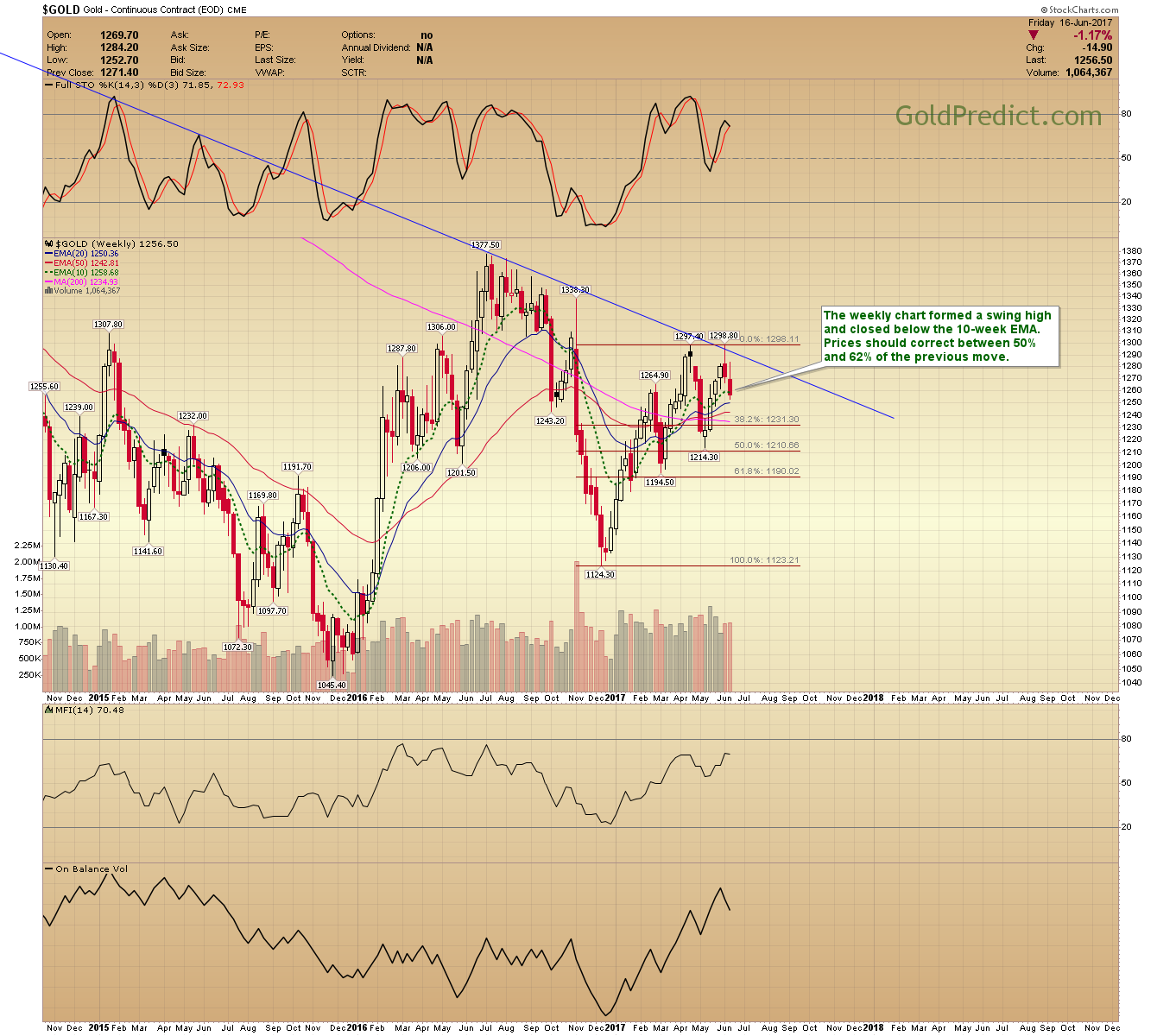

Gold and Silver formed weekly swing highs, and prices should be working their way down into the 6-Month low. The bull market breakouts in 1986 and 2002 are similar to the current setup. If the correlation advances, we should see gold break above the long-term trendline later this year, confirming a bull market.

Metals and Miners should drop a little further next week to test their respective trendlines. If the trendlines hold, we could see an intervening bounce out of a daily cycle low. The bounce, if we see one, should rollover and generate a failed daily cycle.

Mid-July to early August seems appropriate for the 6-Month low. Price objectives for gold range between $1,190 and $1,212. The 6-Month low could arrive sooner if prices collapse through their trendlines next week

PREVIOUS BULL MARKET BREAKOUTS

-1986 BULL MARKET BREAKOUT- Prices probed the trendline several times. The breakout occurred 311-Weeks after the $873.00 8-Year cycle high. The 6-Month low before the breakout retraced 50%.

-2002 BULL MARKET BREAKOUT- Prices probed the trendline several times. The breakout occurred 314-Weeks after the $419.70 8-Year cycle high. The 6-Month low before the breakout retraced 62%.

-2017 BREAKOUT?- The multi-year correction is similar to the 1986 and 2002 breakouts. It has been 301-weeks since the $1923.70 8-Year cycle high. We could see this 6-Month cycle retrace between 50% and 62% before bottoming. Once complete, I’ll look for a breakout above the trendline sometime between August 21st and September 15th.

-US DOLLAR- The Dollar is struggling to confirm a bottom; I think it will next week. Once complete, we should see at least a 1-3 Month rally. The intensity of said rally will determine the potential for new highs.

-GOLD WEEKLY- The weekly chart formed a swing high and closed below the 10-week EMA. Prices should correct between 50% and 62% of the previous move.

-GOLD DAILY- It will take time to discover the path to the 6-Month low. Perhaps we see an ABC style correction. Breaking the intermediate cycle trendline is a must.

-SILVER WEEKLY- Prices formed a swing high after the weekly bearish engulfing candle. It’s vital to see how silver reacts at the $15.75 support zone before determining price targets.

-SILVER DAILY- We should see prices drop a little more before a potential bounce.

-GDX- Miners should test the $21.00 level next week before generating an interim bounce.

-GDXJ- The rebalancing of the junior mining ETF is skewing the chart. The XAU offers a cleaner representation.

-XAU- We should see the XAU test the 77.50 level next week. Prices should ultimately break 77.50 before reaching the 6-Month low.

-SPY- The consolidation continues. Prices are storing up energy for the rally to 246+.

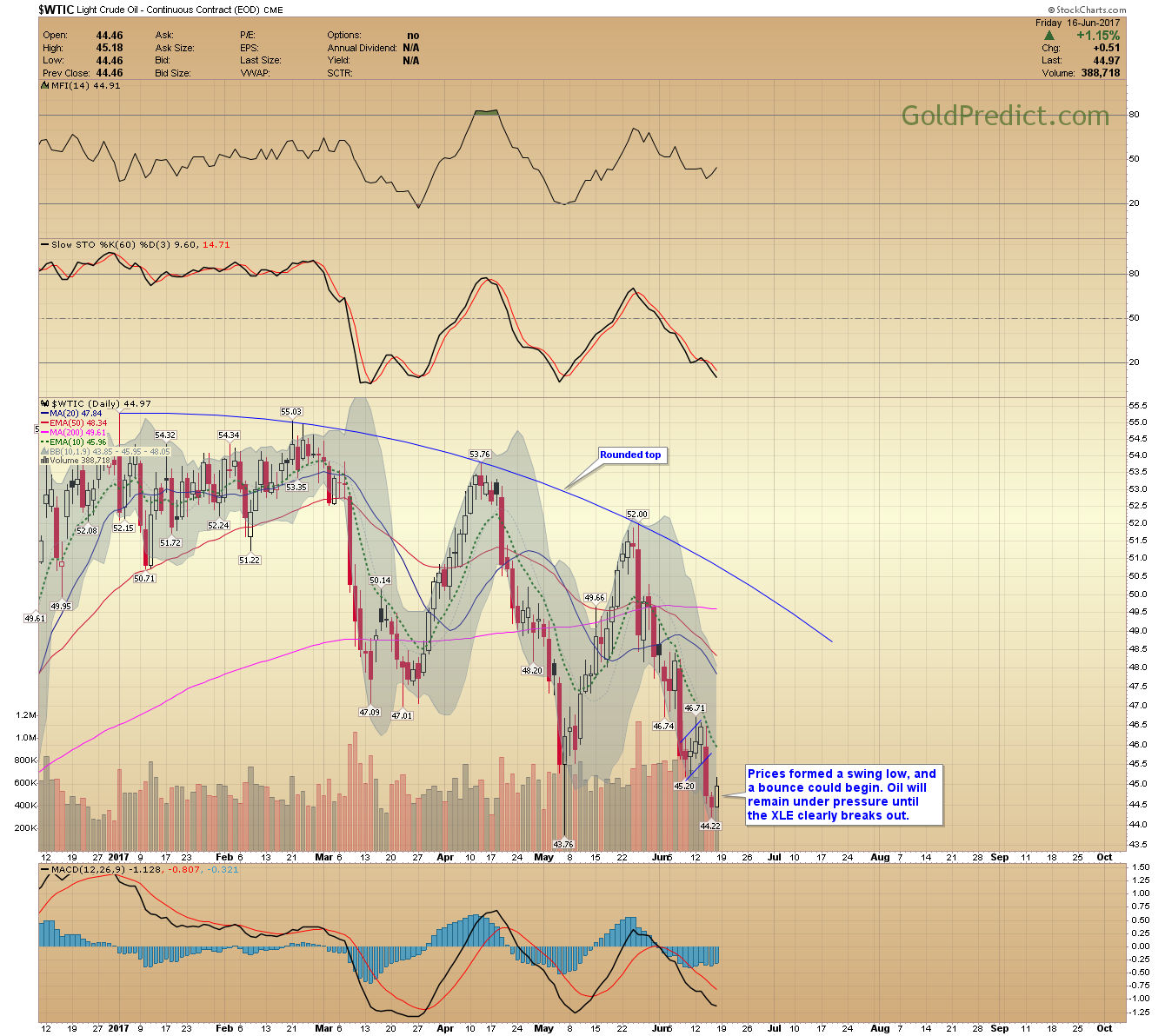

-WTIC- Prices formed a swing low, and a bounce could begin. Oil will remain under pressure until the XLE clearly breaks out.

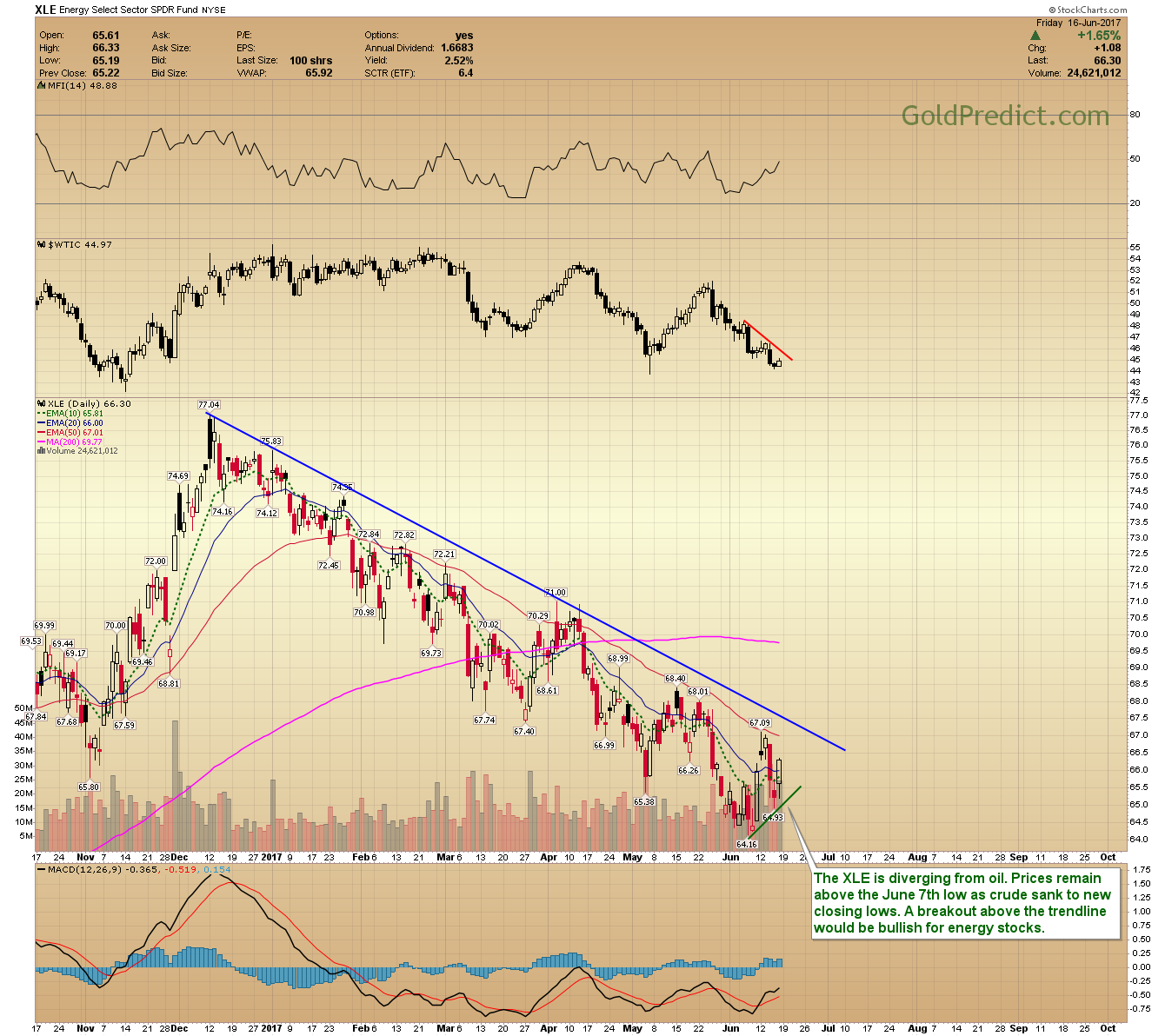

-XLE- The XLE is diverging from oil. Prices remained above the June 7th low as crude sank to new closing lows. A breakout above the trendline would be bullish for energy stocks.

The next two weeks will be hectic as we transition our new house. I need to complete several projects before we move in. Reports and updates may occasionally be delayed. Thank you for your patience during this process. Happy Fathers Day!