Gold is about to test the $2100 level while the S&P 500 is nearing its pre-coronavirus February peak. It feels like we are entering a crucial and potentially volatile period. I think things may start to selloff if Congress continues to defer a second stimulus package.

Tomorrow’s employment data could trigger a multi-week correction in stocks and precious metals. This scenario requires a bottom in the US dollar.

Note: If the dollar doesn’t bottom and continues its decline – then gold could continue above $2100 and enter a mini-bubble.

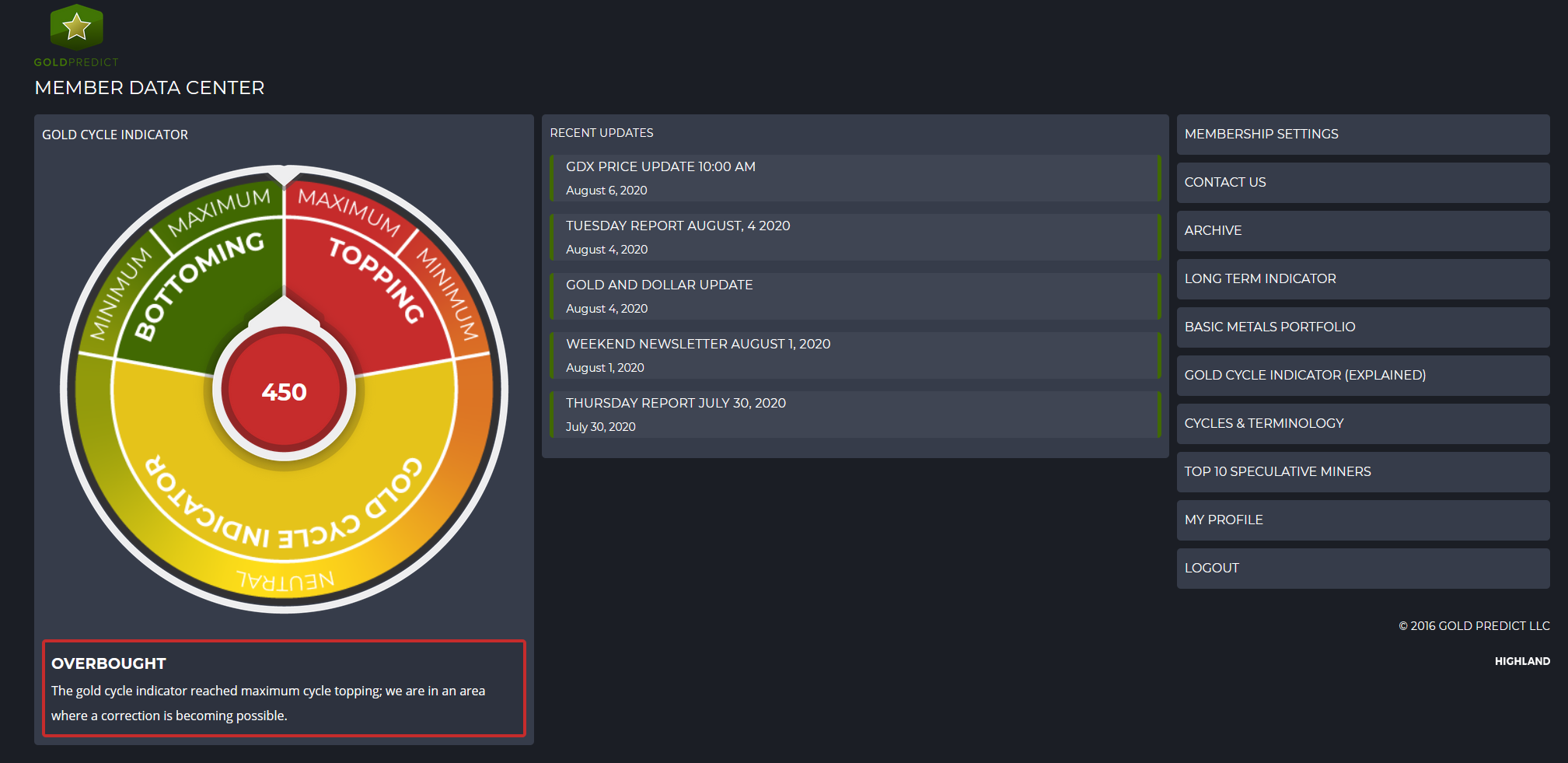

The gold cycle indicator remains pegged at 450; the near-term trend is very overbought.

-GOLD DAILY- Any close back below $2000 in the coming days would support a spike high and temporary peak in gold. Prices would have to close progressively above $2100 to extend the current advance.

-SILVER- Silver broke the $26.00 level and is testing resistance around $28.00. It looks like prices want to test $30.00. Tomorrow and Monday’s close are crucial. Still no evidence of a top.

-PLATINUM- Platinum is about to test the $1050 resistance zone. Prices would have to break decisively above $1050 to support more upside.

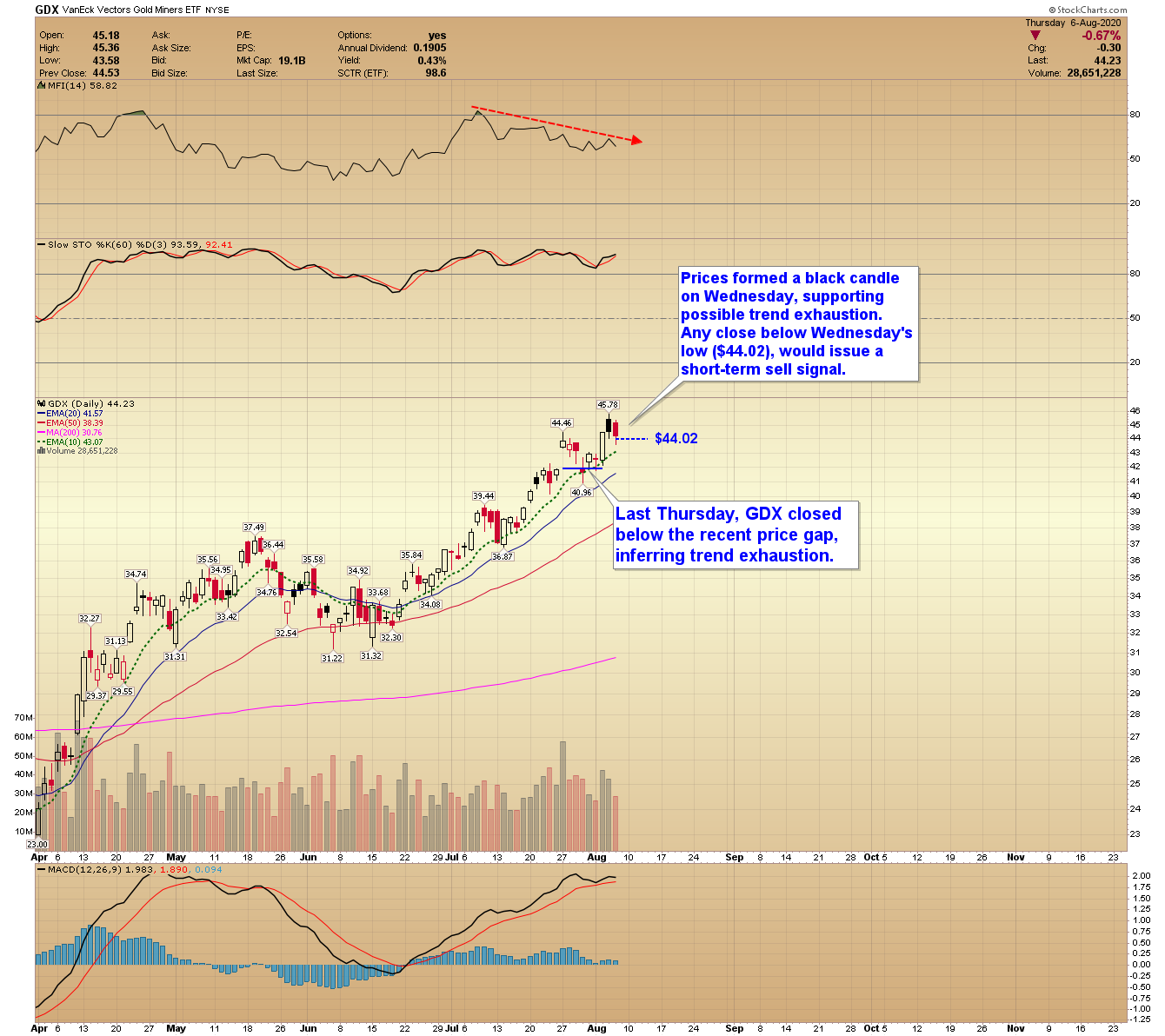

-GDX- Prices formed a black candle on Wednesday, supporting possible trend exhaustion. Any close below Wednesday’s low ($44.02), would issue a short-term sell signal.

-GDXJ- Yesterday, miners formed a black candle. Closing below $62.94 would issue a short-term sell signal and represent a potential top.

-SPY- Stocks are within striking distance of the February top. Like gold, the near-term trend is extremely overbought and due for a significant pullback. The 10-year Treasury yield continues to diverge similarly to the February peak. I’m beginning to think gold and stocks could decline together after prices top.

I’ll update Premium members after tomorrow’s employment report and again mid-morning. The trend in stock and precious metals is so stretched that when they peak – prices could selloff sharply.