Gold futures continue to work their way lower after peaking in September. The topping process appears complete, and the next wave of selling could begin any day. I went over the 4-stages of an intermediate correction in the Weekend Newsletter. Today, I’d like to revisit gold’s cyclical nature.

If you study the markets long enough, you’ll begin to recognize a cyclical nature to virtually everything. Financial assets rise and fall with the business cycle. Agricultural commodities are subject to weather patterns and drought. In gold, you’ll notice prices seem to base or bottom about every 6-months.

THE 6-MONTH CYCLE- Below is a weekly chart of gold from 2007 to 2012. The blue arrows represent each 6-month bottom. Not every cycle is equal, but there is a definite cadence to the lows. In bull markets, each 6-month low should be higher than the last. Note, the 2008 series made a lower low, and that turned into the 8-year low. The next 8-year low is due in late 2024 to early 2025.

Now that we have a confirmed bull market, each 6-month cycle low should arrive higher than the last. Meaning this correction should stay well above the May $1267.30 low. A breakdown below the preceding 6-month low implies a more significant 8-year cycle correction.

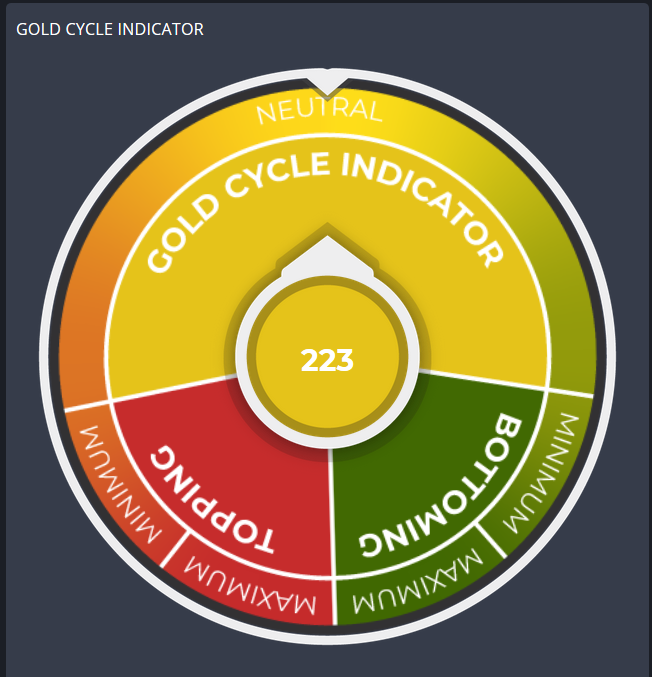

-GOLD DAILY- I believe we will transition into stage three (top acknowledged) once gold breaks the October $1465 low. Commercial net-shorts remain elevated at -310,492. Our Gold Cycle Indicator (currently 223) should dip below 100 to support conditions consistent with minimum cycle bottoming. Prices should find support near the 200-day MA.

After this cycle bottoms, a new sequence begins – wash, rinse, and repeat. Some corrections are more profound than others, while some are unusually shallow. The market throws a curveball occasionally to keep traders on their toes.

-SILVER- The trend appears to be rolling over once again. Breaking the October $16.94 low would conceivably trigger another selling event (possibly sharp). As I said before, picking price objectives for silver is difficult due to its volatility. Nevertheless, prices should remain above the May $14.27 low.

-GDX- Miners closed below the $26.50 support level – we could see a gap lower tomorrow. The next target is primary support near $24.00.

-GDXJ- Juniors finished below $36.00. Next, we could see a breakdown to $32.50.

-SPY- Stocks are approaching new all-time highs on news that the trade war is finally deescalating. Money is flowing out of safety assets like gold and utilities and into riskier small-cap stocks and cyclicals.

-WTIC- If we are to see a pickup in economic growth, we should get a bump in energy demand. However, the oil chart still looks bearish and could be forming a bear flag.

Have a great night.