Another day of weakness in metals and miners. If gold is indeed forming a small bear flag, it should break lower by tomorrow or Monday. I’m assigning roughly 70% odds to the alternate scenario. If there isn’t a decisive breakout either higher or lower this lack of action could morph into a tedious sideways consolidation. Hopefully, that isn’t the case.

-US DOLLAR- As long as the dollar remains above the 94.94 low, it has a chance to rally.

-GOLD- Gold is still carrying a small bear flag formation and could break lower any day. This lack of buyer conviction increases the likelihood of a collapse toward the Buy Zone.

-SILVER- Prices were unable to close for a second day above the 10-day EMA. If there is going to be a breakdown, it should occur forthwith.

-GDX- Miners made another higher high but closed even lower than yesterday, another sign of distribution.

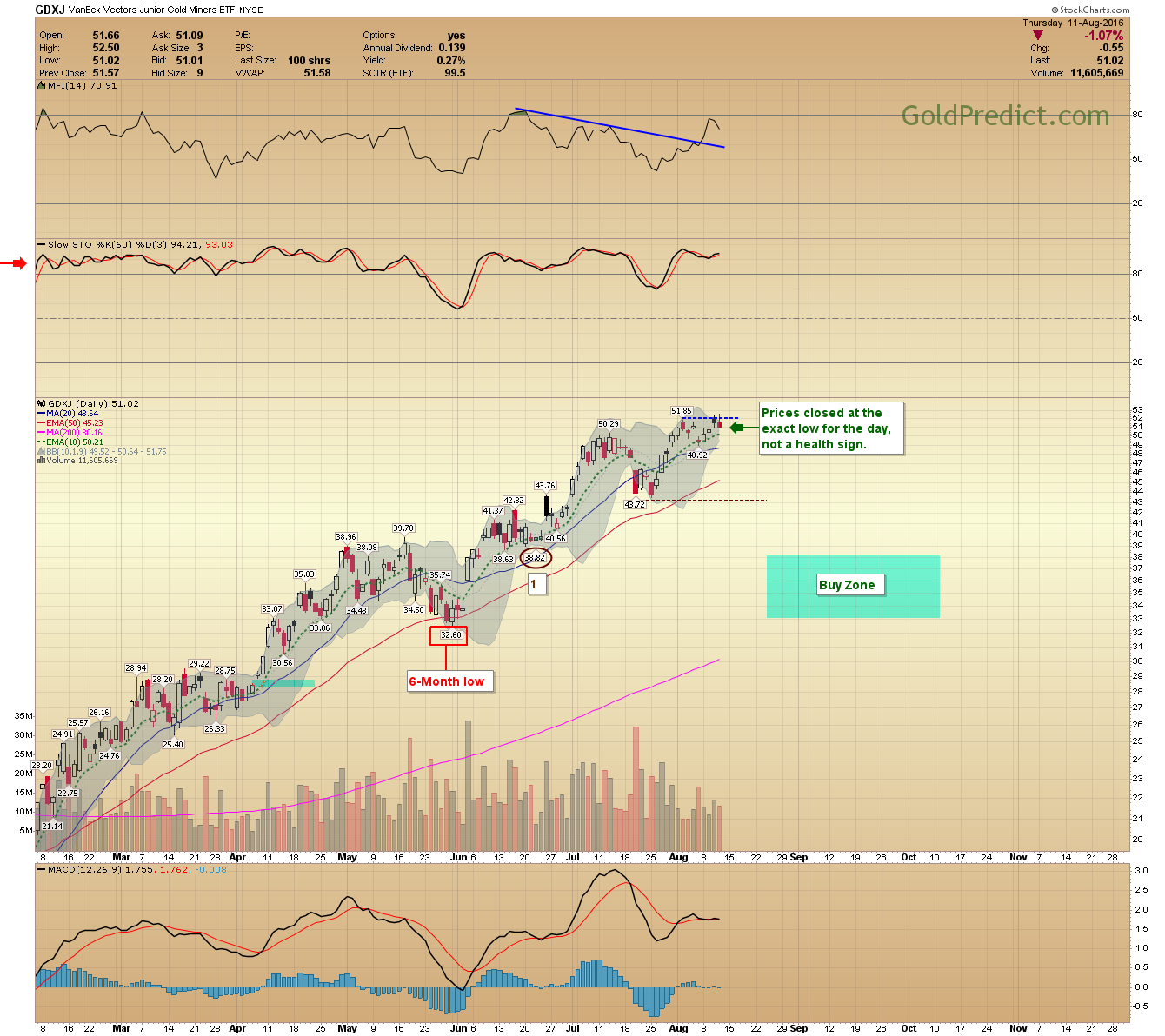

-GDXJ- Prices closed at the exact low for the day, not a health sign.

-WTIC- Oil had a huge up day and is very close to confirming the new cycle higher. I’d like to see prices close twice above the 50-day EMA before calling it.

A price breakdown to the respective Buy Zones will give everyone a chance to buy long-term positions for the next 4+ years, a great opportunity. I’d like to see this happen.