Gold and silver reacted as anticipated, but the unexpected strength in miners surprised me. Miners have a tendency to lead precious metals, so the sudden change got my attention. However, the reversal on Friday may have marked a top. We need to see follow-through to the downside to be sure. Prices closing above the Friday highs would be a buy signal.

It is still unclear if precious metals are dropping into an 8-year cycle low. A sharp decline in silver below $15.68 would provide confirmation. Until then, we have to keep an open mind. It’s important not to become overly confident in any scenario until there is indisputable evidence.

-US DOLLAR WEEKLY- The US Dollar broke out of a 2-year consolidation and targets between 108-112. It would take a weekly close back below the breakout level of 100.60 to alter the bullish outlook.

-JAPANESE YEN WEEKLY- The correlation between the Japanese Yen and gold continues. The weekly chart needs a close above the 87.30 level to neutralize the downtrend.

-GOLD WEEKLY- After 7-consecutive weeks lower gold prices finally ended a week higher. A weekly close above $1,170 will form a price swing and signal a potential bottom.

-GOLD DAILY- It’s been 10-trading days since the $1,124.30 low and the rally may have terminated Friday. A daily close below $1,140 could spark another wave of selling.

-SILVER- Daily silver prices formed a bearish engulfing pattern on Friday. If we are dropping into an 8-year cycle low, I would expect to see a sharp selloff if the $15.68 low is taken out.

-HUI- Prices tagged the critical resistance level and immediately reversed. If we are dropping into an 8-year low, I’d expect the capitulation phase to begin from this level. Note: If prices rally and close above today’s high (194.75) then 160.25 will become an important low, and I’ll issue a buy signal for precious metals and miners.

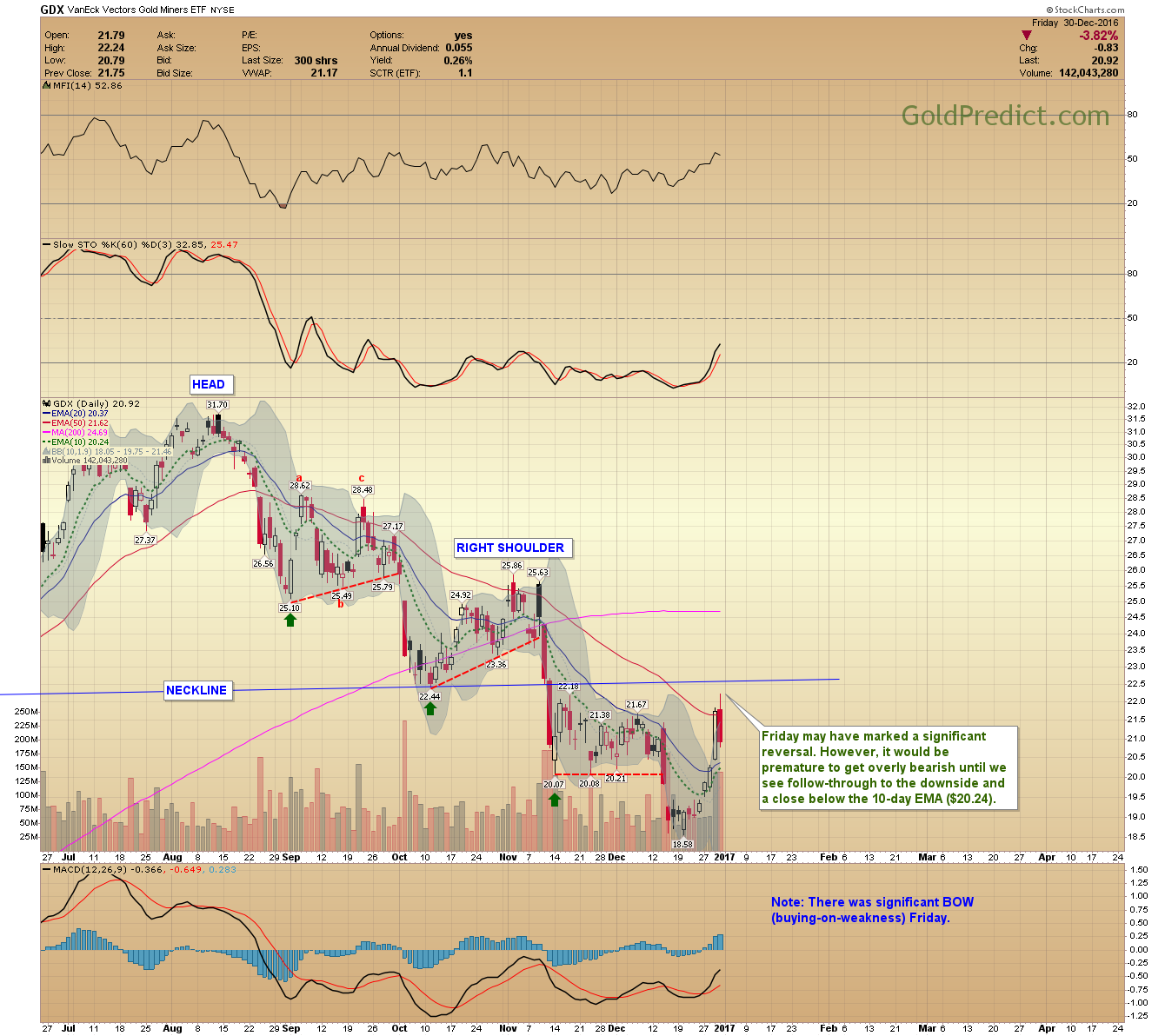

-GDX- Friday may have marked a significant reversal. However, it would be premature to get overly bearish until we see follow-through to the downside and a close below the 10-day EMA ($20.24). Note: There was significant BOW (buying-on-weakness) Friday.

-BUYING_ON_WEAKNESS- A large buying-on-weakness number popped-up Friday after the close disputing the Friday price reversal. Data from the WSJ.

-GDXJ- Junior miners also reversed Friday sharply, but there needs to be follow-through to the downside before I consider an interim top. A close above the green trendline would produce a buy signal.

-SPY- Stocks closed below the lower boundary of the consolidation box and prices could correct down to 221.50-220.00 before turning back higher.

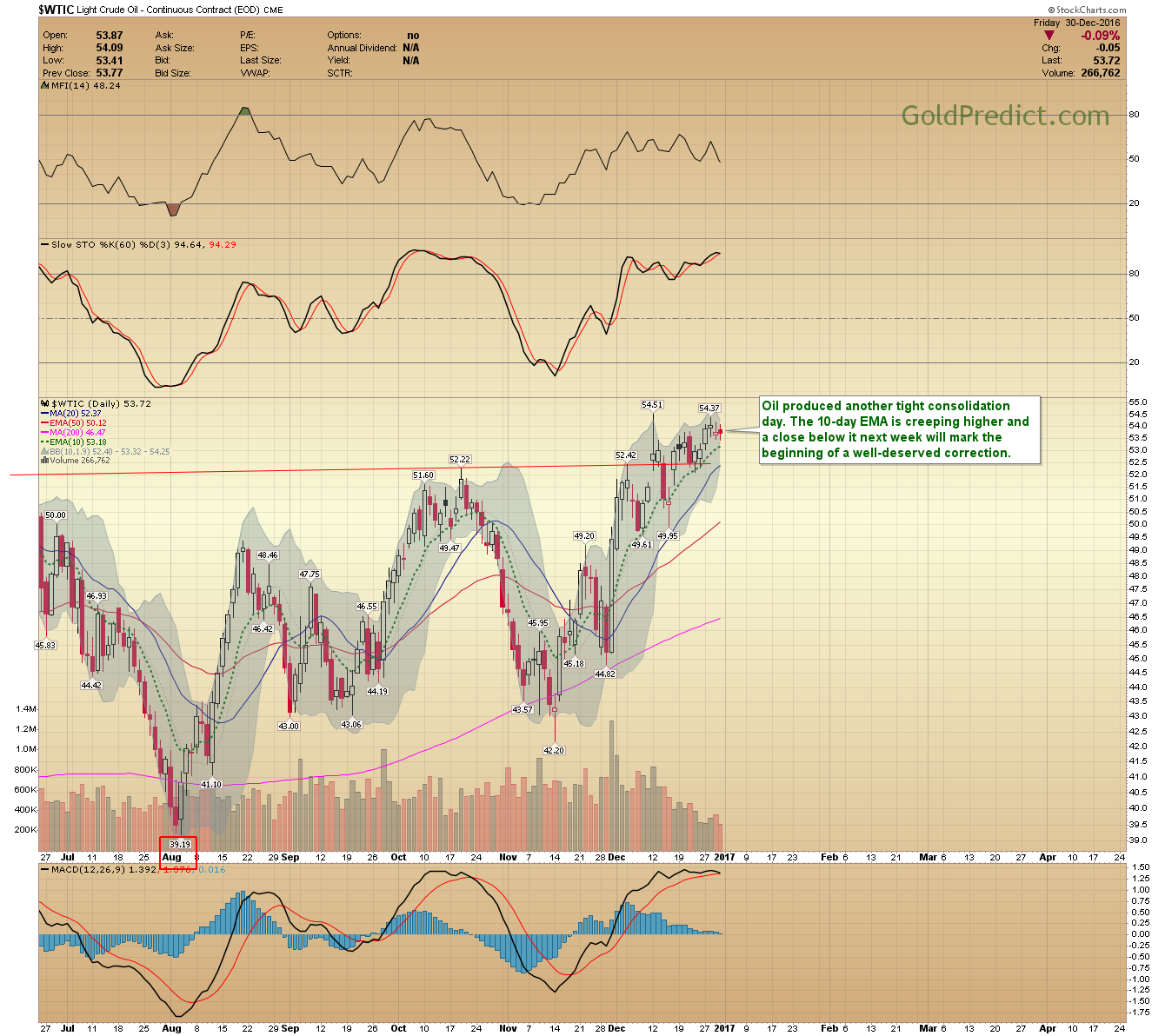

-WTIC- Oil produced another tight consolidation day. The 10-day EMA is creeping higher and a close below it next week will mark the beginning of a well-deserved correction.

Markets are closed Monday. I will anxiously be watching miners next week for clues. Significant follow-through to the downside could initiate the capitulation phase to an 8-year cycle low. However, a daily close above the Friday highs will print a fresh buy signal. We are at a significant inflection point.

I wish everyone a healthy and prosperous New Year.