The speculation in today’s market is incredible. Millennials seem to be the driving force behind these bubbles. They stampede from one hot-stock to the next, looking to get rich. Currently, they have their sights on Gamestop (GME). The stock was up 92% today and 685% in January.

-GME- The momentum traders have turned to Gamestop. Prices are going parabolic. In January, GME is up 685% – this too is a bubble.

I remember something similar in the 2000s. Money would flow aggressively into one sector or stock; momentum traders would follow, looking to get rich. Eventually, that bubble would burst, and they would rush to the next trade.

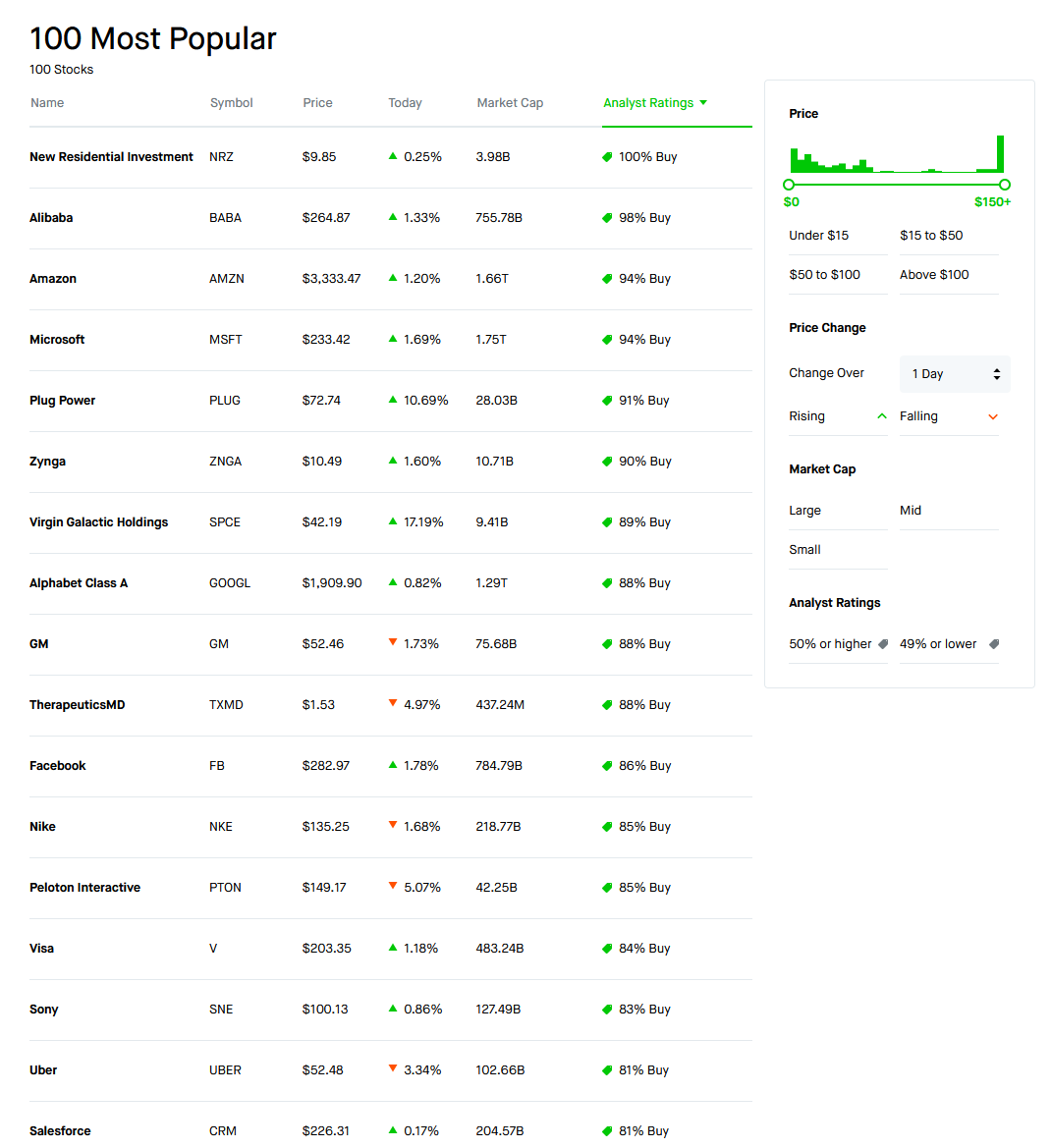

Currently, there is not one precious metal or mining-related stock on Robinhood’s popular 100. That will change at some point, but we have to remain focused and patient in the meantime.

What could cause millennials to notice precious metals? Great question! I see a few possibilities.

- A breakout to new highs in gold could get the attention of momentum traders. They seem to buy things that are moving higher and are overpriced. If it’s a good value (like gold now), they stay away.

- 2) Millennials love cryptocurrencies and bitcoin. Economist Nouriel Roubini believes bitcoin has no fundamental value and prices are manipulated. I tend to agree. If a massive bitcoin scam is uncovered, as he suspects, we could see a mad rush into precious metals.

- 3) Some consider the December 2020 cyberattack on SolarWinds the digital Pearl Harbor. It was by far the largest cyberattack on record – the true damage is unknown. A large-scale cyberattack on coinbase or other crypto platforms could terrify bitcoin investors.

One of the above events, a sharp market pullback or a black swan, could spark the next major rally in precious metals. When will that occur? I don’t know, but I believe is only a matter of time.

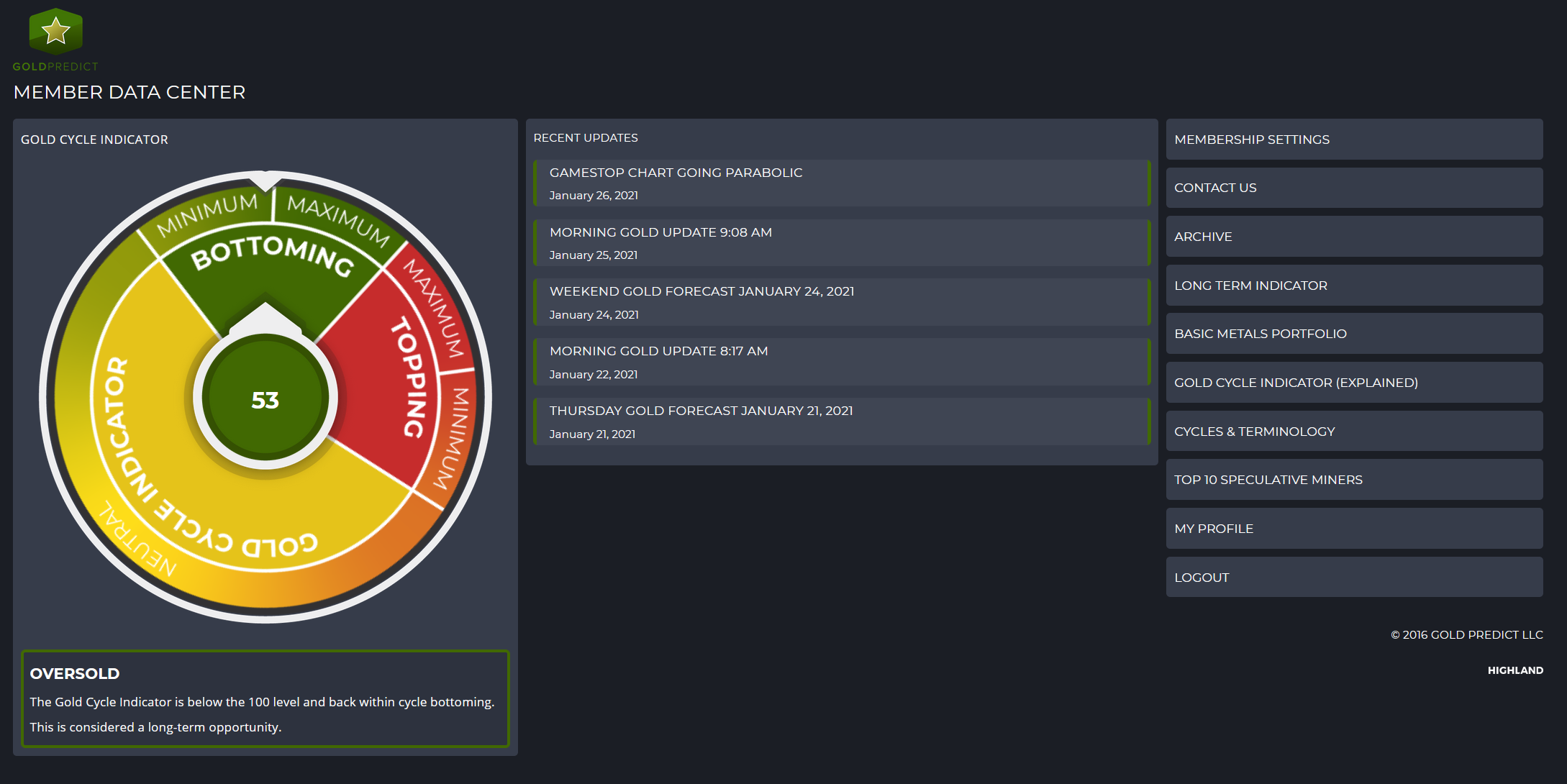

The gold cycle indicator remains in bottoming territory.

-GOLD- Gold continues to struggle after bottoming in late November. Prices need to close above $1874.60 to establish a mid-cycle low. Until then, a breakdown below $1800 could extend the correction.

-SILVER- As long as silver stays above last week’s $24.04 low, prices may be forming a rounded continuation pattern. Closing below $24.00 could trigger a retest of the $22.00 zone.

-PLATINUM- No change in platinum. Prices need to close above $1150 to support a breakout or below $1100 for a correction.

-GDX- The near-term price levels remain the same. A close above the green line ($36.50) is needed to support a breakout. Whereas closing below the red line ($34.50) could trigger a breakdown.

-GDXJ- No change in juniors.

-XLE- Looks like the XLE is finally correcting. Initial support arrives at $37.00.

Have a great night.