Metals and Miners rolled over on Wednesday, but the ensuing decline was lackluster. I was expecting a substantial breakdown before the weekend. Gold dropped below $1313 on Friday, but it was unable to crack the $1309 zone. To setup a low next week, gold needs to drop below $1300.

The probabilities for a March rate hike have risen to 94.4%. The big question is whether the Fed will increase rates 3 or 4 times in 2018. For answers, participants will pay careful attention to Wednesday’s post-meeting remarks (2:30 PM). This will be Powell’s inaugural press conference as the new Fed chair. His narrative will be meticulously dissected for clues and could send markets reeling if he’s viewed as overly hawkish.

Wednesday and Thursday are pivotal days. The price action leading into and after the press conference will guide our outlook. If gold dips below $1300, then I’ll look for signs of bottoming on Wednesday or Thursday. Expect increased volatility. As always, I’ll do my best to keep members informed every step of the way.

-US DOLLAR- I had conflicting data between stockcharts and TD Ameritrade on Thursday. The later showed prices closing above the short-term trendline; apparently, they didn’t. A swing low formed, and prices could rally with a close above 90.00. Failing to produce upside follow-through next week will set the stage for another decline.

-GOLD- Prices rolled over on Wednesday and ended the week slightly lower. The structure is demanding patience. I thought prices would be considerably lower by now. Nevertheless, breaking below $1300 will setup the next low, possibly on Wednesday or Thursday. The price action will dictate my entry strategy. I’d like to see a swing low before entering positions. Failing to break below $1300 would open the door to alternate scenarios.

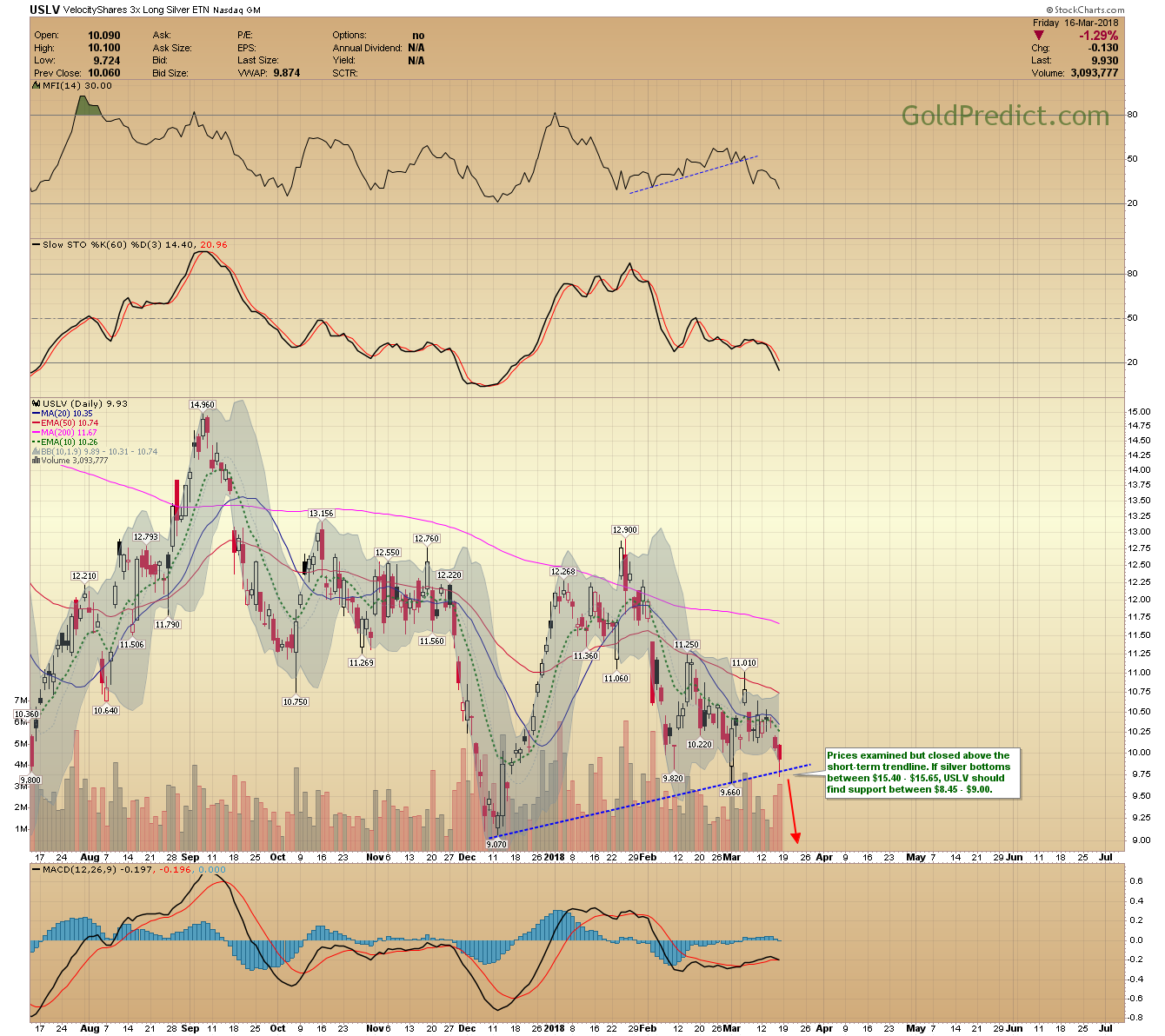

-SILVER- Silver broke lower from the triangle formation. The breakdown suggests a low between $15.40 – $15.65 sometime next week.

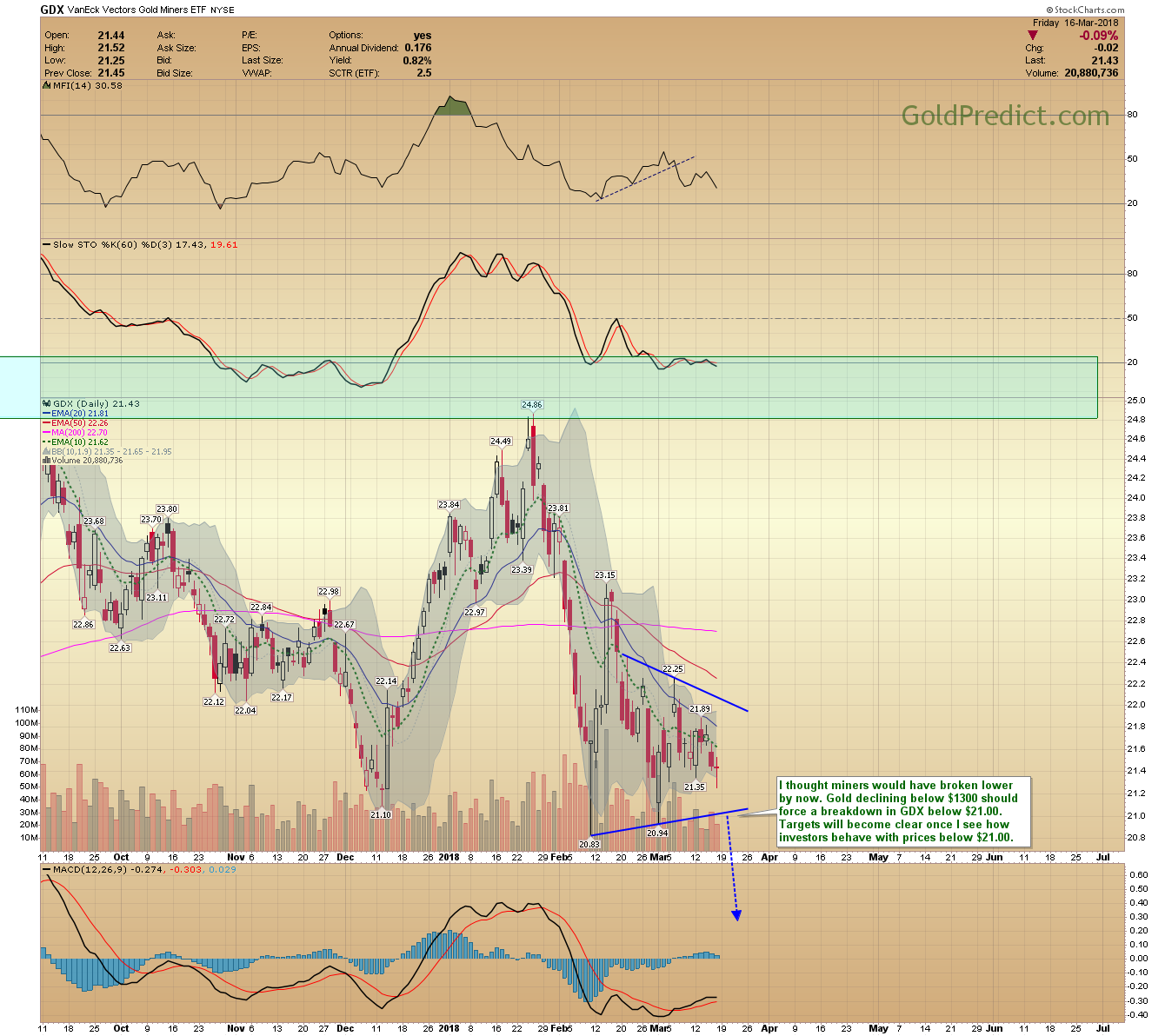

-GDX- I thought miners would have broken lower by now. Gold declining below $1300 should force a breakdown in GDX below $21.00. Targets will become clear once I see how investors behave with prices below $21.00.

-GDXJ- Juniors tested the lower triangle boundary but managed to close slightly above it. Prices are running out of time for a decline and support around $29.00 should hold.

-JNUG- Time is running out for a decline, and I think JNUG will bottom between $10.00 – $11.00.

-USLV- Prices examined but closed above the short-term trendline. If silver bottoms between $15.40 – $15.65, USLV should find support between $8.45 – $9.00.

-SPY- Prices filled but never closed below the prior week’s gap. Progressive closes below 273.34 would support a retest of the March 263.76 low.

-WTIC- Prices closed above the short-term consolidation line, and could set a secondary high in the coming week(s). The 39-41 day cycle window supports March 22nd to March 26th as the next potential turning point.

The next 3-4 trading days are crucial. I’ll deliver my entry strategy and change the color codes if/when a bottom is suspected.

Have a safe and pleasant weekend.