Spot gold is currently trading around $1387. Last night’s spike to $1397.70 registered a new multi-year high. On the surface, it looks like gold prices are finally breaking out. But as we are well aware, the market manipulators and algo’s are masterful at painting the tape to get people on the wrong side of the trade. Consequently, I’d like to see where prices close on Friday before declaring a full-blown breakout.

If gold is breaking out, then there will be plenty of time to enter and add to positions. It’s not like the rally will end in just a few days or few weeks. A confirmed breakout here would signal the onset of a multi-year advance.

Silver, platinum, and miners remain well below there 2016 highs, so there is plenty of upside remaining if precious metals are indeed breaking out.

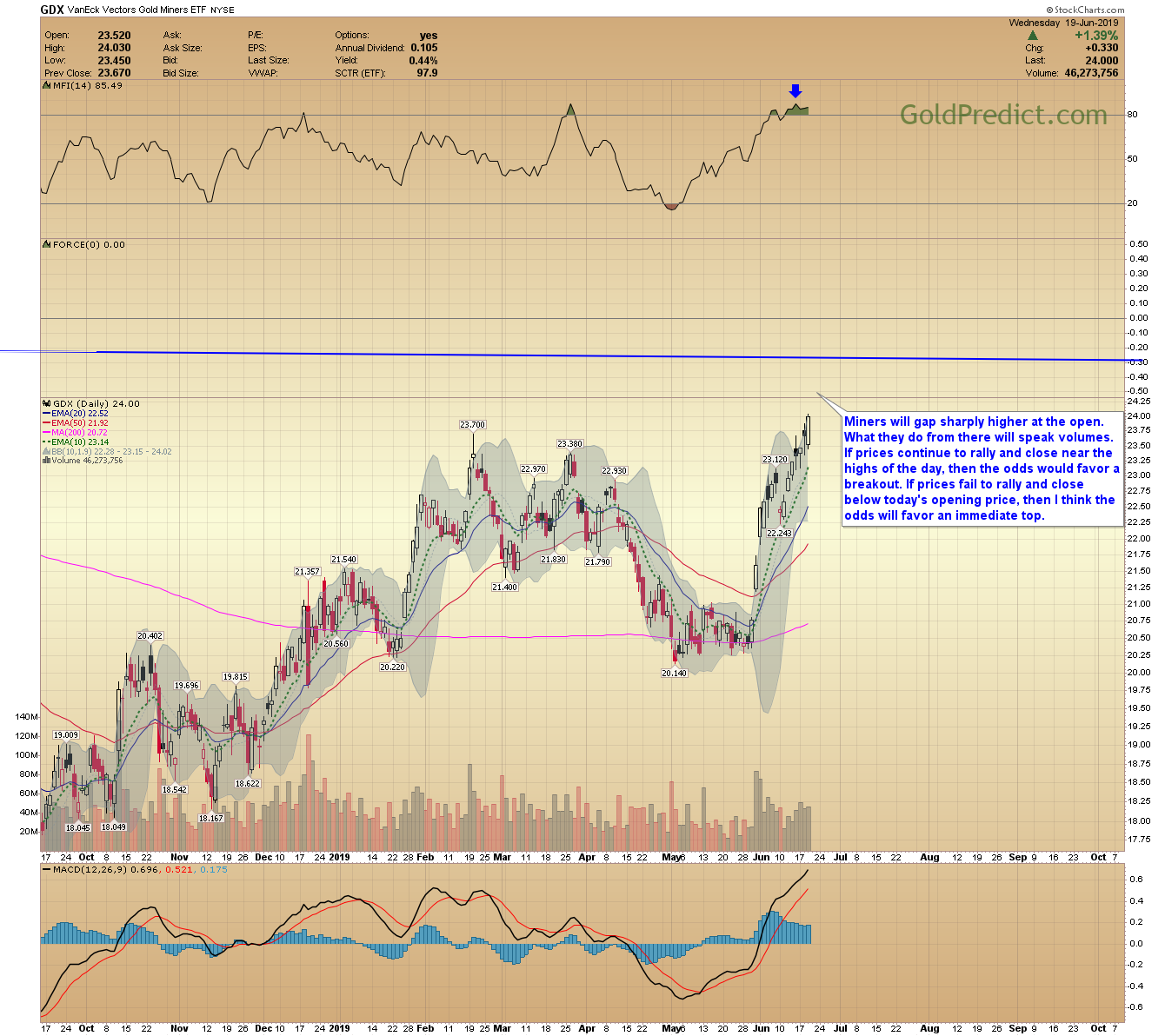

-GDX- While gold has exceeded its 2016 high, gold miners remain well below it. It would take a decisive rally through $25.00 – $25.50 in GDX to signal a corresponding breakout. I suspect prices will test this trendline today. I will be paying particular attention to how and where prices close today and tomorrow.

-GDX CLOSEUP- Miners will gap sharply higher at the open. What they do from there will speak volumes. If prices continue to rally and close near the highs of the day, then the odds would favor a breakout. If prices fail to rally and close below today’s opening price, then I think the odds will favor an immediate top.

-GDXJ- Juniors should fill the gap near $32.80 today.

Yesterday’s Fed decision put the odds for a July rate cut at 100%. The stock market, oil, and precious metals are all rallying. The S&P 500 tagged a new all-time high in the futures market this morning. I can’t say that I’ve ever seen the Fed cut interest rates with the stock market at new all-time highs.

President Trump announced that he would run for reelection in 2020. He has touted a strong economy and rising stock market as his success. To increase his odds for reelection, the economy, stock market, and agriculture prices need to be healthy. Many Trump supporters are rural Americans and farmers, who are struggling. To get reelected, Trump needs to end the trade war with China, and that would take the pressure off the Fed to cut rates in 2019 and potentially deflate gold.

I’ll watch prices closely and update throughout the day.