Overnight gold declined to $1,307.40, and a breakdown below $1300 was nigh. Unfortunately, prices reversed around 2:00 AM and closed the day at $1,317.80. The odds for a bottom forming around the time of the Fed meeting are fading; it’s time to build alternative scenarios. The key levels going forward are $1310 and $1343 in gold.

Gold peaked in late January. Prices failed to breakout above $1377 and slowly rolled over. The structure is demanding patience. Nevertheless, I see a correlation that may provide some guidance.

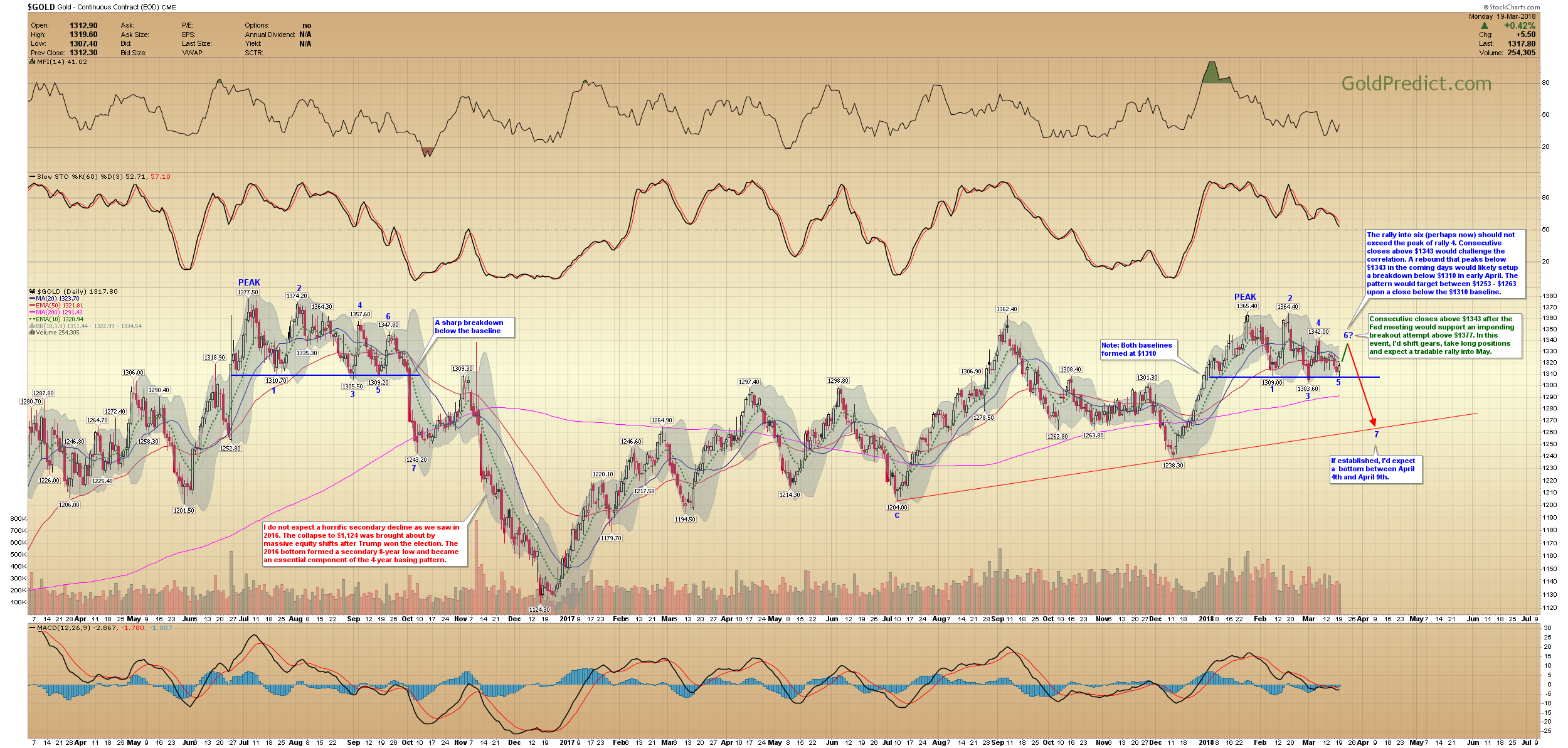

The current price pattern is very similar to the 2016 topping formation. Prices formed a clear baseline at $1310, and each rally generated a lower high, just like now (see chart).

For the correlation to stand, gold needs to hold (not close above) the $1343 level. If established, and prices rollover below $1343, I’ll expect a decline below $1310 in the coming weeks. A bottom in early April would then become likely. The price action after Wednesday’s Fed meeting will confirm or deny this scenario. Consecutive closes above $1343 would support an impending breakout attempt above $1377.

-ALTERNATE SCENARIO- The rally into six (perhaps now) should not exceed the peak of rally 4. Consecutive closes above $1343 would challenge the correlation. A rebound that peaks below $1343 in the coming days would likely setup a breakdown below $1310 in early April. The pattern would target between $1253 – $1263 upon a close below the $1310 baseline. If established, I’d expect a bottom between April 4th and April 9th.

Consecutive closes above $1343 after the Fed meeting would support an impending breakout attempt above $1377. In this event, I’d shift gears, take long positions and expect a tradable rally into May.

Note One: Both baselines formed at $1310.

Note Two: I do not expect a horrific secondary decline as we saw in 2016 if prices breakdown below $1310. The collapse to $1,124 was brought about by massive equity shifts after Trump won the election. The 2016 bottom formed a secondary 8-year low and became an essential component of the 4-year basing pattern.

I’ll monitor the progression of this pattern and keep members informed. I may enter short positions if prices rollover and fail to close above $1343 by Thursday or Friday.