The Dollar sold off, and metals rallied after Friday’s weak employment numbers. The April and March data was revised lower, adding fuel to gold’s rebound. Oddly, the softer than expected economic data didn’t affect the odds for a June rate hike which remain at 94.6%.

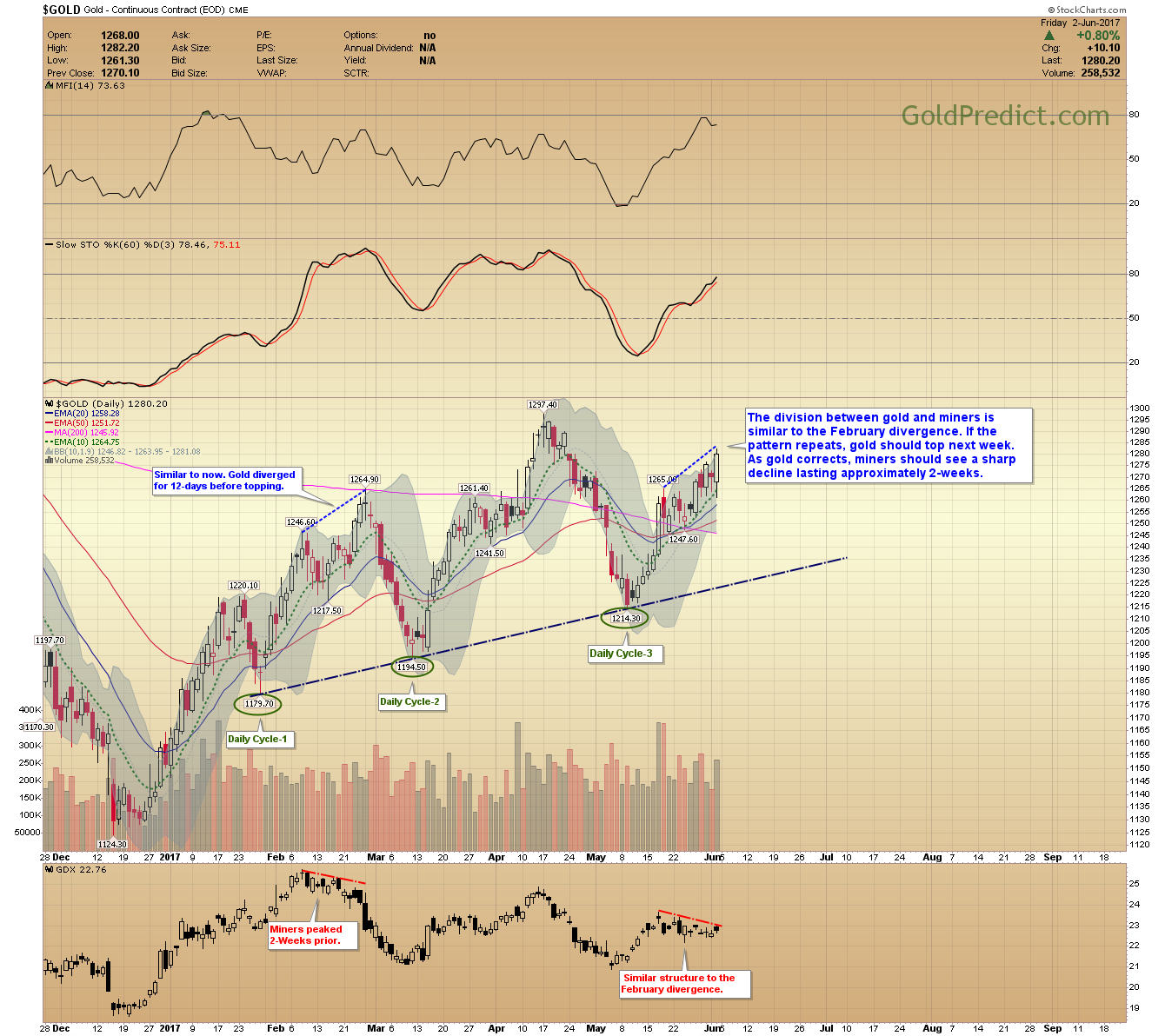

The steadfast underperformance in miners contradicts the persistent rally in metals. Nevertheless, it appears the 6-month gold cycle is stretching, and prices could temporarily exceed the April $1,297 high. Once the rally concludes, a 4-8 week correction should follow.

The price action Monday and Tuesday will set the stage for the rest of the week. If gold begins to rollover early next week, then a retest of $1,297 is unlikely. However, if gold starts the week running, we could see an extension beyond $1,300 and potentially up to $1,315. Whatever the outcome, prices are likely to top by Friday.

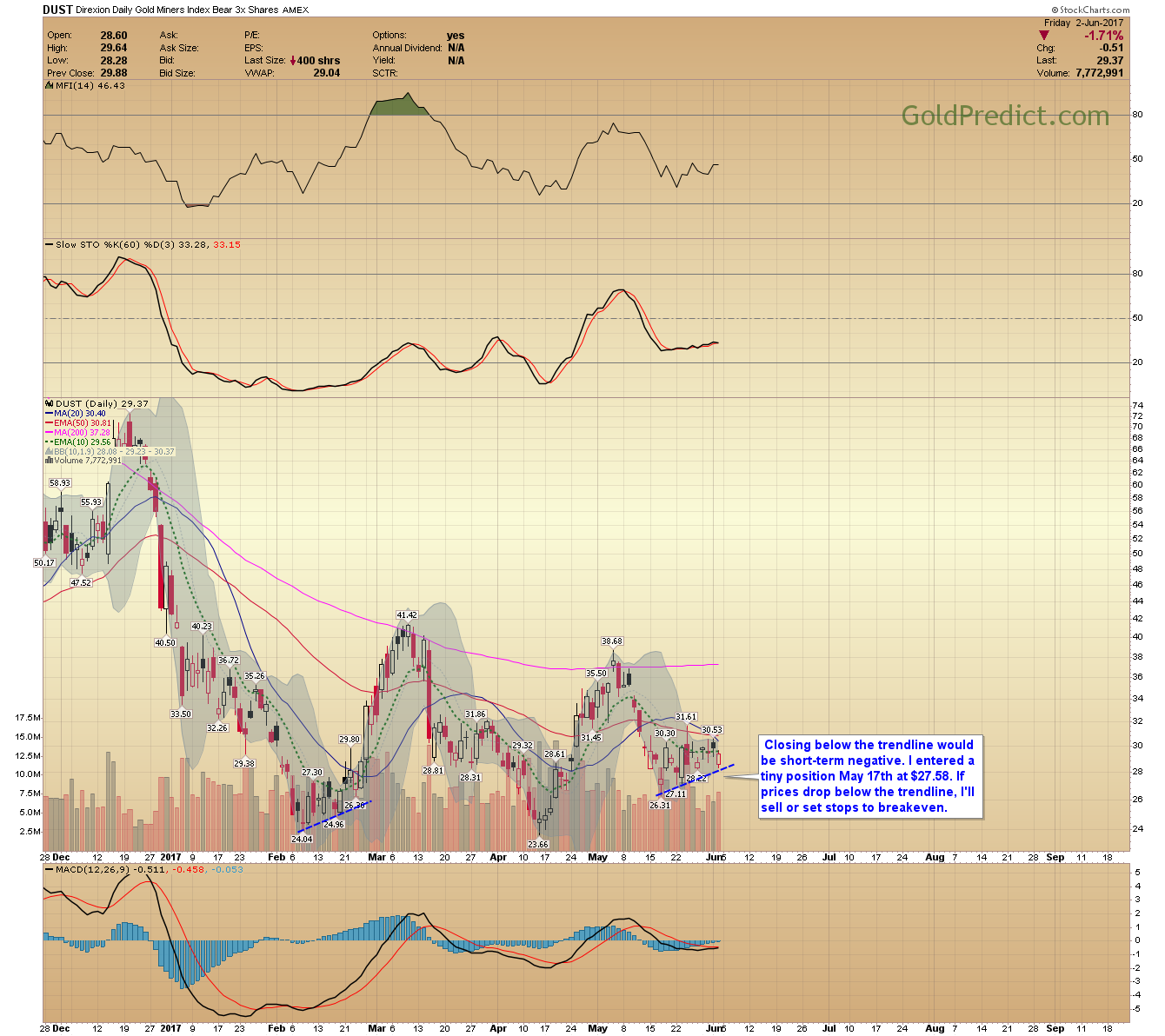

Expect multiple updates early next week. DUST and JDST have modest gains since the May 17th update. I’d be ready to sell if prices drop through their trendlines. Consider raising stops to breakeven.

-US DOLLAR WEEKLY- The dollar’s had multiple opportunities to bottom, but prices remain weak. The cycle is stretching, and prices are deeply oversold. Conditions are ripe for a reversal. Nevertheless, the extended decline is causing extensive technical damage to the chart, challenging the dollar’s capacity for a steady advance. Once prices bottom, we should see at least a 1-3 month rally.

The strength and duration of the next intermediate-term rally will determine the future of the dollar. The dollar needs a weekly close back above the 101 level to maintain the potential for new highs. Failure to retake the 101 by September would support the onset of a new dollar bear market.

-DOLLAR DAILY- Prices are dropping after forming a quick bear flag. The sentiment is extremely bearish, and selling is nearly exhausted.

-GOLD WEEKLY- The intermediate cycle in gold is extending, and prices could test the $1,297.40 high next week. A quick spike to $1,310 – $1,315 isn’t out of the question. Once complete, we should see a 4-8 week decline into an elongated 6-month cycle low. The Stochastics crossed over just below the 50-level. However, we never saw a failed daily cycle. Therefore, this is probably a cycle extension and not the beginning of a new 6-month cycle.

-GOLD DAILY- The division between gold and miners is similar to the February divergence. If the pattern repeats, gold should top next week. As gold corrects, miners should see a sharp decline lasting approximately 2-weeks.

-SILVER WEEKLY- The next level of resistance for silver arrives between $17.75 and $18.10.

-SILVER DAILY- Prices reversed sharply on Friday and are set to challenge the 200-day MA. A quick spike to $18.00 – $18.10 is not out of the question.

-GDX- The price action early next week is crucial. A daily close above $23.25 will project a short-term rally to the $24.00 – $24.25. However, a daily close below $22.50 will initiate a down leg to $20.00 – $19.50.

-GDXJ- If juniors close above $32.50, we could see a test of the upper trendline. Closing below $31.00, would initiate a test and likely decline below the December $27.37 low.

-DUST- Closing below the trendline would be short-term negative. I entered a tiny position May 17th at $27.58. If prices drop below the trendline, I’ll sell or set stops to breakeven.

-JDST- Dropping below $74.60 would be counter productive. I have a stop at breakeven ($69.02), but I might sell before then if I don’t like what I see.

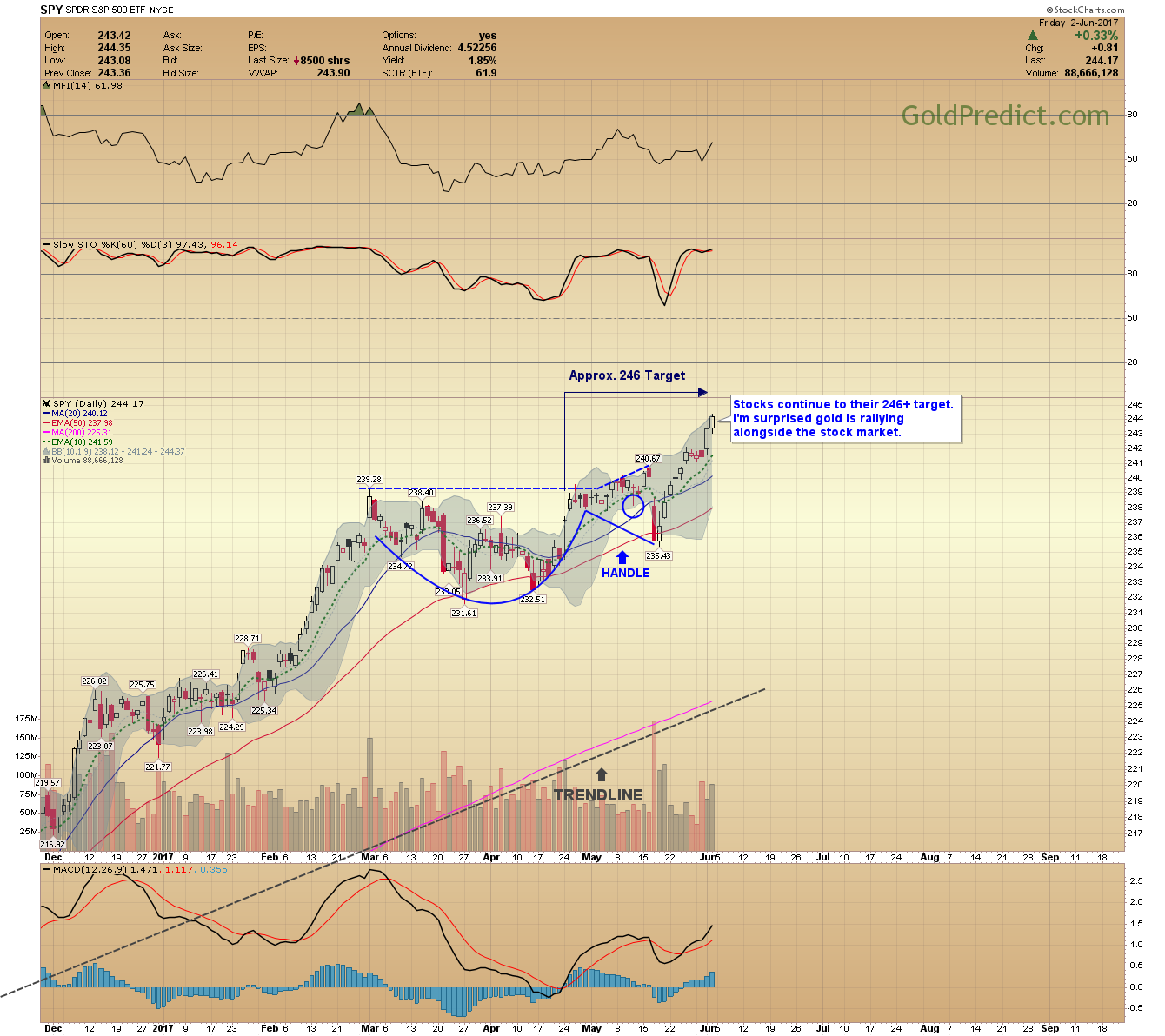

-SPY- Stocks continue to their 246+ target. I’m surprised gold is rallying alongside the stock market.

-WTIC- Prices bounced off the $47.00 support level, and we could see a brief rebound. Prices would need to close consecutively above the 10-day EMA to suggest more. Failure to recapture the 10-day will lead to another drop and a possible retest of $44.00.

I will be on the lookout for shorting opportunities next week. Volatility could increase. Remaining calm will be key. I will estimate upside targets for DUST and JDST later in the week if they retain their trendlines.