Last week will go down in the history books as one of the most violent and volatile weeks in stock market history. I hope you survived it.

Precious metal prices collapsed throughout the week, especially on Friday. I’m curious to see next week’s COT report. I bet the commercials reduced their short positions dramatically.

The coronavirus continues to expand. Half the cases are now outside of China. In the last two days, there were just 36 new cases reported in China. I think things are getting better there. Unfortunately, the virus is just getting started elsewhere.

The COVID-19 virus appears to be most dangerous to people over 60-years old. One report said no children under the age of nine have died. So, it seems less risky for children.

Watershed Moment: As bad as things are, there is some good news for precious metals. The one-two punch of a global pandemic and crashing stock market has jolted precious metal demand. Last year the US investor wasn’t interested in gold or precious metals. That is no longer the case – precious metals are flying off the shelves, especially silver.

- I believe we will look back at the recent events and realize this was a 9/11/2001 type moment for precious metals; a sudden and then sustained increase in demand.

- Precious metals desperately needed the average investor to get involved. Now that they are, it should launch us into the next stage of the bull market.

- Prices could go a little lower first but with the increase in demand, any near-term price disparity should be corrected.

TOP 10 SPECULATIVE MINING STOCKS: I will soon be updating my list of favorite speculative miners. There are some incredible bargains out there, and I’m going to have to do my homework. I’ll pick the best of the best and revise my list for next weekend.

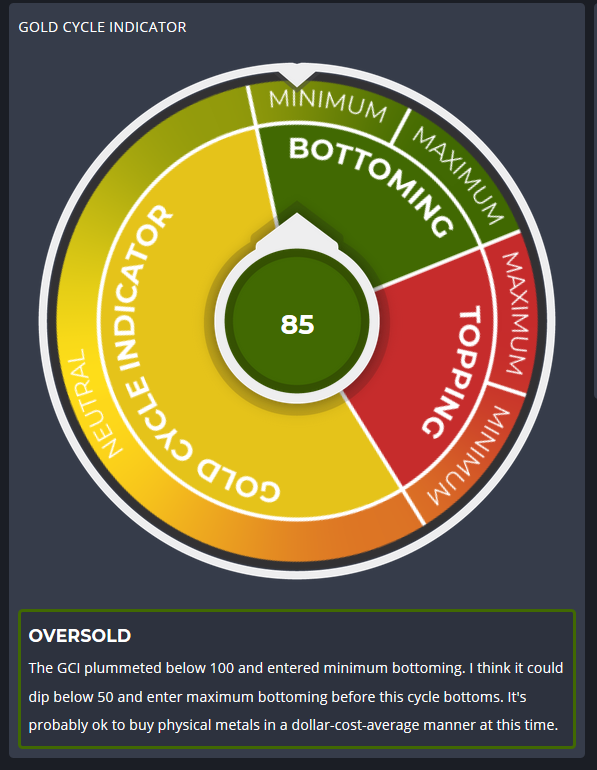

GOLD CYCLE INDICATOR: The gold cycle indicator finished the week at 85 and within minimum bottoming territory. Depending on the market’s reaction to the Fed, I see the potential for a bottom in gold as soon as next week. With the massive spike in volatility, it’s best to be patient. The gold cycle indicator could reach maximum bottoming in a reading of 0 (zero) before this 6-month cycle bottoms.

-GOLD MONTHLY- Gold remains in a structural bull market after breaking above the $1377 high last year. Worst-case scenario, prices may come back to test the $1370 – $1400 level. The larger 10-year basing pattern continues unabated. A breakout above $2000 remains our primary outlook.

-GOLD DAILY- In one week, gold crashed from “maximum topping” and a reading of 412 (Monday) to minimum bottoming and a reading of 85 by Friday’s close. That’s how fast prices are moving.

Extreme volatility like this overrides most cycles and can make forecasting difficult. Instead of running on fundamentals, the markets have been running on fear, and that makes them unpredictable.

I’m beginning to think we could get a bottom in gold as soon as next week. What kind of bottom? I’m not sure. Technically, it’s too early for a 6-month low…it’s only been 4-months. But with FEAR spiking, I can’t rule out anything. Currently, we have more questions than answers, so patience is key until we know more.

-SILVER WEEKLY- The recent decline in silver has…well…scared the hell out of me. I did not expect anything this severe. Now, that doesn’t mean all hope is lost. For that, silver would have to drop and then stay below $13.50 for several weeks.

I love silver as an investment, and I’m not ready to give up just yet. In my opinion, precious metals and especially silver needed something to spark an increase in investment demand. Remember how last year the US mint sold the least amount of gold eagle coins ever??? Well, the coronavirus has spiked investment demand. Just what we needed.

I think prices will hold support around $14.00. But if prices do spike lower, I think it’ll just be temporary as “investor demand” will force prices higher.

-SILVER DAILY- Silver prices finished the week in crash mode. The next level of support is last May’s 6-month low around $14.27.

I think prices will hold support surrounding $14.00. But, if prices continue to crash and break below $13.50, then there’s no telling how low they could go. If that happens, my guess would be a drop to $10.00.

-PLATINUM WEEKLY- Like silver, platinum is back down testing long-term support. I’d like to see prices hold between $700 and $750, but they may not. A decisive breakdown below $700 would imply a recession and deflationary deleveraging.

-PLATINUM DAILY- Platinum has been making interim lows approximately every 27 to 32 trading days. The last cycle bottom 23 days ago so we could be getting close to a low. Prices may bottom surrounding next week’s Fed announcement.

-PALLADIUM MONTHLY- I have to see where prices finish the month, but it’s beginning to look like palladium reached a multi-year peak just shy of the upper boundary. A monthly close below $1580 would confirm a top and support a decline to the lower trend channel around $500.

-GDX- Gold miners crashed on Friday, reaching a low of $16.50. The severe collapse is unjustified and, at some point, should result in a significant snapback rally.

-GDXJ- Junior miners collapsed, dropping briefly below $20.00 on Friday in an outright capitulation. Sooner or later, miners are going to bounce, and I suspect it will be just as violent.

Have a safe and pleasant weekend.

Premium members – expect multiple updates throughout the week.