The Federal Reserve hiked rates 50 basis points on Wednesday, raising the Fed funds to 0.75% and 1.00%.

Powell took the potential for a 0.75% hike off the table and implied back-to-back 0.50% hikes in June and July.

Markets reacted higher initially but rolled over quickly on Thursday and into Friday.

There is a good chance we will see continued market weakness in May with the added potential for a flash crash or liquidity event.

Metals and miners could get dragged lower temporarily with market conditions, but I still see gold finishing the year near $3000.

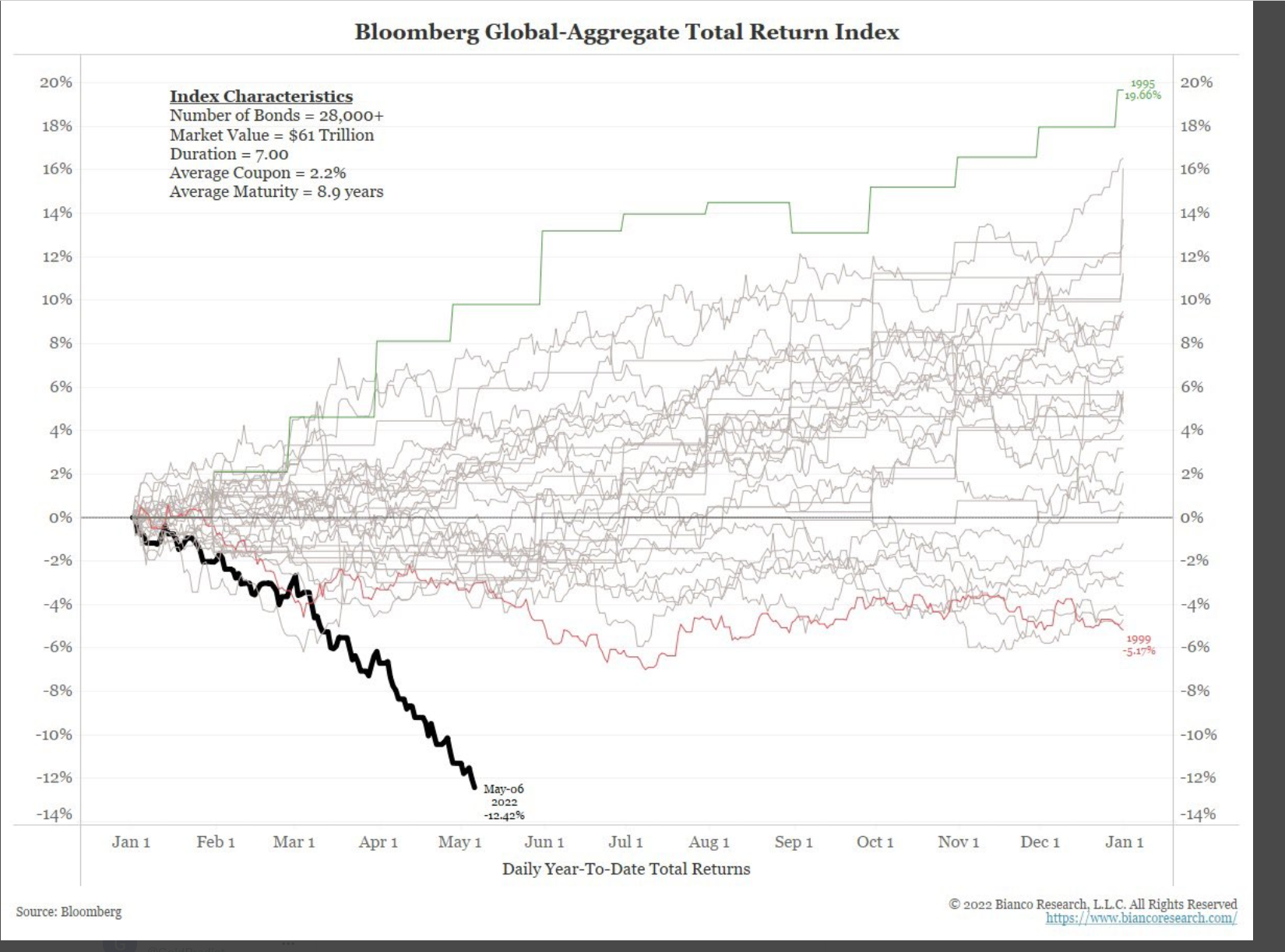

Bond Market Blowout

Below is a chart for the Bloomberg aggregate bond index going back several decades. At -12.42%, this is the worst year-to-date return ever; nothing comes close.

source: https://twitter.com/biancoresearch/status/1523089784658620418

China Covid Lockdowns

Chinese policymakers are doubling down on their zero covid policy, and Beijing could be next to lockdown. Residents are being tested for covid three times a day in some areas; others scramble to gather enough food for lockdowns.

I’ve heard that up to 130-million elderly Chinese are unvaccinated. The situation is dire, and if covid runs rampant, millions could die. The Chinese vaccine is much less effective than mRNA, and Beijing is allegedly too proud to ask for vaccines from the West.

Inflation

Next Wednesday, we will get the latest inflation print, expected at 8.1%. The Ukraine war and Chinese lockdowns will ensure prices stay high for the foreseeable future. I heard diesel inventories in the US are at 22-year lows. That could be a huge problem if energy prices continue to rise or remain high as forecasted. Get ready for even higher gas prices.

The Gold Cycle Indicator finished at 78.

-GOLD- I remain very bullish on gold. Over the past 20-months, gold has been building a cup-with-handle consolidation pattern below the $2000 level. Sometime this year, I believe gold will breakout above $2000, and it won’t look back. When exactly…I don’t know.

-SILVER- Prices have been stuck between $22.00 and $30.00 since June 2020. Silver could slip to fresh lows in the coming days/weeks with the broader market. If prices do decline further, it would be temporary, in my opinion.

-PLATINUM- Over the past 7-years, platinum has traded between $800 and $1100 over 90% of the time. Prices finished the week at $956, and they could dip further, especially if markets sell-off. A dip below $800, if it occurs, would likely be very temporary.

-GDX- The pattern in miners continues to look constructive as long as prices stay above the 200-day MA. A sustained breakdown below the 200-day ($33.00) would support an extended decline. To register a cycle bottom, GDX needs a close above Thursday’s $36.17 high.

-GDXJ- Juniors need a close above $44.42 for a bottom or below $40.00 for an extended decline.

-SILJ- Silver juniors need to close above Thursday’s $12.88 high for a cycle bottom. Whereas a sustained breakdown below $11.50 could trigger more downside.

-DOW- The DOW has held up better than other indices. Prices are trying hard to hold the 32,500 area; a breakdown in May is possible. The 20% correction level is 29,600, which specifies a bear market.

-COMPQ- The Nasdaq closed below the 2021 low (12,397.05), a very negative sign. Many tech stocks are down 50% or more from their 2021 highs.

As soldiers run in the other direction, just two generals remain Apple and Tesla. How long before they retreat? Next stop…the 30% correction level???

-AAPL- To register a breakdown in Apple, prices need to close below $150.

-TSLA- Tesla needs to close below $750 to imply a bearish retreat.

-BTCUSD- Bitcoin stopped precisely at the 200-day in March, supporting a crypto bear market. Prices should continue to work their way down towards the $28,800 area. Sometime this year, I expect bitcoin to drop below $28,000 towards $20,000 or lower.

-CARDANO- I’m bullish on ADA long-term but believe prices are in a bear market and could drop lower with bitcoin. How low could they go? I have no idea, but I wouldn’t be surprised to see $0.40. Note the flash crash highlighted by the pink arrow. Another spike lower is possible in the coming months, in my opinion.

All eyes will be on the inflation numbers next week.

Expect continued volatility.