’s breakout in gold and miners. We could see the breakout on Monday. I will consider a position in USLV.

-PLATINUM DAILY- Like silver, platinum hardly budged on Friday as gold and miners surged higher. I’m not sure why but it’s a little cause for concern. Progressive closes above the 10-day EMA ($806) next week would support a 6-month low.

-GDX- Friday was the much-anticipated 45-day cycle turning point. Prices gapped sharply higher, and the turning point may have timed a breakout. However, a 45-day cycle high remains possible until prices close decisively above $21.80.

-GDXJ- If Friday’s breakout was legitimate, then prices should not close below the gap at $28.50.

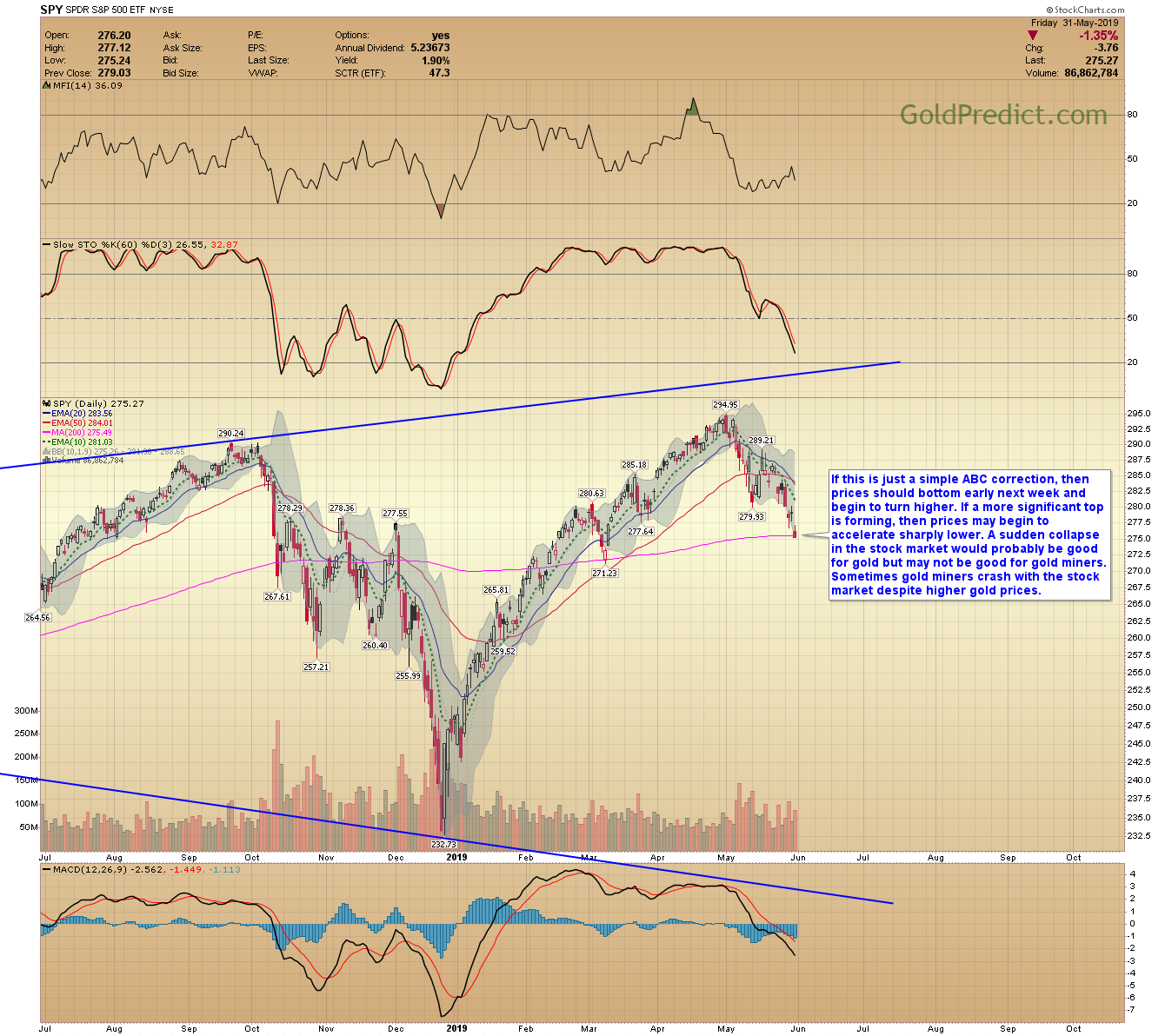

-SPY- If this is just a simple ABC correction, then prices should bottom early next week and begin to turn higher. If a more significant top is forming, then prices may begin to accelerate sharply lower. A sudden collapse in the stock market would probably be good for gold but may not be good for gold miners. Sometimes gold miners crash with the stock market despite higher gold prices.

-WTIC- Oil prices are oversold and have reached the 50% to 61.8% retracement level of the prior advance. There is significant support between $50.00 – $53.00. I suspect prices are approaching a short-term bottom.

Hope you’re having a wonderful weekend.