The Educational Metals Portfolio is a long-term accumulation strategy designed to reduce trading stress and improve long-term gains. The Educational Metals Portfolio is for informational purposes only and should not be construed as a solicitation or offer to buy or sell any financial instrument. Consult a licensed and qualified professional before making any investment decisions.

Asset Allocation: There are several schools of thought on proper asset allocation. Most investment professionals would likely suggest a maximum allocation of 5% or 10% into gold or precious metals.

Physical Precious Metals: Physical precious metals are ALWAYS our first choice. We prefer recognizable, government-issued coins over bullion, bars or rounds. Bars and rounds can be counterfeited easily. When it comes time to sell, you will want something that is readily accepted. Some dealers may require bullion products to be assayed before releasing funds.

Once you have established a robust core position in physical metals, then you may want to consider allocating a little to gold and silver miners, depending on your risk tolerance.

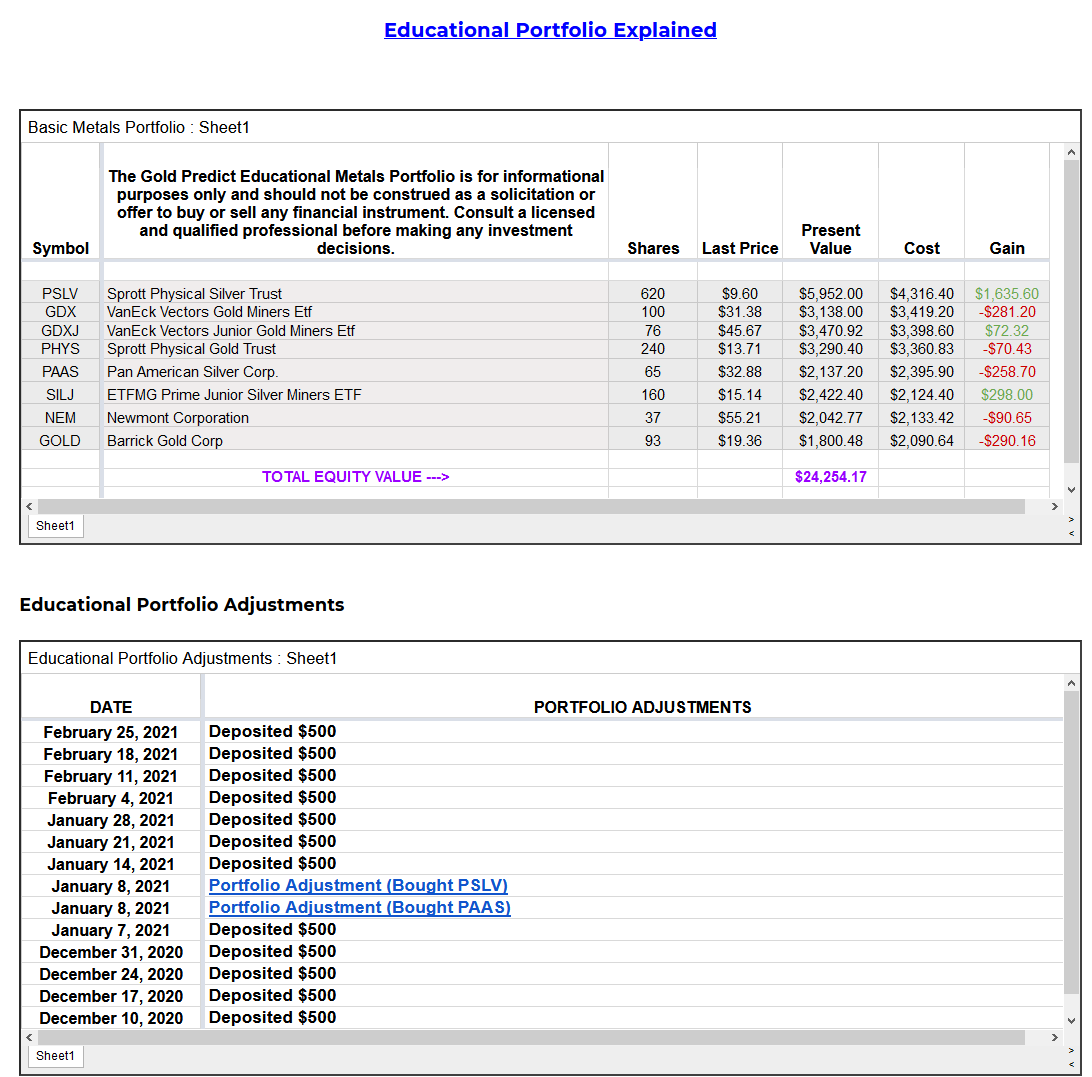

Educational Metals Portfolio: I started the Educational Metals Portfolio in April 2020 with $10,000. Each week, I add $500 to this account (the accumulation aspect of the strategy). For trading signals, I use the Gold Cycle Indicator (GCI) and the Long-Term Indicator. When the GCI reaches certain levels (listed below), I put some money to work. The portfolio will hold these positions until the Long-Term Indicator rises above 45 and enters the mania phase, likely after 2030.

Deployment Strategy For Cash Reserves

- When the GCI dips below 100, I will enter 25% of the cash reserves.

- When the GCI hits 50 or less, I will add 50% of the cash reserves.

- When the GCI reaches zero, I add 100% of the remaining cash reserves.

- If the cash reserves are depleted, and the GCI remains below 100, the $500 deposited weekly will be added directly to the portfolio.

Note: I’ll buy whatever asset(s) is/are underperforming at that time.

The spreadsheet tracks every entry and deposit.

Premium members can view the portfolio in the Member Data Center.

If one or more assets are underperforming on a long-term basis, I may replace it/them within the portfolio.

IMPORTANT- Risk only the money you are willing to lose. Buying ETFs, options, futures, and equities carry extreme risk – you could lose everything…and then some. We do NOT recommend trading. A long-term approach is preferred.