At the beginning of the year, I like to review my 10-year strategy. I believe the 2020s will be great for commodities and not so good for the stock market.

Best Performing Assets

Each decade has its investment theme and a best-performing asset. The asset that did best in the last decade usually underperforms during the next. See the examples below.

- During the 1990s, the stock market was the place to be. An explosion in Internet growth led to the dot.com bubble. The Nasdaq rallied from 330 in 1990 to 5100 by 2000.

- During the 2000s, precious metals and commodities were the best-performing assets. Gold rallied from a low of $255 in 2001 to $1923 by 2011.

- During the 2010s, money flowed back to the stock market and risk assets. Ultra-low interest rates and unprecedented stimulus triggered a bubble in unprofitable tech, crypto, and electric vehicle stocks peaking in 2021.

The Mania Peak of 2021

During Covid, the US government injected $6-trillion into the economy. Free and easy money triggered a speculative mania. Investing was made easy through apps like Robinhood. The riskier the investment – the more attractive it became.

An excellent example of extreme risk-taking was Hertz car rentals. In May 2020, Hertz Global filed for bankruptcy, and prices collapsed below $1.00. Within a week or two, prices had spiked to over $5.00 and above the pre-bankruptcy announcement.

source: https://www.bloomberg.com/news/articles/2020-06-12/hertz-proposes-1-billion-stock-sale-to-capitalize-on-odd-rally

Nothing is riskier than going “all-in” on a company that just filed for bankruptcy! It’s like paying above the asking price for a house that’s on fire, hoping the current owners have insurance. As expected, Hertz shares stopped trading, and the company restructured. I don’t have the details, but I imagine common stockholders received pennies on the dollar.

Where We Stand Now

From 2010 to 2021, risk assets, crypto, and electric vehicle stocks were the place to be. The remainder of the 2020s should favor commodities, energy stocks, precious metals, and other tangible assets.

What About the 2030s

If I had to guess, I would say around the year 2030 (+/- 2 years), the commodity super-cycle will begin to rollover, and it will be time to switch to the next asset class. What might that be? I have no idea, but I’ll be looking closely at high-quality dividend stocks and watching the Shiller PE ratio (see below).

Shiller P/E Ratio

Here is a long-term graph of the Shiller PE ratio. Note that at the height of the stock market boom in 1929, it was around 30. Currently, it’s at 28.48, which is still very high. I consider anything over 20 overvalued. Around 15 is a great deal, and below 10 is an opportunity of a lifetime. Roughly every 50 years, we get a reading below 10. The last arrived in the early 1980s, so we could see another opportunity in the early 2030s.

Long-Term Strategy

I’ll continue to accumulate commodities and high-quality producers for the remainder of the decade. During the next recession, I’ll add energy producers and maybe some uranium.

When it becomes clear the commodity cycle is nearing its end (possibly around 2030), I’ll begin to exit long-term commodity holdings rolling them into whatever is excessively undervalued at that time, perhaps stocks or maybe real estate.

The Gold Cycle Indicator finished at 107.

December Employment

I was surprised at Friday’s market reaction to the December employment report. Jobs came in above expectations (223k vs. 200k), but the real shocker was unemployment falling from 3.7% to 3.5%. November was revised lower to 3.6%.

February Rate Hike Odds

The odds for another 0.50% hike in February fell from 41.9% to 24.3% after the employment data. I find that odd, given the plunge in unemployment. The market is still begging for a Fed pivot which I see as unlikely without a total market meltdown.

-US DOLLAR- The dollar peaked in September as gold bottomed. The 50-day EMA (red line) is crossing below the 200-day MA (pink line). A close above 106 is needed to support a rebound. Otherwise, a retest of the 100 area seems likely in the first quarter.

-GOLD- Gold formed a bullish engulfing candle after Friday’s employment report. The trend is nearing resistance between $1880 and $1920, which could prove challenging. My overall expectation is for a continued rally into February or March before entering a deeper pullback. Bullish support between $1780 and $1820.

This year I’m expecting gold to at least challenge the $2000 level and see a reasonable chance of making new all-time highs.

What could derail my thesis? A crippling market event that triggers cascading liquidation.

-SILVER- I believe silver reached a major bottom in 2022, but I’m less confident about its mid-term direction due to recession risk.

Prices are up against the trendline and what happens next is crucial. A breakout above the trendline would support a more pronounced rally. However, I wouldn’t get too excited until I saw weekly closes above $30.00.

On the bearish side: declining below the 200-day MA (currently $21.24) would indicate a recessionary breakdown and potential retest of the $18.00 area.

-PLATINUM- I like the outperformance I’ve seen in silver and platinum since the September lows. Prices are at critical resistance: a breakout above the trendline would be bullish and could trigger a sharper advance.

On the bearish side: platinum is subject to a recession (like silver), and breaking back below the 200-day MA (currently $941.87) would support a breakdown.

-GDX- Gold miners have a long way to go to challenge the trendline near $40.00. They are perking up, but I haven’t seen enough to get excited.

A big volume breakout above $33.00 would be bullish, sending prices toward $40.00 by February or March. In contrast, closing below the 200-day MA (currently $28.48) would be medium-term bearish.

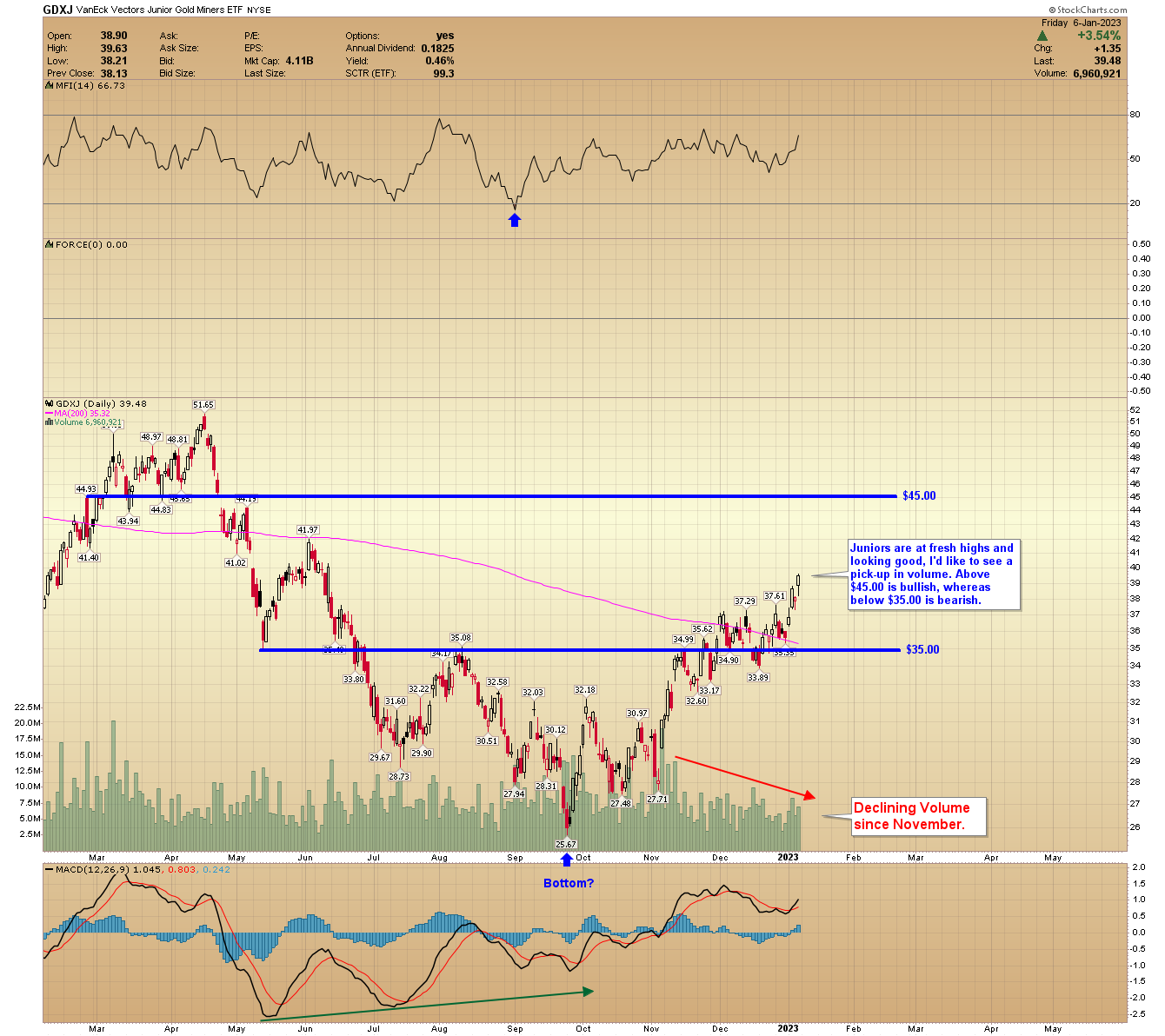

-GDXJ- Juniors are at fresh highs and looking good; I’d like to see a pick-up in volume. Above $45.00 is bullish, whereas below $35.00 is bearish. Note the declining volume since November.

-SILJ- Silver juniors are back above the 200-day MA but barely. It would take progressive closes above the trendline on increasing volume to signal a breakout. Otherwise, prices could stay rangebound. Closing back below $10.00 would be near-term bearish.

-DOW- Overall, I think stocks have entered a lost decade similar to what we saw from the late 1960s to the early 1980s. Of course, I could be wrong, but this is my best assessment at this time. If proven correct, stock indices could trade mostly sideways into the early 2030s before the next bull market takes hold.

Bitcoin Overview

It’s hard to calculate the truth behind crypto. On the one hand, I see tremendous potential in distributed ledger technology with free and open systems. But on the other hand, the vast majority are total nonsense or get-rich-quick schemes. If I had to guess, I’d say 95% to 99% have no value.

I Have Two Problems With Bitcoin

Mining Rewards: One problem I see with bitcoin is the mining incentives. Every four years, the amount of bitcoin paid to miners for securing the network is cut in half. In April 2024, bitcoin rewards will drop from 900 bitcoin per day to 450. In 2028, daily bitcoin rewards will fall to 225, and then to 112.5 by 2032, and so on. Could you imagine having your pay cut by 50% every four years?

This incentive structure creates a winner take all environment where only the biggest and most powerful miners will survive – making the protocol more centralized and vulnerable to attack.

Mainstreet Adoption: My other issue with bitcoin is that after 14 years, it still has no use case. Investors buy it for capital appreciation and speculation, but nobody uses it. Some would argue bitcoin has become a religion, and instead of using it true believers hoard it expecting unlimited wealth.

-BTCUSD- After 12 months of lower prices, I’m yet to see sufficient emotional capitulation. I continue to look for a final washout towards the $10,000 area. Closing above the trendline would support a potential bottom.

-ADAUSD- I believe Cardano is building the best infrastructure, and it’s my bet on the future for crypto. This project could fail and go to zero, but I think I see enough potential to start building a position. I’d like a washout below the lower red boundary to signal a buying opportunity.

Next Thursday, we are expected to see Core CPI drop from 6.0% to 5.7%. An unexpected number above or below could sway markets.

Have a great week.