The markets are crazy, and volatility is spiking. Everyone now understands the coronavirus is a black swan type event that could potentially result in a global recession. I see two potential outcomes.

1) The coronavirus begins to fade after April with the warmer weather and is no longer a threat by July/August. This would likely result in a massive snapback rally of economic activity due to pent-up demand. In this scenario, stocks and commodities would rally sharply into year-end.

2) The coronavirus continues to spread into a major pandemic. Economic growth slows as quarantine and closures disrupt numerous parts of the economy. In this scenario, stocks and commodities would remain under pressure, and we would enter a bear market.

Coronavirus Update: Currently, the coronavirus has 107,811 confirmed cases and 3,661 deaths. Approximately 75% of the cases remain within China. Approximately 25% of the cases are growing outside of China.

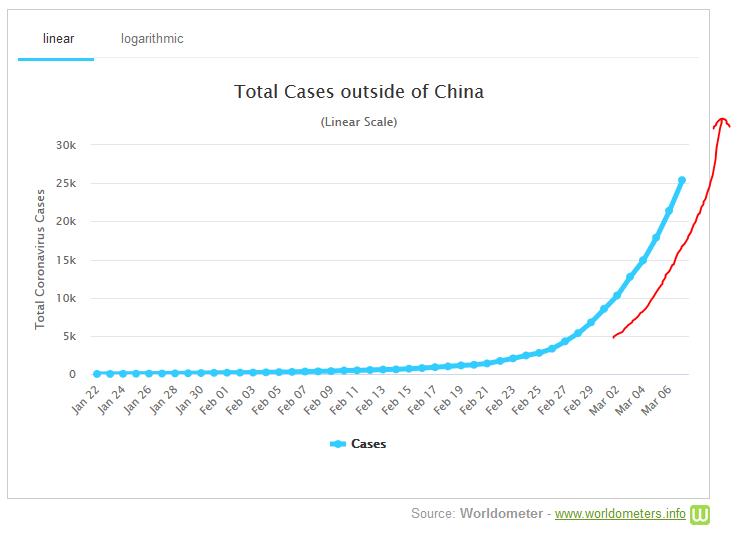

Cases Outside of China: As you can see in the chart below, the line is nearly vertical and is approaching a parabolic rise. If it continues at this rate throughout March, then we will likely see the bear market scenario above.

https://www.worldometers.info/coronavirus/coronavirus-cases/

Psychological Turning Point: Looking back, I think we will realize the coronavirus was exactly what precious metals needed to kick off the bull market. Remember, last year, when I told you US mint gold eagle sales reached record lows. I said that often precedes a significant turning point, which I think is now upon us.

Let me explain – to have a strong bull market in precious metals, we must have secular demand. By secular demand, I mean the average person buying physical bullion and coins. Last year, nobody was interested in gold. I think the coronavirus is changing that.

If I’m correct and the average person is starting to wake up and look at precious metals, what will they find? They will see that silver prices are very cheap and still below the 2016 high – they will buy silver. They also notice that platinum is incredibly cheap compared to gold. At nearly half the price, some will buy platinum instead of gold.

So, no matter how terrifying the recent drop was or how disheartening it is to have a losing trade, take heart and know that it is only temporary. The bull market in precious metals is just getting started – average investors are finally waking up. Note: Check out the 2003 post-SARS silver chart. I think we could be setting up for a “coronavirus” repeat.

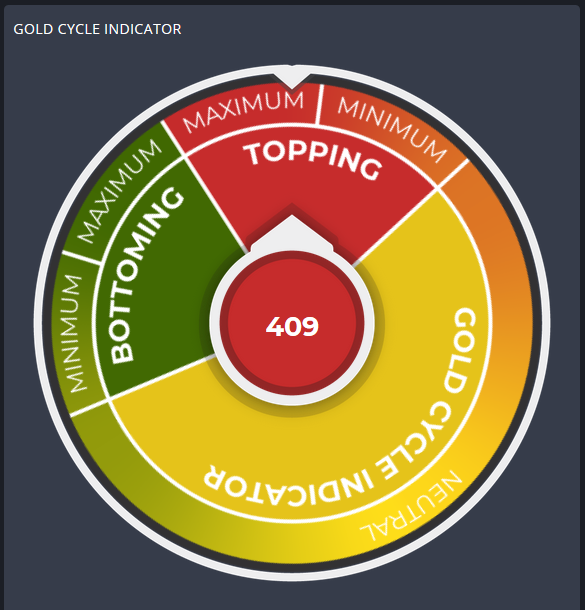

The Gold Cycle Indicator finished at 409.

University of Michigan Consumer Sentiment: Consumer sentiment remains key to gold’s long-term bull market. Sentiment is essentially how optimistic or pessimistic the average consumer is regarding the economy. When things are good, sentiment is high, and nobody is thinking about protecting themselves with precious metals. That was evident in last year’s US Mint Gold Eagle sales, which hit all-time lows. The average person wasn’t interested in gold last year.

Surprisingly, sentiment has remained stubbornly high (currently at 101). However, I think that is about to change with the coronavirus and the upcoming elections. This feels like a tipping point. This number will be updated on March 13 (expected at 95), I’m thinking lower.

-US DOLLAR- After reaching a new high, the dollar index crashed. I don’t see how the government can get out of this without devaluing its currency. Low interest rates aren’t enough to stimulate the economy, clearly.

-GOLD- Gold is back and approaching my original March target between $1685 and $1730. The manipulators like to get as many people to buy near the top as possible. Often, they will create a false breakout to fresh highs before pulling the plug. If prices consolidate next week, then I will look for a turning point around the March 18 Fed announcement.

-SILVER- I have to admit, I’m a little surprised concerning silvers 6-month cycle. Prices failed to make a new high and then broke the previous 6-month low. That equals a failed cycle. A failed cycle generally means lower prices and a bear market. I’m hesitant to accept this because I genuinely believe silver is in a bull market. Nevertheless, I think we have to accept the possibility that if the economy enters a full-blown recession, then silver could slip back towards $14.00 or $15.00. I prefer a repeat of the 2003 post-SARS outbreak, where silver prices exploded higher.

-SILVER’S 2003 POST SARS BREAKOUT- The SARS epidemic from January to July 2003 resulted in an explosive move in silver. Will the coronavirus have the same result? I think it might!

-PLATINUM- Platinum prices collapsed with silver, but I’m not ready to give up on them yet. I see major support between $820 and $845. If that level holds, then we could be off to the races later this year. Progressive closes below $800 would set the stage for new lows in platinum.

-PALLADIUM- I think palladium may be approaching a long-term top sometime in 2020. Once prices peak, there is usually a violent collapse. If the pattern repeats, prices could drop to between $500 and $600 by 2022 or 2023.

-GDX- With gold approaching its original March target and with the gold cycle indicator at 409, the remaining upside in miners is probably limited. It would take a clear and definite breakout above $31.84 to make me think otherwise. Currently, I’m not expecting the next major bottom in miners until late April or early May.

-GDXJ- It looks like we have a five-wave impulsive structure off the 2018 bottom (bullish advance). Prices could consolidate for a while before starting the next up leg. Ideal support remains around $32.50.

-SPY- I don’t think the panic is over and stocks will likely slip to new lows. That will encourage the Fed to keep cutting interest rates. Ultimately, I believe this will produce a massive second-half recovery once we realize the coronavirus is under control, and workers go back to work. There will be a lot of pent-up demand.

-WTIC- Weekly oil prices have broken key support and the previous trendline. I see the potential for a legitimate breakdown that declines to test the $26.05 low set in 2016.

I hope you’re having a pleasant weekend.