The miners appear to have broken down today; the final move lower should be underway. As the formation develops, we will refine our targets and timeframe. I will advise members when I begin to enter positions.

-US DOLLAR- Prices bounced off the 10-day EMA and are attempting another push higher.

-YEN CHART- The Yen made a new price low today after the bearish 20/50 crossover, and the next stop will be the 200-day MA.

-GOLD- The stubbornness in gold continues, but prices look close to breaking lower.

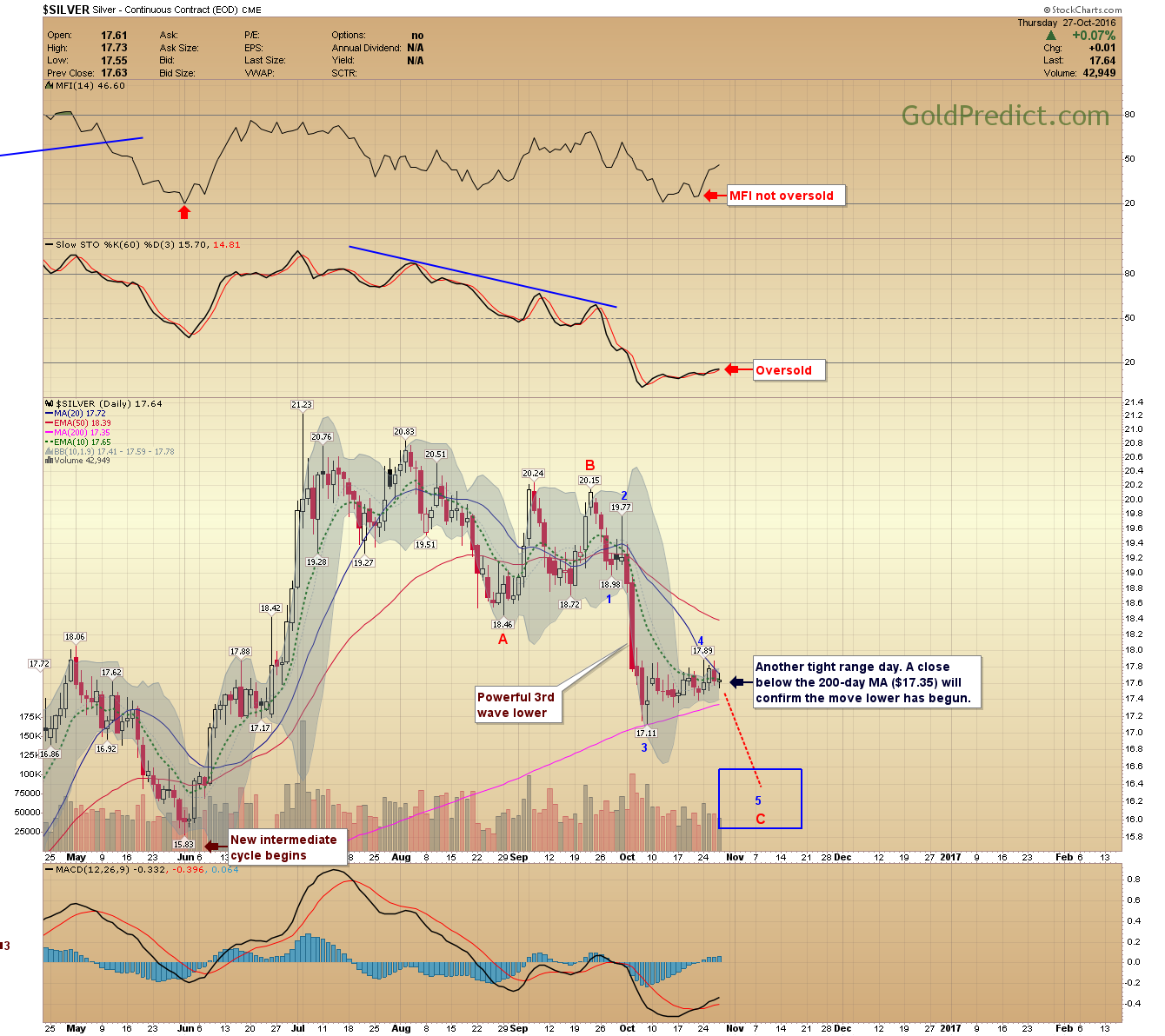

-SILVER- Another tight range day. A close below the 200-day MA ($17.35) will confirm that the move lower has begun.

-GDX- Prices have broken down through the trendline and made the second lower close below the 10-day EMA. Suggesting $24.99 was the bounce high and that prices are slowly breaking down.

-GDXJ- Prices are yet to break below the trendline. We are still calling for prices to reach $35.00 or lower by mid-November.

-SLW- Silver Wheaton clearly broke below the well-defined trendline and could target the gap fill at $19.00.

-SPY- Prices opened higher but sold off throughout the day and into the close. The structure is slowly confirming that a rollover in progress.

-WTIC- Prices made the second lower close below the 10-day EMA yesterday, and it looks like $52.22 is the cycle top. We expect prices to trend lower until late January 2017. We need to see a few more weeks of price action to determine the target zone.

Ideally, precious metals and miners will continue lower tomorrow, but it’s not a requirement.

Have a safe weekend.