There was a short-covering panic Friday as underwater traders covered their positions before the weekend. The buying back of shorts caused prices to climb higher and higher which in turn provoked even more short-covering. Sequentially, this action pushed gold and GDX well past my targets areas; silver and GDXJ remain within their designated territories. Friday is an excellent example of why it’s important to wait for confirmation before entering short positions. Taking positions too early, without fixed stops or a clearly defined risk-reward figure causes anxiety that leads to panic conditions like Friday. I’m still looking for the cycles to top relatively soon, and I will keep you informed as this situation develops.

-US DOLLAR- The dollar made a potential cycle low at 94.04, but we need a confirmed price swing, and then two higher closes above the 10-day average to confirm.

-GOLD WEEKLY- Prices closed well above the 50-week moving average, and a top could form next week. Note how the slow stochastics is now overbought (top).

-GOLD- Price shot past my target area during the panic short-covering rally. I will be looking for signs of topping next week. Note the indicators at the top.

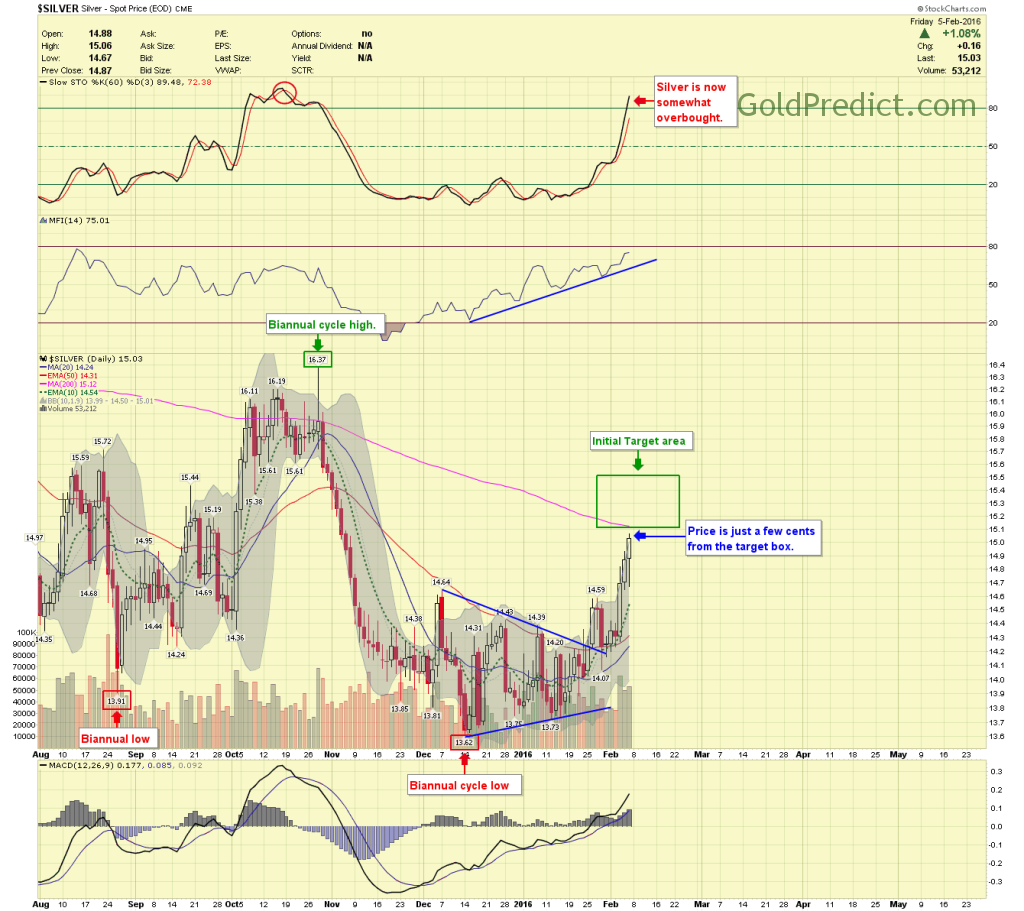

-SILVER WEEKLY- Weekly silver prices are just short of the designated target area and the 50-week average.

-SILVER- Price is a few pennies from the target box, and it too has now become overbought.

-HUI MONTHLY- I wanted to pull up the monthly chart to show the resistance level between 150 and 160. Though prices have moved higher than expected, they will soon run into a major resistance zone.

-HUI WEEKLY- Price could go a little higher from here (5-15 points), but I’m still expecting a top, possibly next week.

-GDX- Prices have blown past my target area, and I expect a top to form soon. Note the indicators at the top.

-GDXJ- Prices are now well within the target area, and a top could come soon.

-SPY- Prices are back near the 187 level, a close below there could see more selling and lower lows.

-WTIC- Prices quickly closed back below the 2009 lows. Two higher closes above the 10-week average are needed for a significant bottom to form.

Gold, silver and miners are overbought, and we could see prices top out pretty soon. Once the February top is in I will estimate the April/May lows. I’m still expecting the major 8-year cycle bottom to arrive either a few months before or a few months after the 2016 US Presidential election.

The new website is nearing completion, and I think everyone will like its functionality and features. Hopefully, it will be active by the end of the month. Once live, I will continue to send out reports via email for a time until I’m comfortable everyone is familiar and properly logged into the new site.

Have a wonderful week,

-Pierce