The US elections are next week, expect a significant uptick in volatility.

The markets hate uncertainty, so a close or disputed election could send stocks reeling.

Covid numbers are on the rise globally, and we are starting to see more shutdowns. This could impede the recovery and disrupt supply chains.

I see a generational buying opportunity in energy-related assets.

THE RETURN OF INFLATION

Inflation has been tame for nearly 40-years, but I think that’s about to change. Forced government shutdowns and supply chain interruptions have reduced productivity. To combat the slow growth, governments have printed obscene amounts of money. This is all very inflationary, in my opinion.

The last time inflation was out of control was during the 1970s. During an inflationary period, investors flee fixed income for assets with some inflation protection (commodities). It doesn’t make sense to be locked into a Treasury yielding 0.7% if inflation annualized is significantly higher. During the 70s, I believe the annual inflation rate exceeded 8%.

By the late 1970s, nobody wanted to own Treasuries – no matter what they were yielding (sounds like energy stocks today). Bonds were considered “certificates of confiscation.” BusinessWeek’s August 1979 issue was titled “The Death of Equities” how inflation is destroying the stock market. At that time, 30-year Treasuries were yielding something like 14%, and no one wanted them. That turned out to be a generational buying opportunity.

Fast-forward 40-years, and here we are again. However, this time it’s the opposite. The April 22, 2019 issue of BusinessWeek was titled “Is Inflation Dead?” and had the image of a Dinosaur. Could this be yet another contrary indicator? I believe it is, and I think a new inflation is getting started.

When inflation rages, the price of “things” go up. By “things,” I mean anything we use or consume or anything out of the ground. Precious metals are an excellent inflation hedge, but I believe all commodities will go higher.

One of the most valuable commodities on the planet is oil. Without energy (oil, coal, uranium, and natural gas), the world would shut down. It is essential to everything we do. Energy is incredibly cheap, and I believe we are witnessing a generational opportunity.

I started buying energy stocks aggressively in October. Prices could dip a bit further, depending on the elections and more shutdowns. I will continue to accumulate if prices decline.

Expect crazy volatility next week. I’ll post multiple updates throughout the week to Premium Members.

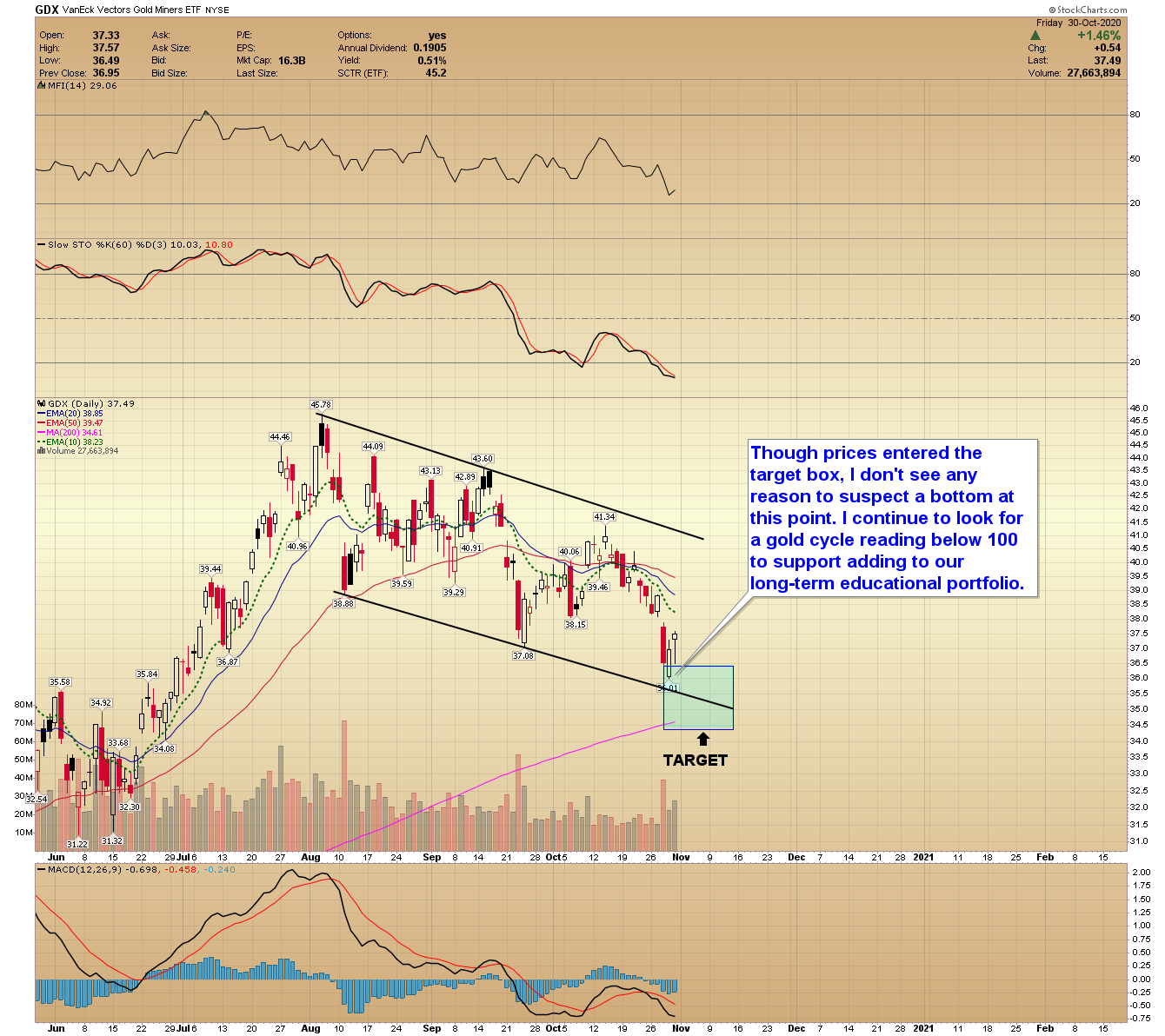

The gold cycle indicator finished at 127, and we are very close to the next 6-month low.

-US DOLLAR- The dollar has been grinding out an intermediate bottom. Prices finally look ready to turn higher, and I continue to anticipate a rebound towards a 200-day MA. we could see an upward bias in the dollar through November and possibly into the first half of December, depending on the elections.

-GOLD- The gold cycle indicator finished the week at 127, and I believe we are close to a 6-month low in precious metals. Ideally, gold will drop a little bit further and into our preferred target. Caution- next week could be extremely volatile. Our cycles are focused on the trading days surrounding November 6.

-SILVER- We also expect one final decline in silver to our preferred target. Ideally, prices will test $20.00 (+/- $1.00). We remain very bullish on silver and believe it could surpass $100 later this decade.

-PLATINUM- Platinum could see one more decline towards $800. A retest of support around $750 is possible. Of the precious metals, platinum is the best of value, comparatively. I think we will see prices breakout above $1000 next year and possibly sooner, depending on the elections.

-GDX- Miners entered the target area late last week, but I think they could drop a little further before bottoming. Selecting targets for miners can be a bit tricky – the stock market influences them, and sometimes that exacerbates selling. Nevertheless, I think we are close to a crucial 6-month low.

-GDXJ- Junior miners entered the leading edge of our target box. I think prices could drop a little further with emphasis on the tradings days surrounding November 6.

-SPY- The stock market failed to make a higher high in October, and prices could be forming a double top. Closing below 319 would establish a minimum target of 300 with the potential of reaching 285.

-TSLA- Tesla failed to make a higher high in October, and prices are rolling over. Closing below 329 would signal a breakdown to 220 to 250. I’m very bullish on Tesla long-term but believe there is too much hype in the stock. Millennials have been buying this stock like crazy with government stimulus via the Robinhood app. At some point, I believe prices will tumble lower. I think prices could eventually reach $50-$70.

-XLE- Over the last month or so, I’ve turned very bullish on energy. It is the most reviled sector in the stock market. With all the money printing, I don’t see how energy prices can stay suppressed. I’ve been buying quality energy names over the last month and will continue to add to my portfolio on any weakness. The XLE is an excellent way to get some exposure to energy and is currently paying a 7.61% dividend. Note- This is a long-term idea with a minimum hold time of 3 to 5-years.

Have a great weekend.