Well, we finally got the breakdown in prices we were looking for. There was tremendous progress achieved today; this will likely to push forward the intermediate-term bottom from November to October.

With the huge drop toady, prices are at or on the verge of becoming oversold. I still think we will descend a bit further, but the majority of the declines appeared today during panic selling. Nevertheless, prices are dropping into an excellent buying opportunity, and it will likely arrive this month.

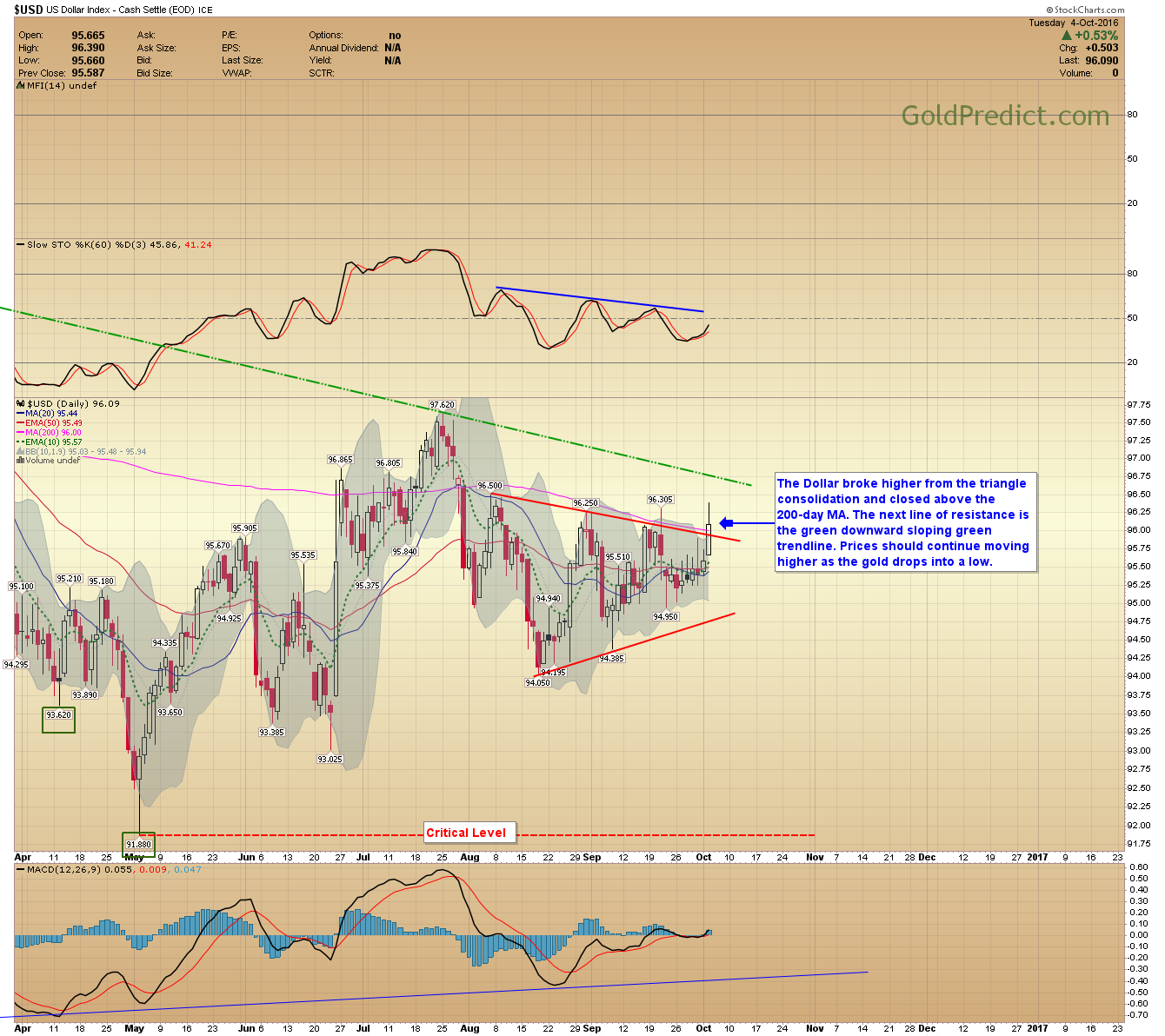

-US DOLLAR- The Dollar broke higher from the triangle consolidation and closed above the 200-day MA. The next line of resistance is the green downward sloping trendline. Prices should continue moving higher as gold drops into a low.

-GOLD- Prices dropped hard today and may reach our $1,245 target sooner than we thought. The most I see prices falling before a significant bottom would be $1,205. Prices are very close to the Buy Zone. I still expect $1,245 or less, and we have reached oversold territory on the daily chart.

-SILVER- Silver fell over a dollar today and is entering oversold territory. I expect prices to drop below $17.00, but they should remain above the previous $15.83 intermediate cycle low.

-GOLD:SILVER RATIO- The gold-silver ratio spiked up to the lower range of the target box. I still expect between 75-76 as a target.

-HUI- The HUI is very close to the 200-day MA and prices are in the upper range of the target box. I think prices can dip below 195 before making a bottom.

-GDX- I still like around $22.00 in GDX for the next bottom.

-GDXJ- Junior miners still have a little to drop before entering the target box but $35.00 is still my preferred target.

-JNUG- For those that follow the leveraged juniors. Prices could reach $8.00 or less before finding a bottom.

Tomorrow is important. If the panic selling continues, prices across the board could drop to the lower aspects of their respective Buy Zones. As more evidence and data comes in, I’ll be sure to update.

Tomorrow is the ADP employment report and stronger than expected numbers could push metals and miners lower. Also, the US nonfarm payroll numbers come out Friday; that too could move markets. I’m exercising patience and waiting to buy for the next leg higher.