Tomorrow is the much anticipated Fed announcement; a press conference is to follow at 2:30 PM EST. There is almost a zero chance they will raise rates at tomorrow’s meeting. Therefore, everyone will be focused on specific verbiage and the press release.

Gold could easily breakout above $1,300 tomorrow but with the Brexit vote looming I wouldn’t rush to any conclusions. Miners soldoff somewhat today as traders squared positions before tomorrow’s meeting.

We will soon have the answers to many questions. Regardless of what happens the next few days or weeks, gold and silver have extremely bright futures.

-US DOLLAR- The dollar is on the fourth day of a new cycle. Prices need to exceed the previous cycle high of 95.90 to remain bullish.

-GOLD- Gold could easily breakout above $1,300 tomorrow with dovish Fed comments. There could be a $40.00+ move in either direction, but higher seems to be the path of least resistance.

-SILVER- Like gold, silver could easily breakout to new highs with dovish Fed comments tomorrow.

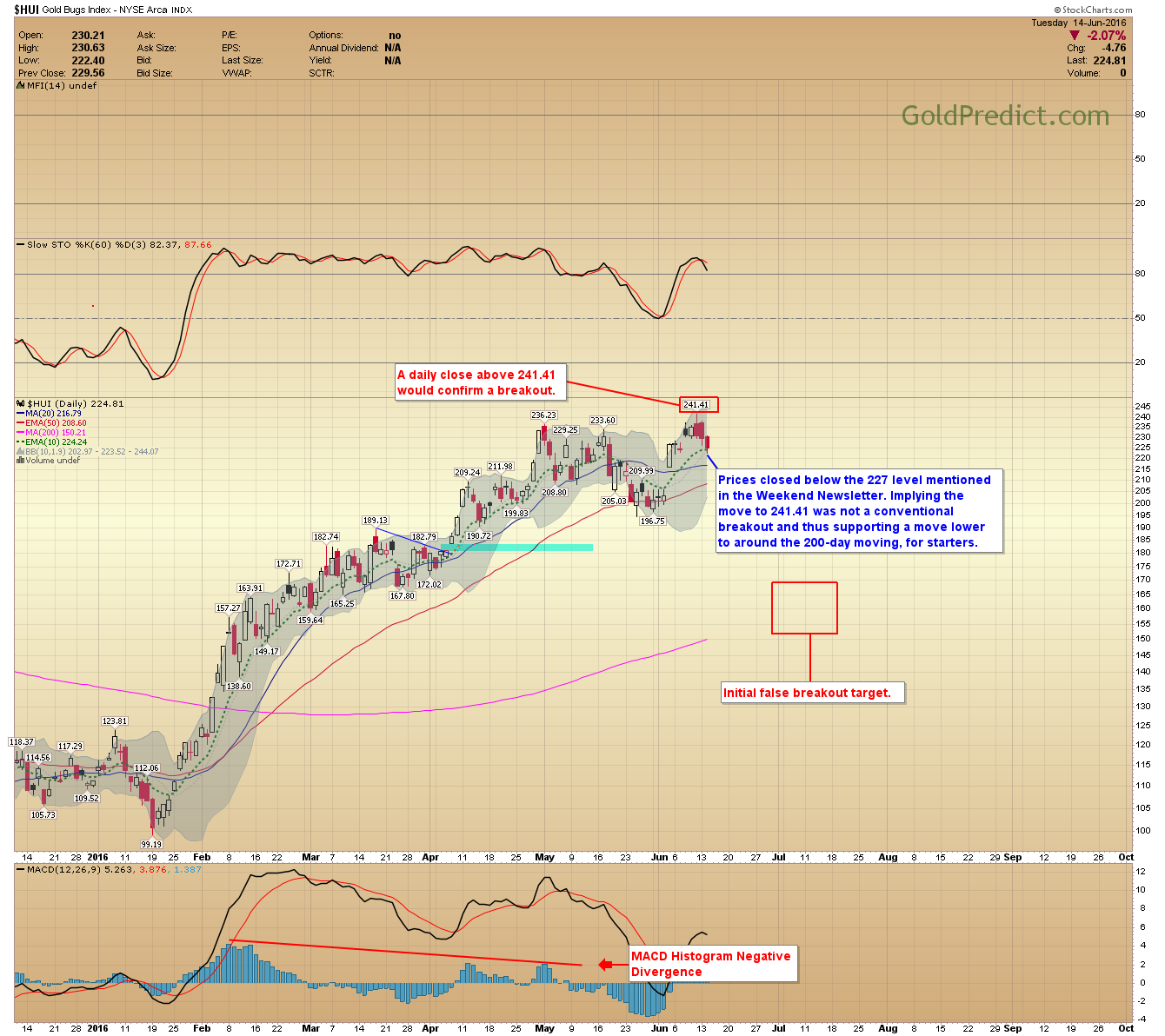

-HUI- Prices closed below the 227 level mentioned in the Weekend Newsletter. Implying the move to 241.41 was not a conventional breakout and thus supporting a move lower to around the 200-day moving, for starters.

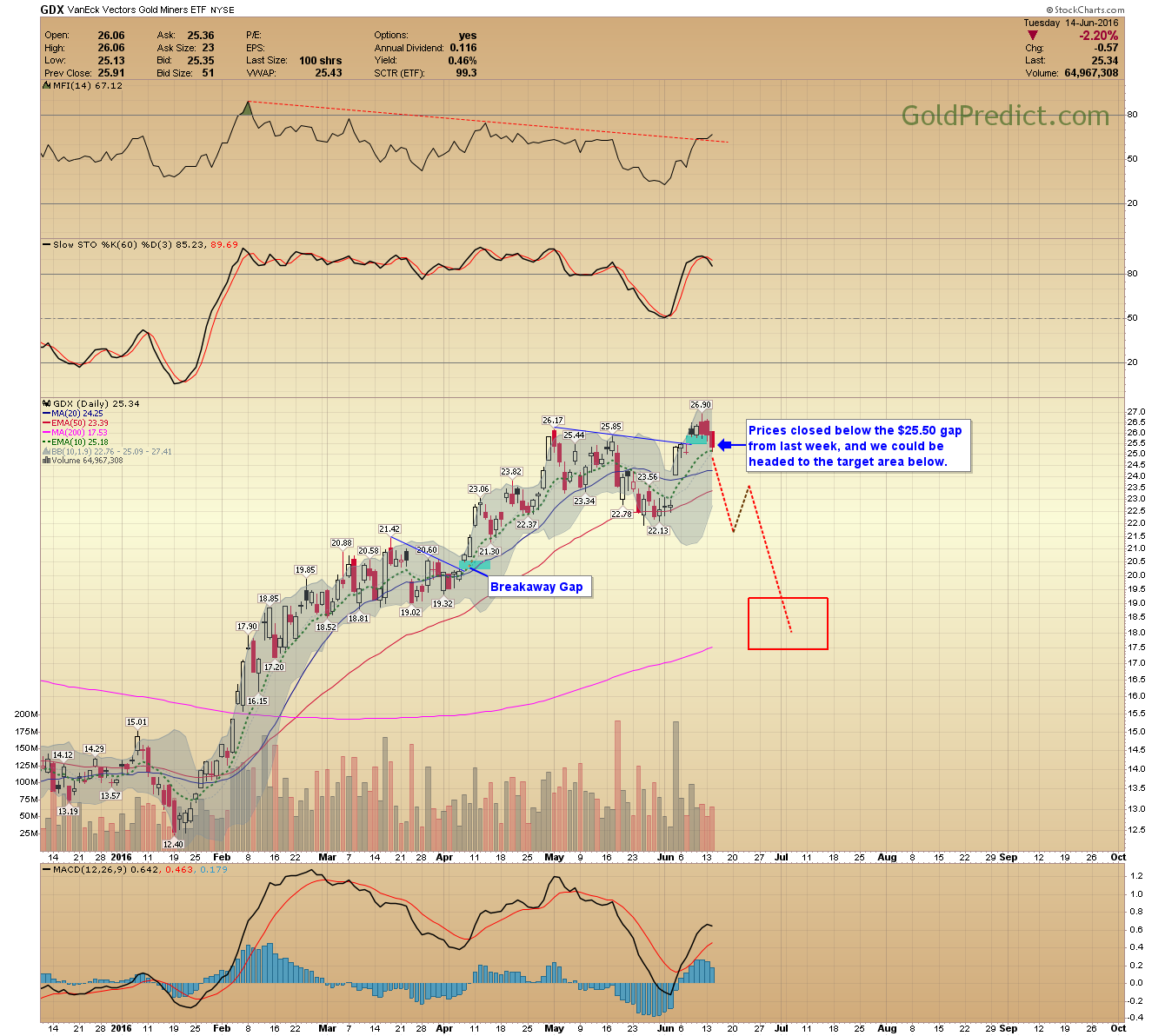

-GDX- Prices closed below the $25.50 gap from last week, and we could be headed to the target area below.

-GDXJ- Prices failed to close the gap but a swing was made, and $41.37 could be the peak of a false breakout.

-WTIC- Oil still looks like it put in an intermediate cycle top and I think prices will drop from here to around $39.00.

-SPY- Traders are taking profits before the Fed meeting and Brexit vote, there is just too much risk of a price shock.

-$XBP (British Pound)- I’ve been searching for hints as to the potential outcome of next weeks Brexit vote. The currency shows a robust 7.5-year cycle which just so happens to be due for a bottom. These cycles have based between 136 and 138 rather regularly; did prices bottom there once again (138.44)? A vote to leave the EU will crash prices through the long-term support at 136. However, any move lower should bottom quickly. If there is a flash-crash, prices could challenge the 110 level and briefly reach parity with the US dollar. The 136 level is key.

Meetings kept me over, and I apologize for the delayed Tuesday Report.