The last few weeks have been challenging as metals and miners consolidate. When prices are on the verge of a breakdown – they stop and suddenly reverse higher. That happened several times around the $1920 level in gold. Eventually, the $1920 level in gold should break and trigger a speedy decline to $1750 – $1800, and perhaps the next 6-month low.

The next 2-months could be volatile as markets begin to factor in the November election. I think a Trump victory would be good for the stock market. However, much would depend on who controls the House and the Senate. A Biden win would be bad for stocks as he would eventually raise taxes. Gold will benefit from either candidate but could sell off during another “all-out” liquidation.

SUPPLY SHORTAGES: I think supply shortages are here to stay. I see the potential for hoarding industrial metals like silver, platinum, and palladium as manufacturers aim to secure resources. Consequently, finding quality “investment grade bullion” could become problematic. I think premiums on 1-ounce Gold, Silver, and Platinum Eagles could go for double their spot price or higher during this decade.

Currently, the gold cycle indicator is at 281. It should drop below 100 before indicating the 6-month low.

-US DOLLAR- The dollar dipped briefly below the 92.00 level on Tuesday but quickly recovered. Prices continue to grind out an intermediate low. The dollar should rise into the elections as investors step to the sidelines awaiting the results.

-GOLD- Gold has tested the $1920 area several times, and each time prices bounced. The rebounds are getting weaker, and eventually, prices should drop below $1900. Typically, prices break hard once a support level finally yields. A sudden collapse to $1750 – $1800 is possible in this scenario.

-GOLD 2016- We had a similar pattern in gold before the 2016 presidential election. Prices tested the $1310 level several times, with each bounce getting smaller. Eventually, prices broke and broke hard.

-SILVER- The silver levels are simple: Below $26.00 signals and intermediate-degree decline, and below $22.50 opens the door for $19.00.

-PLATINUM- Platinum is weaker than gold and silver – I expect a retest of the $800 level. Below $800, and we could reach $700. I remain very bullish on platinum; however, finding coins is difficult. Eventually, the ultra-limited supply should lead to a sharp increase in platinum values.

-GDX- Miners are in a slow and annoying triangle consolidation. Once it is completed, I expected a sharp collapse towards support between $31.00 and $33.00.

-GDXJ- Juniors must slip below $54.00 to trigger the breakdown to $42.00 – $44.00.

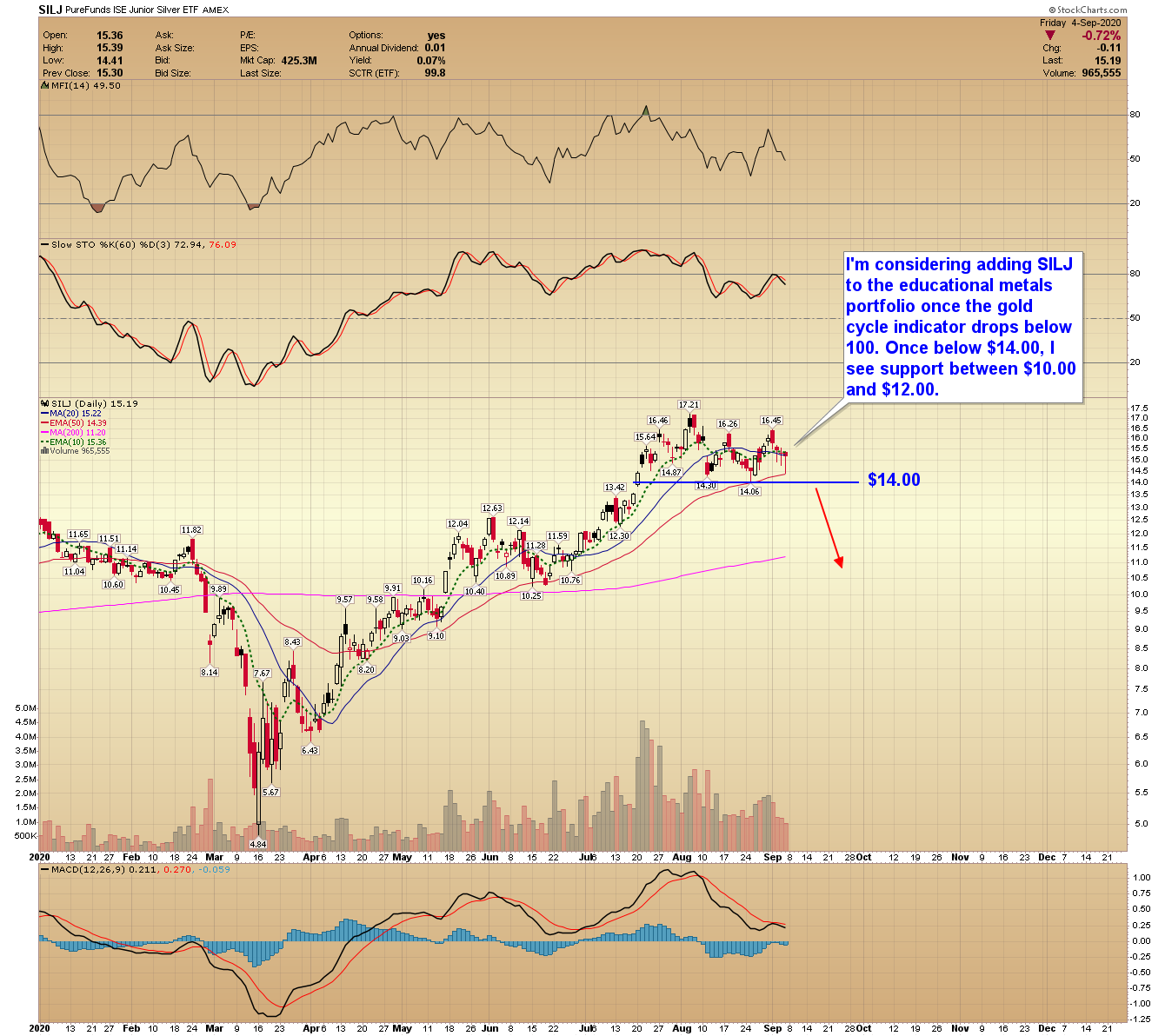

-SILJ- I’m considering adding SILJ to the educational metals portfolio once the gold cycle indicator drops below 100. Once below $14.00, I see support between $10.00 and $12.00.

-SPY- I think stocks will remain under pressure until the November election. A more severe correction is possible on progressive closes below 335. It may take a collapsing stock market to get the second round of stimulus through Congress. Without more stimulus, a double-dip recession is inevitable.

Markets are closed Monday for Labor Day.

Have a safe and pleasant weekend.