Gold and silver remain rangebound after last Tuesday’s outside reversal days. Each needs progressive closes below the 10-day EMA to verify a top.

Miners formed swing lows, and prices are bouncing. If prices peaked as I suspect, then this rebound should conclude within then next 1-3 trading days. A rally that finishes above the August 7th peak(s) would signal more upside, and I’d exit DUST.

A correction into a cycle low is rarely orderly or directly lower. Precious metals and miners may trade sideways or consolidate before breaking decisively lower. Gold would have to close above $1546 to invalidate last weeks reversal day and support more upside.

Occasionally, I check the Robinhood top 100 stocks to see where average investors are parking their money. I view it as a contrary indicator. Currently, there is not one gold or precious metal related stock in the top 100. That tells me average investors aren’t thinking about gold – that’s good. If GLD or GDX were in the top 10, I’d be leery.

-GOLD- Prices remain within the range ($1546 – $1489) of last Tuesday’s outside reversal. The MACD (below) is about to crossover bearishly. Progressive closes below the 10-day EMA would install a top. A daily close above $1546 would invalidate the outside reversal day and support more upside.

-SILVER- Like gold silver remains within the range of last weeks outside reversal day. Prices would have to close above $17.50 to trigger more upside. A daily finish below $16.80 would be the next step in validating a top.

-GDX- Miners formed a swing low, and prices are bouncing. If $30.00 is the cycle top, then this rebound should be over in 1-3 trading days. A daily close above $30.00 would recommend more upside, and I’d exit the DUST position.

-GDXJ- Juniors closed back above the 10-day EMA and formed a swing low. Technically, prices remain in an uptrend making higher lows and higher highs. To establish a trend reversal, this rebound must terminate below the $43.10 high.

-SPY- Stocks continue to consolidate after the early August plunge. I see a potential triangle pattern. If correct, prices may continue to thrash back and forth for a couple more weeks.

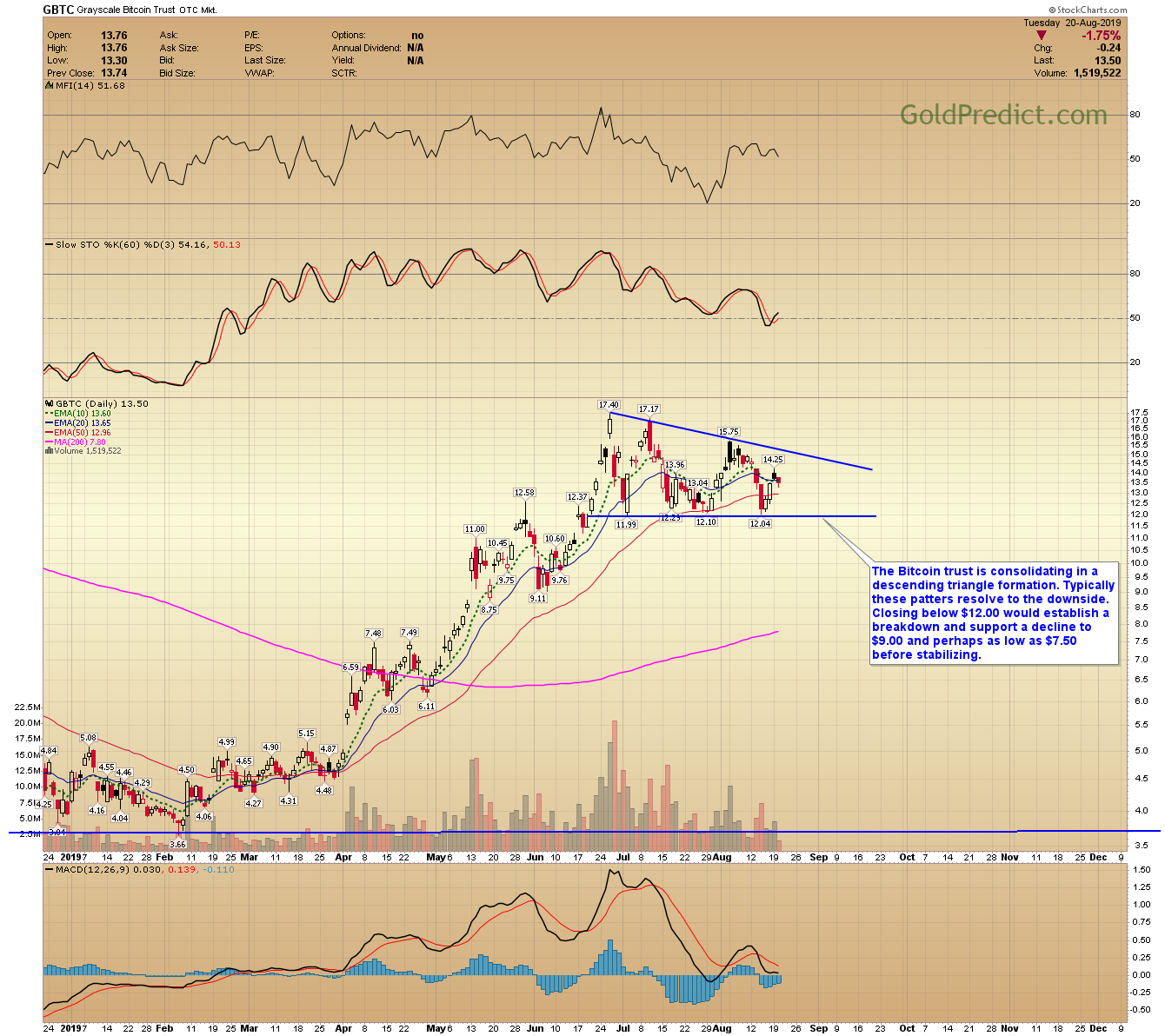

-GBTC- The Bitcoin trust is consolidating in a descending triangle formation. Typically these patters resolve to the downside. Closing below $12.00 would establish a breakdown and support a decline to $9.00 and perhaps as low as $7.50 before stabilizing.

Have a great night.