Tomorrow is the 20th day of gold’s third common (daily) cycle out of the December low. Prices are just reaching the February high, a sign of weakness. We should get some resolution tomorrow. It is still possible for gold to spike above $1,265 and silver above $18.50 before topping. Expect frequent updates tomorrow.

Miners may have topped out yesterday, or they could top tomorrow. Our primary analysis still calls for lower prices into May.

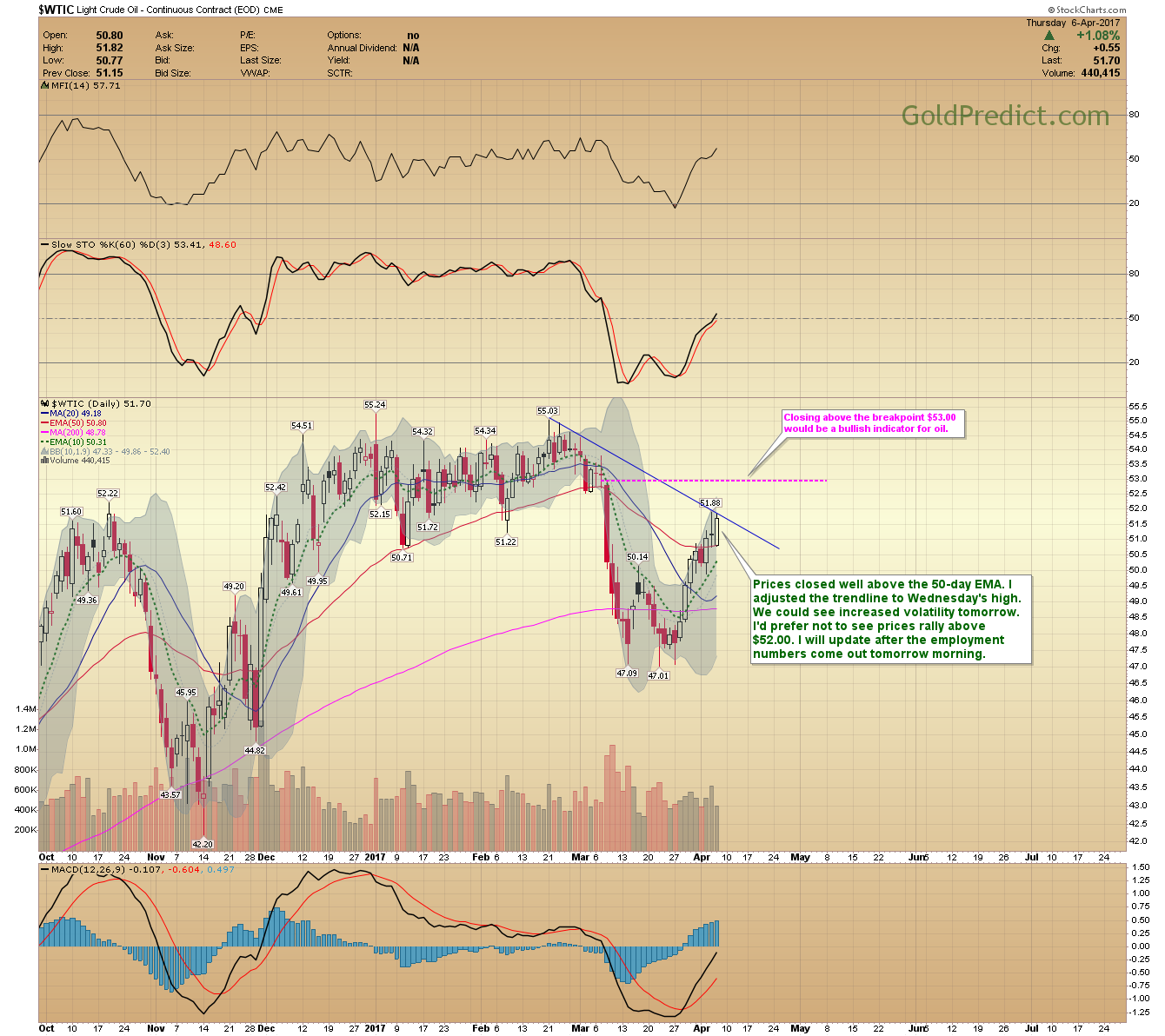

Oil is not making trading easy. We could see increased volatility tomorrow. I will monitor the situation carefully and update after the employment numbers. I removed my stops temporarily…until I see what happens tomorrow. The final line in the sand is the BreakPoint at $53.00 (mental stop).

-US DOLLAR- The Dollar edged higher after yesterday’s reversal and closed above the 50-day EMA (100.55).

-GOLD- Gold touched the 200-day MA again and formed a black candle. Tomorrow is day twenty. Prices will either breakdown tomorrow or spike above $1,265 (possibly both). Dropping below $1,240 should be enough to confirm a cycle high this late in the cycle.

-SILVER- Silver also formed a black consolidation candle. I get the feeling prices will move sharply tomorrow.

-GDX- If prices didn’t top yesterday at $23.66, I think they will top tomorrow. I will watch the action and update throughout the day. A close below the trendline ($22.75), should confirm a breakdown.

-GDXJ- Closing below $35.85 should confirm a decline in Junior Miners.

-DUST- Closing above $31.00 should be enough to spark a rally into May. I moved the potential target into May.

-JDST- A close above the trendline should be enough to ignite a rally in JDST.

-SPY- Prices spiked up to the trendline yesterday and then soldoff after the FED minutes. Prices need to break either trendline for near-term direction.

-WTIC- Prices closed well above the 50-day EMA. I adjusted the trendline to Wednesday’s high. We could see increased volatility tomorrow. I’d prefer not to see prices rally above $52.00. I will update after the employment numbers come out tomorrow morning. Closing above the breakpoint ($53.00) would be a bullish indicator for oil.

-XLE- Prices rallied with oil but closed below the 50-day EMA. I adjusted the trendline to Wednesday’s high. Prices are still under pressure relative to crude.

I’m expecting tomorrow to be an interesting day. We should find out if my analysis is on-track or failing. The employment numbers are expected to reach 185,000. The probabilities for a June rate hike rose from 49% to 62% after the FED minutes.

Expect increased volatility tomorrow. I will post before the open.