It appears earnings are causing the route in miners. Newmont Mining (NEM) fell more than 8% to $29.12 in midday trading Thursday, after the company reported a loss of $145 million, or 27 cents a share, during the third quarter, compared with profits of $206 million, or 38 cents a share, a year earlier.

-NEM- After poor earnings, NEM is already testing the September low.

GLD is down just 0.25%

SLV is down just 0.36% or 5 cents….

GDX is crashing below the neckline and rapidly approaching the October 11th $18.76 gap.

-GDXJ- The neckline in juniors is around $28.10. I didn’t expect a trending move or sustained breakdown until after the elections. So I wouldn’t be surprised if prices bounce or consolidate into early November. I hate to be so skeptical of miners, but I won’t trust a breakdown until prices close below the $27.60 gap and the cycle trend.

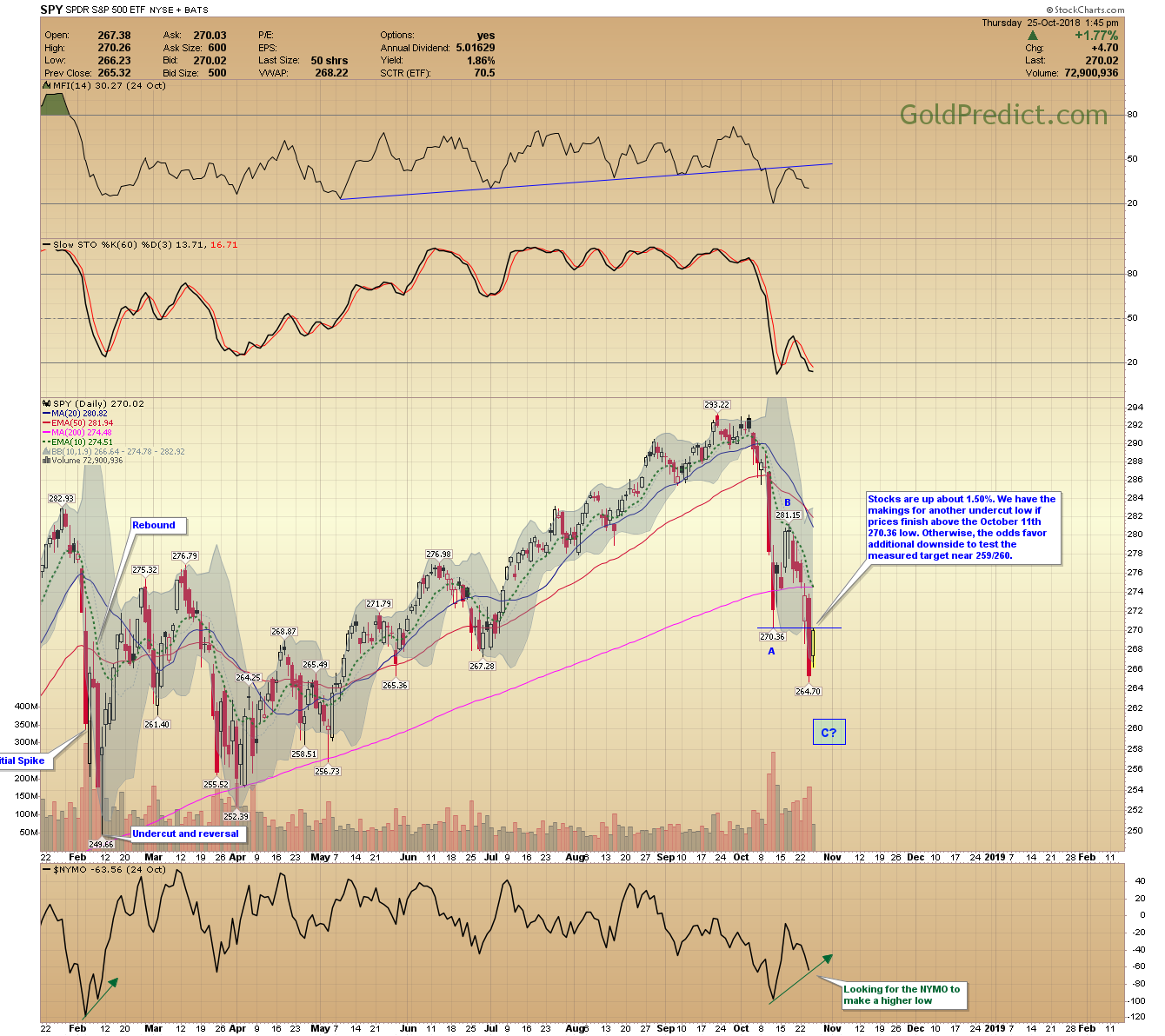

-SPY- Stocks are up about 1.50%. We have the makings for another undercut low if prices finish above the October 11th 270.36 low. Otherwise, the odds favor additional downside to test the measured target near 259/260.