Gold prices corrected after being up for six straight weeks; prices should turn back up soon. Silver and Miners had mild corrections compared to gold but should also turn higher next week. We expect prices to climb for another week or two before dropping into the second common cycle low of the larger 6-Month cycle.

-US DOLLAR- The dollar is 15-trading days into the current cycle and prices should begin heading down into a cycle low. It wasted much of this cycle moving sideways while gold climbed higher. The dollar missed its opportunity to do something.

-GOLD WEEKLY- Prices completed the bearish engulfing pattern, but I’m not too concerned. Gold was up 6-weeks consecutively and needed a break. Again, IF prices drop a bit further $1,310-$,1,300 should hold.

-GOLD DAILY- Daily gold prices have bounced off the 20-day MA twice while forming long tails. That area is finding support and prices may not drop any further before turning higher.

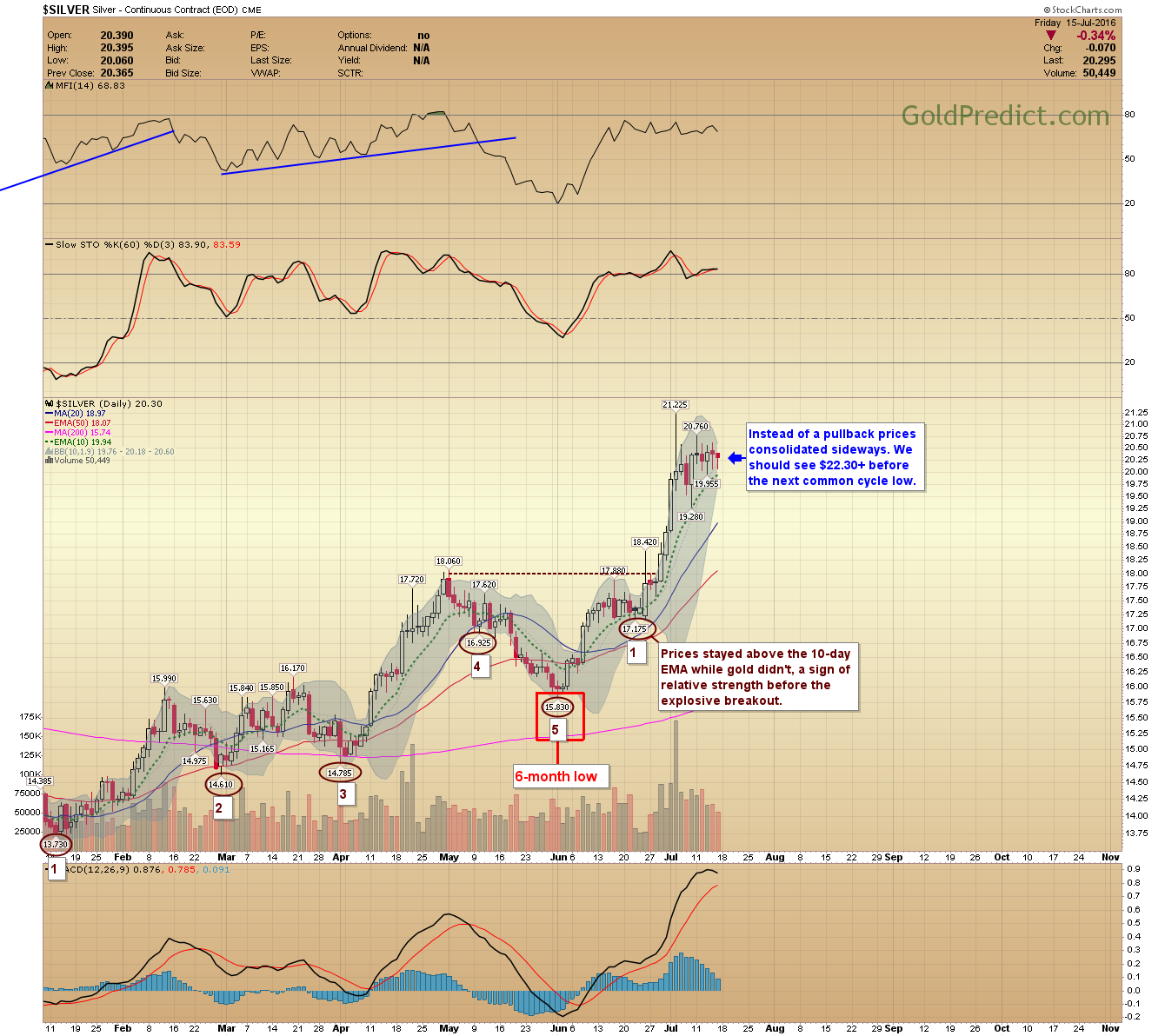

-SILVER WEEKLY- Weekly silver prices barely corrected, only dropping -0.27%. Therefore, prices will likely reach deeper into the target area and may approach the $24.50 level later this summer.

-SILVER DAILY- Instead of a pullback prices consolidated sideways. We should see $22.30+ before the next common cycle low.

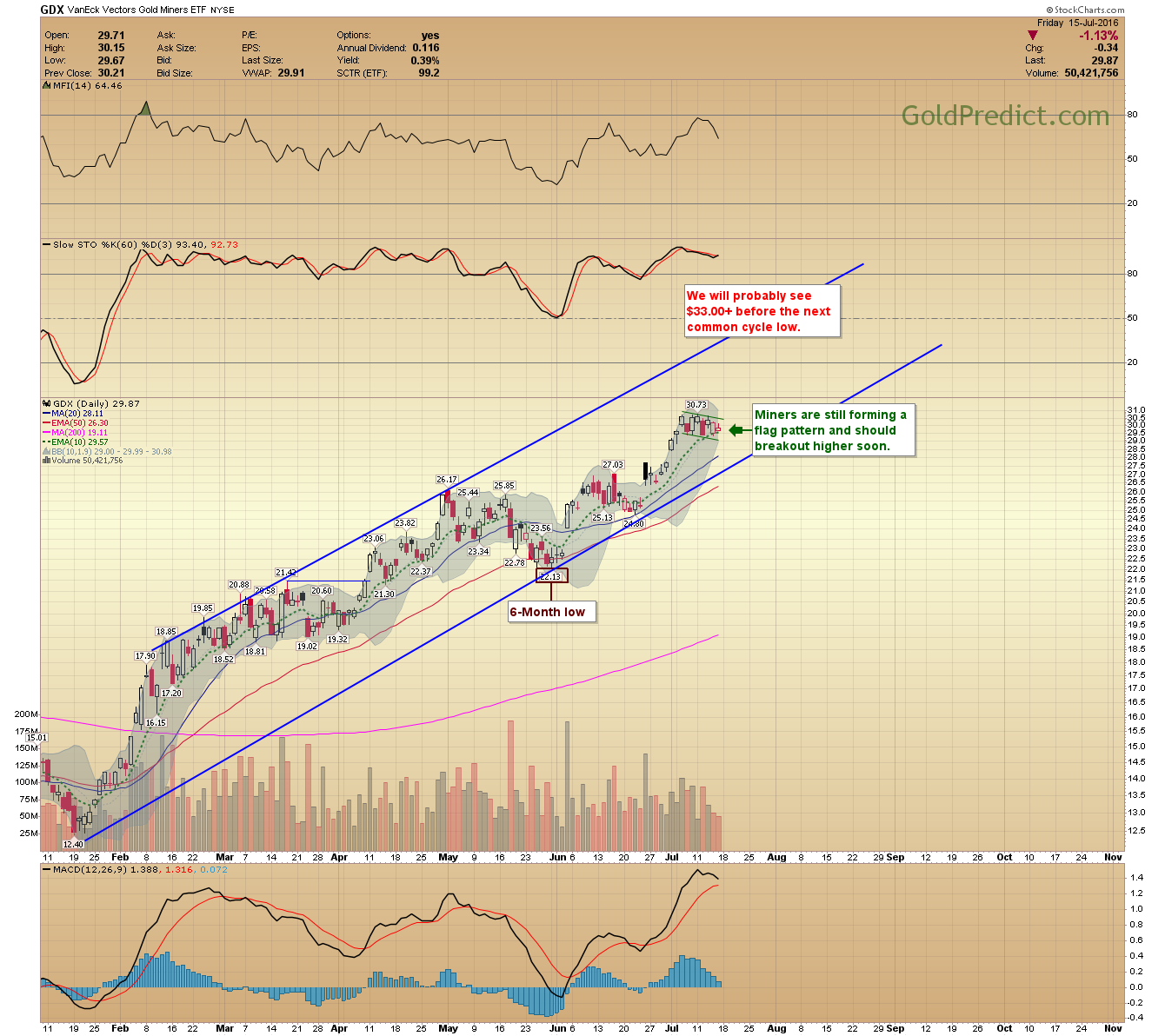

-HUI WEEKLY- Still expecting 310-335 before the end of summer.

-GDX DAILY- Miners are still forming a flag pattern and should breakout higher soon. We will probably see $33.00+ before the next common cycle low.

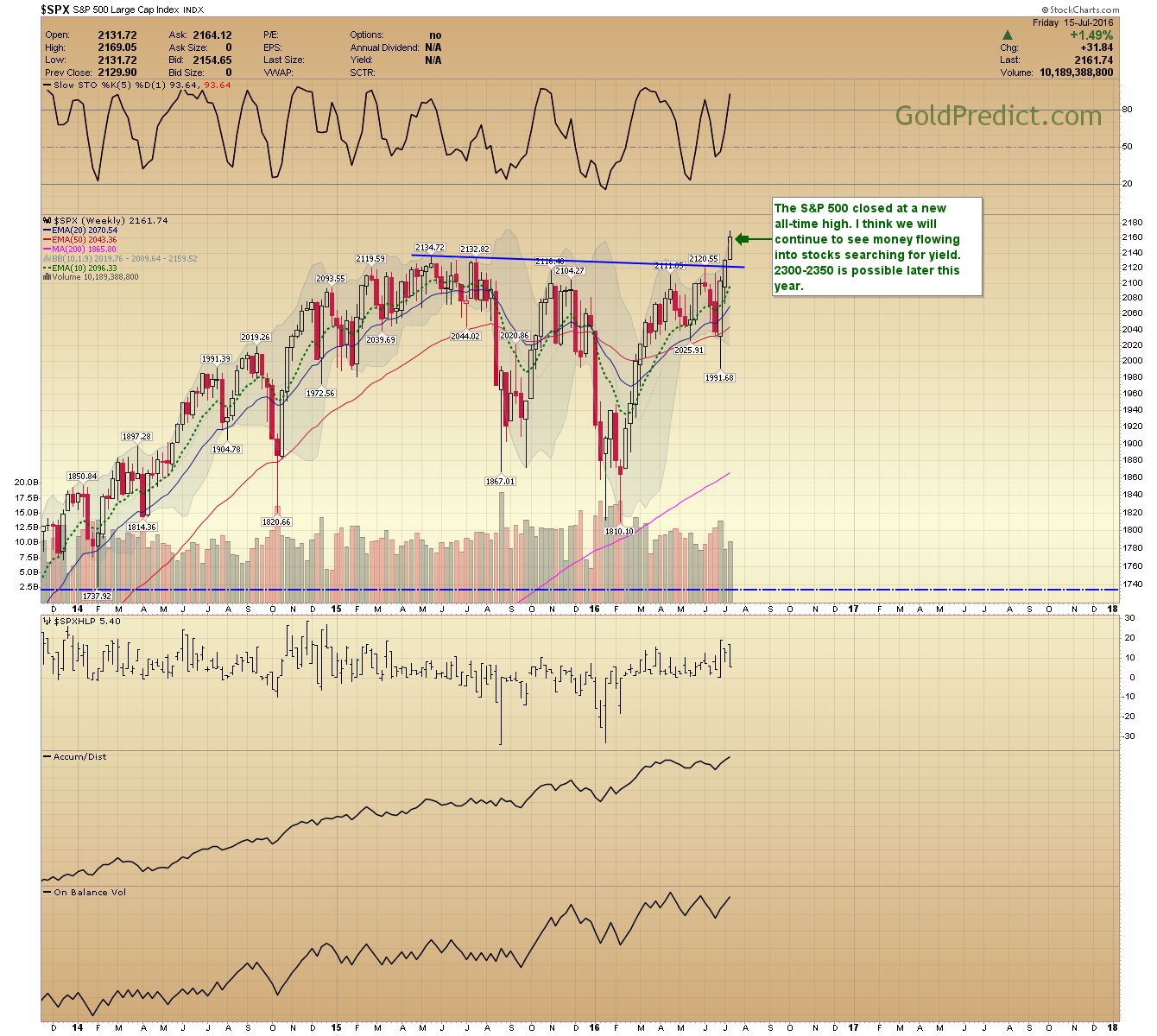

-SPX WEEKLY- The S&P 500 closed at a new all-time high. I think we will continue to see money flowing into stocks searching for yield. 2300-2350 is possible later this year.

-WTIC DAILY- Prices should remain below the blue trendline during any bounce higher.

Have a safe and enjoyable weekend.