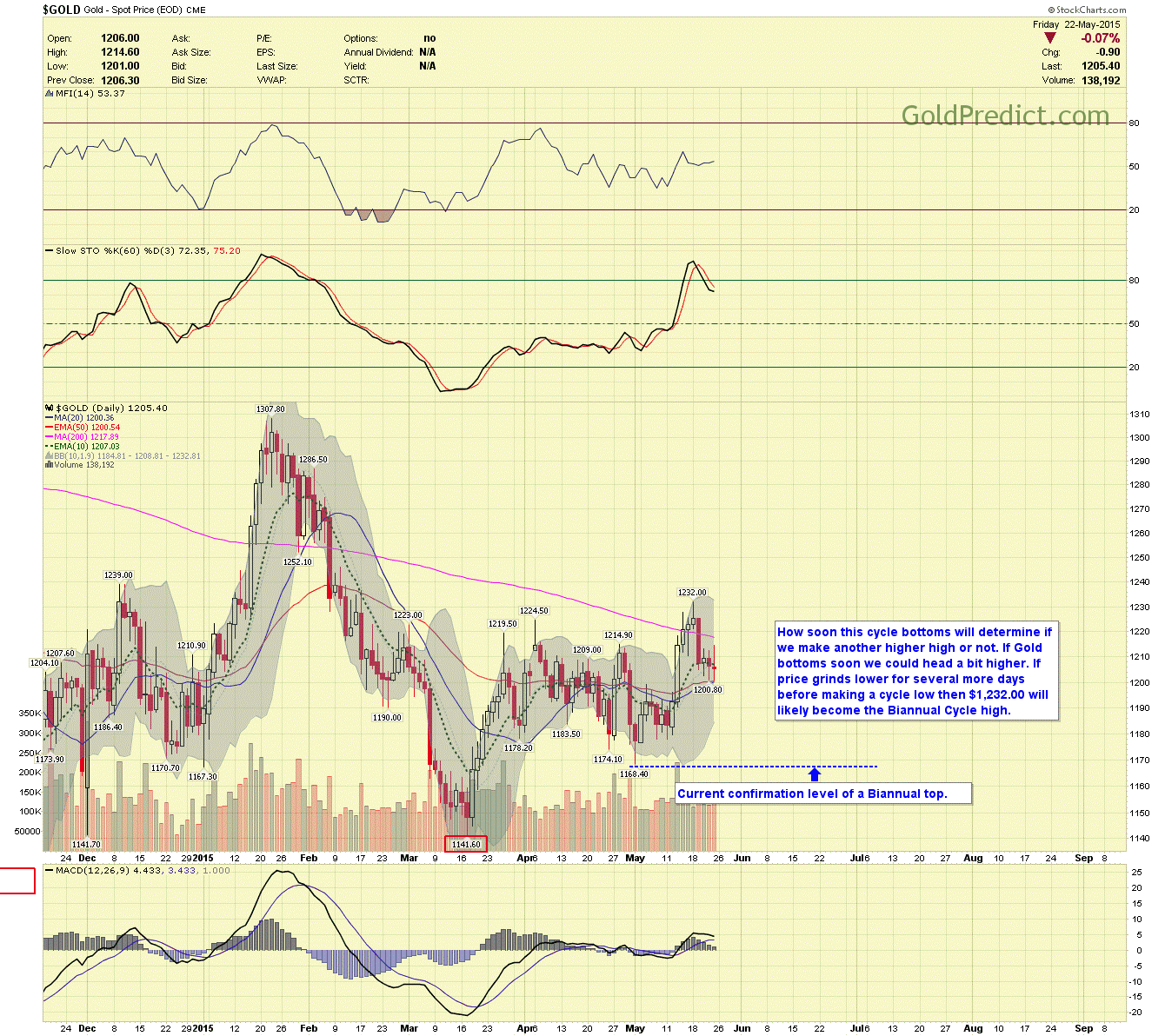

With the Dollar continuing higher into Friday, it greatly increases the probability that Gold, Silver and the Miners have topped in their Biannual cycles. If this does turn out to be the case, the Gold gained a meager $90 from its March Biannual low, unimpressive to say the least. We lack a few confirmations, but I would assign a 70% probability to Gold and Silver having topped in their respective Biannual cycles. If the prices have indeed topped, we can expect the overall trend to be down until Mid-Summer (July/August).

-US DOLLAR- It appear the US Dollar made a cycle low on day 34 of its cycle, I’m surprised it didn’t fall a bit further to challenge the 200-day average. The 93.15 level is now rather substantial and if broken could lead to much lower prices for the Dollar.

-GOLD WEEKLY- Gold has topped between weeks 9 and 11 over the last two years, and last week ended week nine. Just another indicator suggesting that the Biannual Cycle may have already topped.

-GOLD DAILY- The Gold common cycle is on day 15 and could form a cycle low any day now. If price bottoms soon theoretically It could make a new high before rolling over, if price corrects for several more days however before forming a cycle low, then $1,232.00 will likely not be exceeded.

-SILVER WEEKLY- It looks like the 50-week average stopped price once again, we need a few confirmations, but it’s becoming possible we topped last week.

-SILVER DAILY- The daily chart looks to be setting up a small bear flag before another price drop.

-GDX DAILY- Price appears to have topped just like the last cycle did at the 200-day moving average. On Friday, price closed at the lows of the day and very close to the trend line, it may be setting up to break it early next week.

-GDXJ DAILY- It too looks to be setting up for a bearish breakdown through the trend line.