Commodities are under pressure as the global economy slows, gold is finding some support while fears increase, and gold prices should turn higher soon. Oil is cheap, and the bears have full control, the $30.00 level was breached during the week.

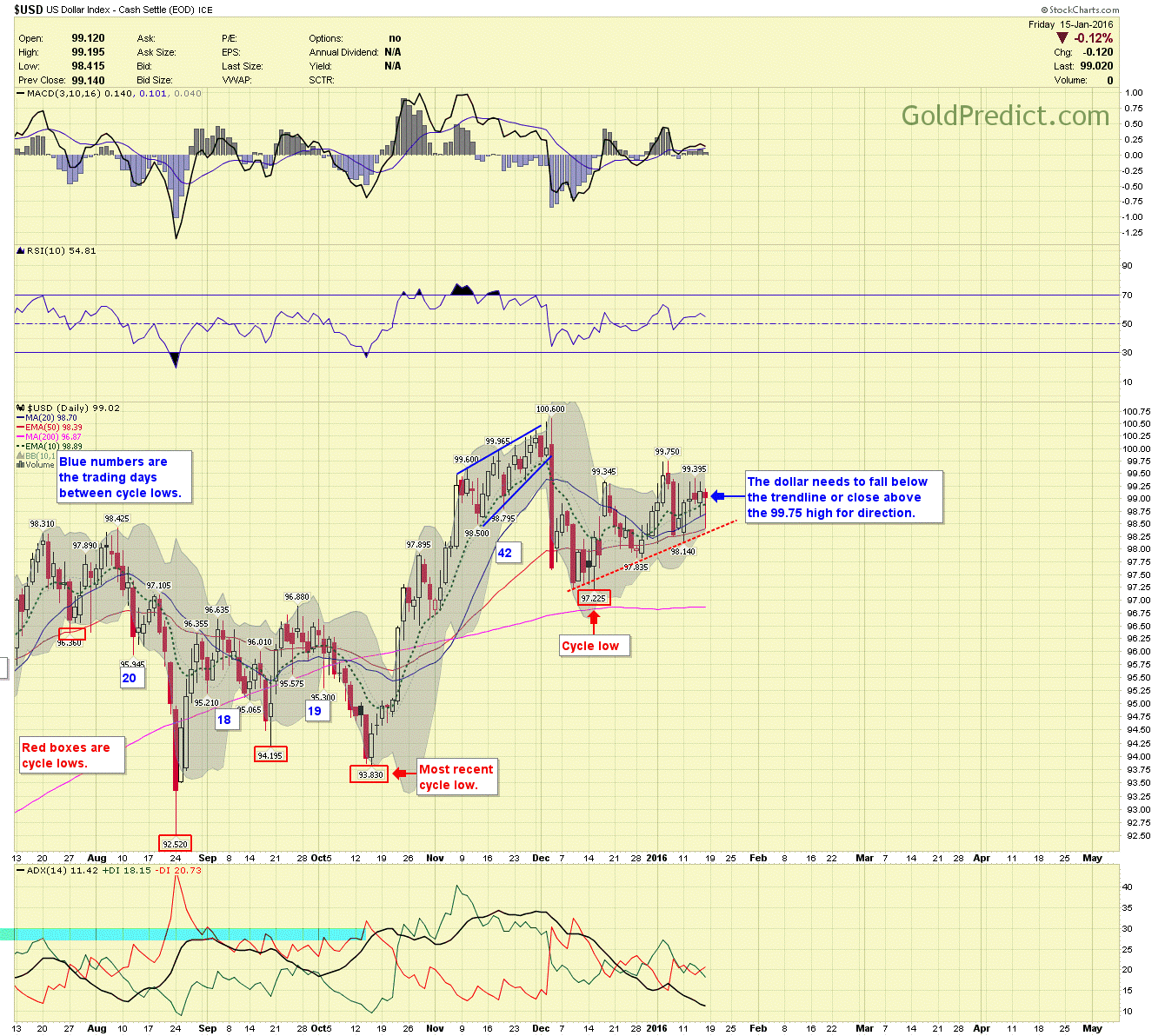

-US DOLLAR- The dollar needs to fall below the trendline or close above the 99.75 high for direction, odds favor breaking the trendline.

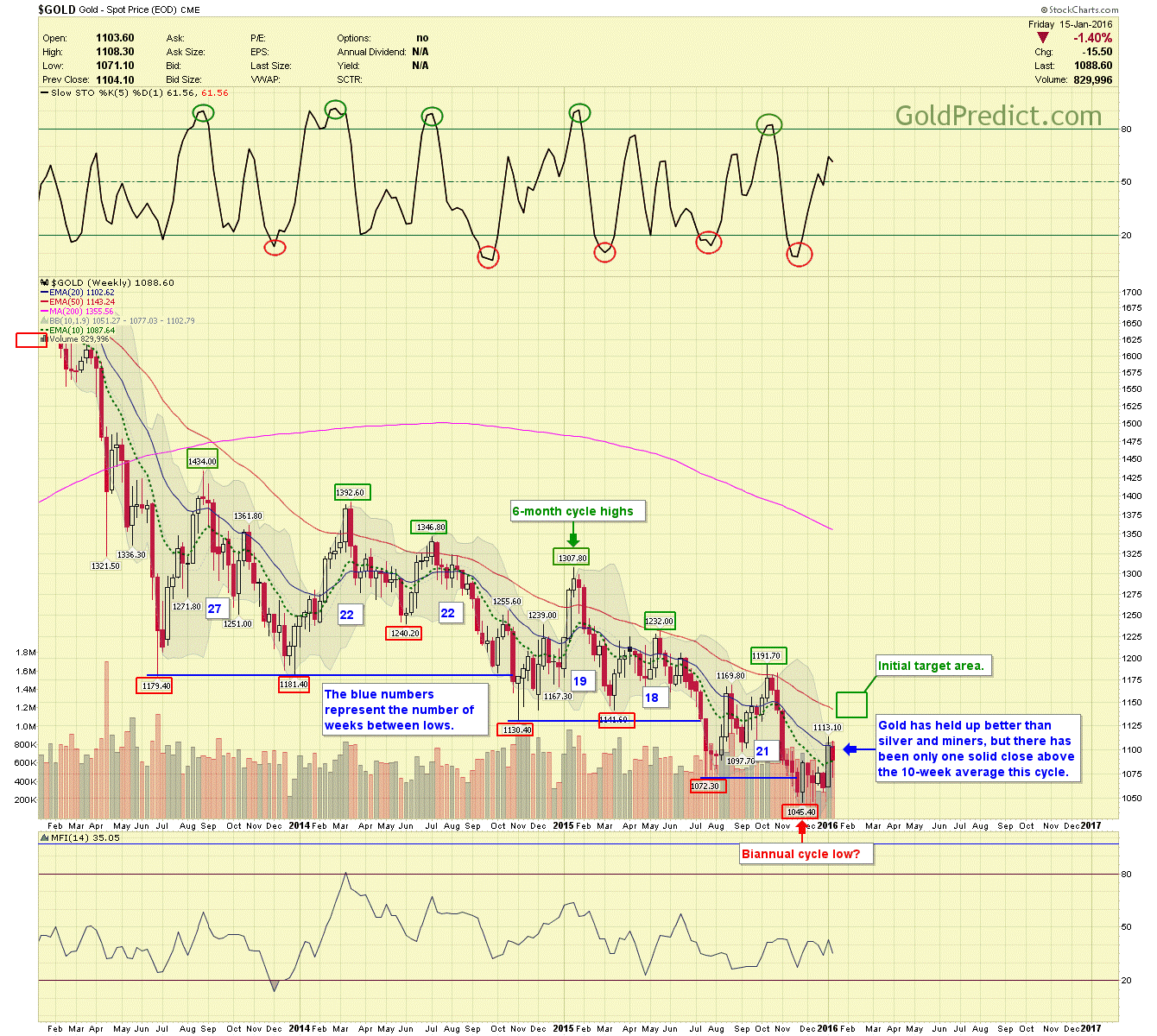

-GOLD WEEKLY- Gold has held up better than silver and the miners, but there has been only one solid weekly close above the 10-week average this cycle.

-GOLD DAILY- Gold looks close to completing a common cycle and prices should turn higher again soon.

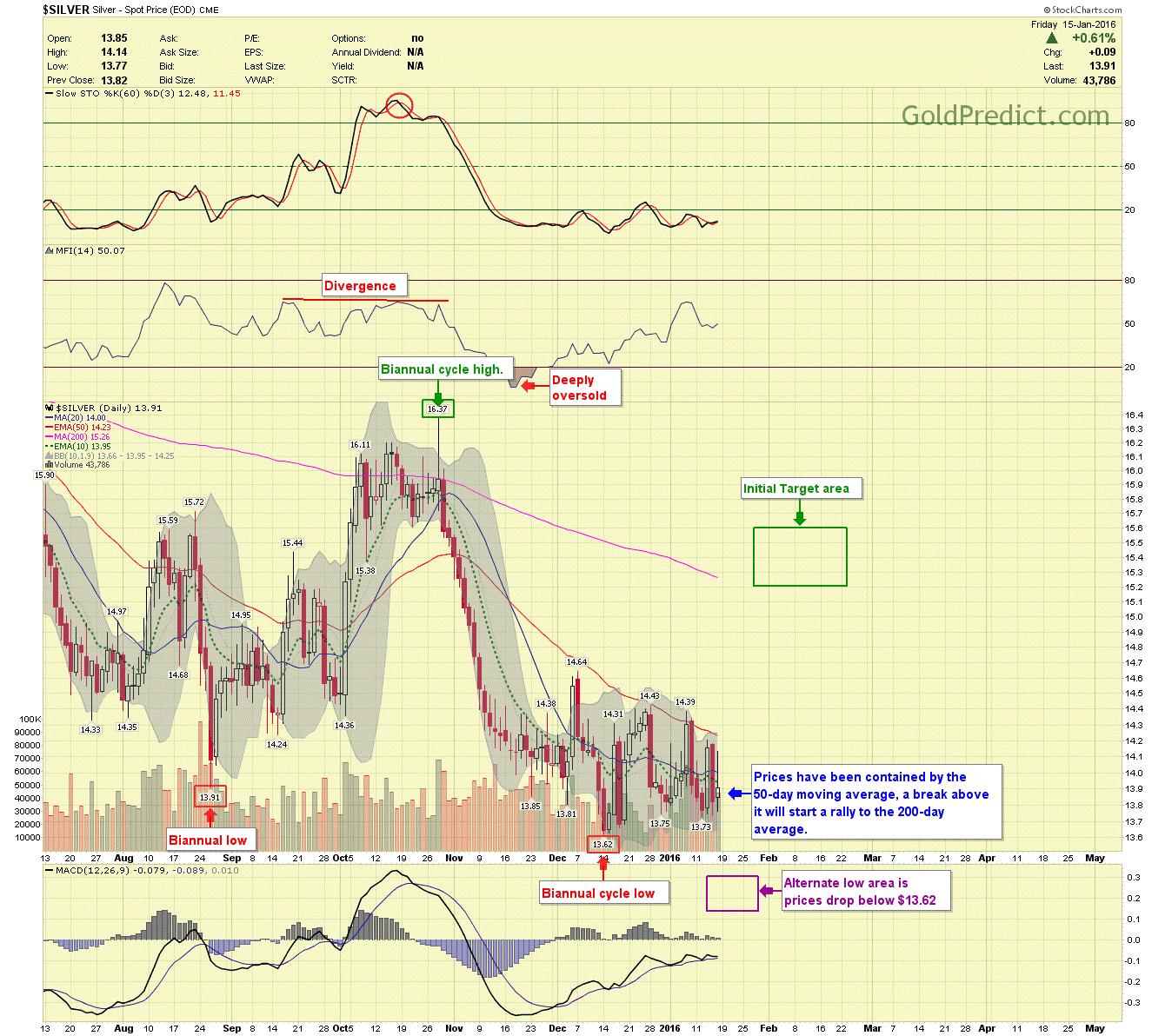

-SILVER WEEKLY- Silver has managed to stay above the $13.62 low for now, and prices will either turn higher toward the target area or drop a bit lower before doing so.

-SILVER DAILY- The 50-day moving average has contained prices, a break above it will start a rally to the 200-day average.

-HUI WEEKLY- I’m torn in my analysis on miners…. The biannual cycle suggests prices should rally to the 50-week moving average, but the current price structure has a bearish look that may lead prices sharply lower, time will tell.

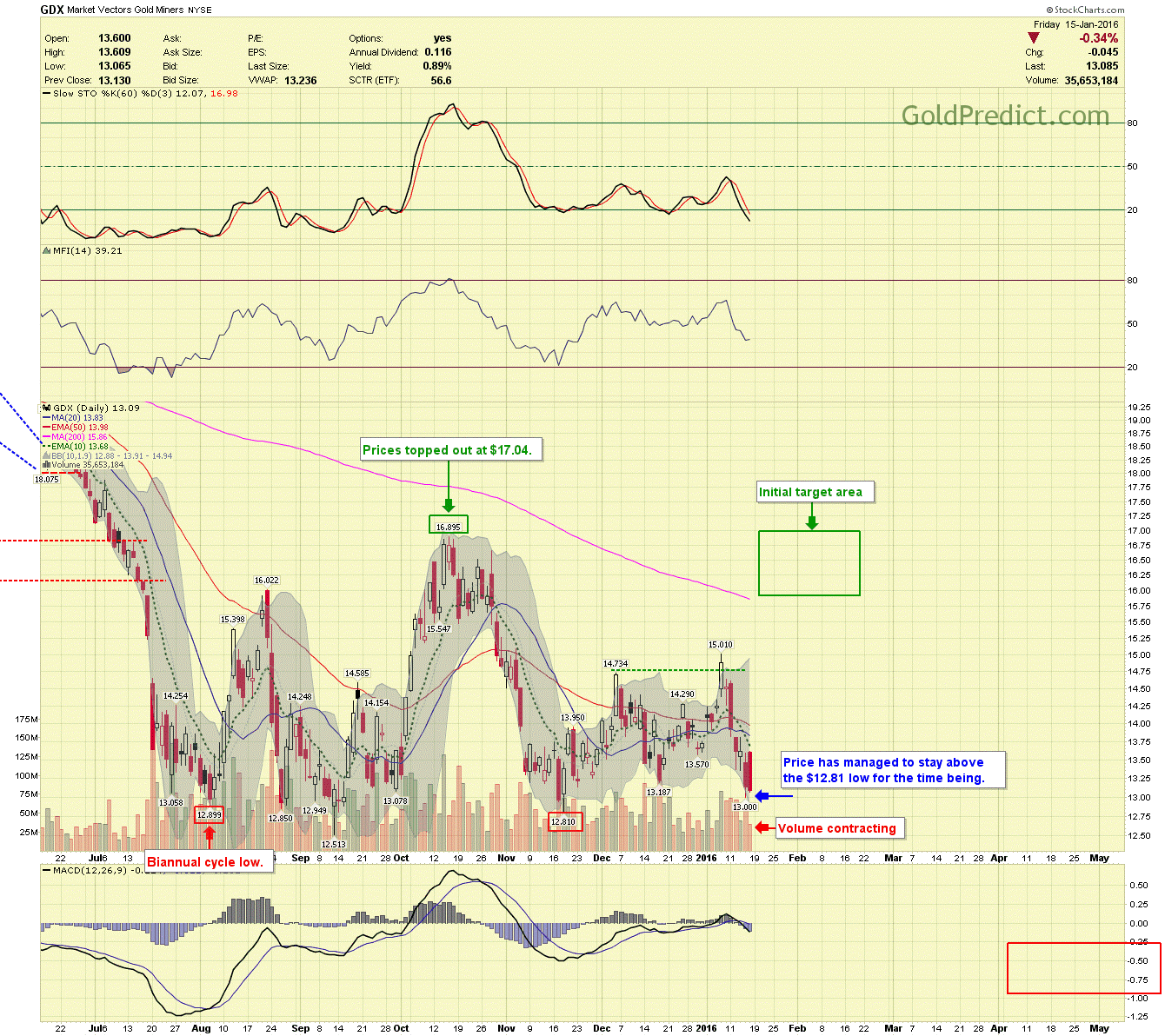

-GDX- Price has managed to stay above the $12.81 low for the time being.

-GDXJ- Price closed below the $18.069 low, but volume has been contracting from the $20.91 high; prices could reverse and head higher.

-SPY- Price has tested the August/September lows, and volume has increased, we may bounce here or there, but I don’t get the feeling price has bottomed.

-WTIC- Prices breached $30.00 this week, and the bears have full control. $25.00 is the next solid level of support if prices continue to drop.

Next week will be very busy, and I will do my best the keep up with reports. Currently, I don’t see an edge in either direction for metals and sitting on the sidelines is probably best.