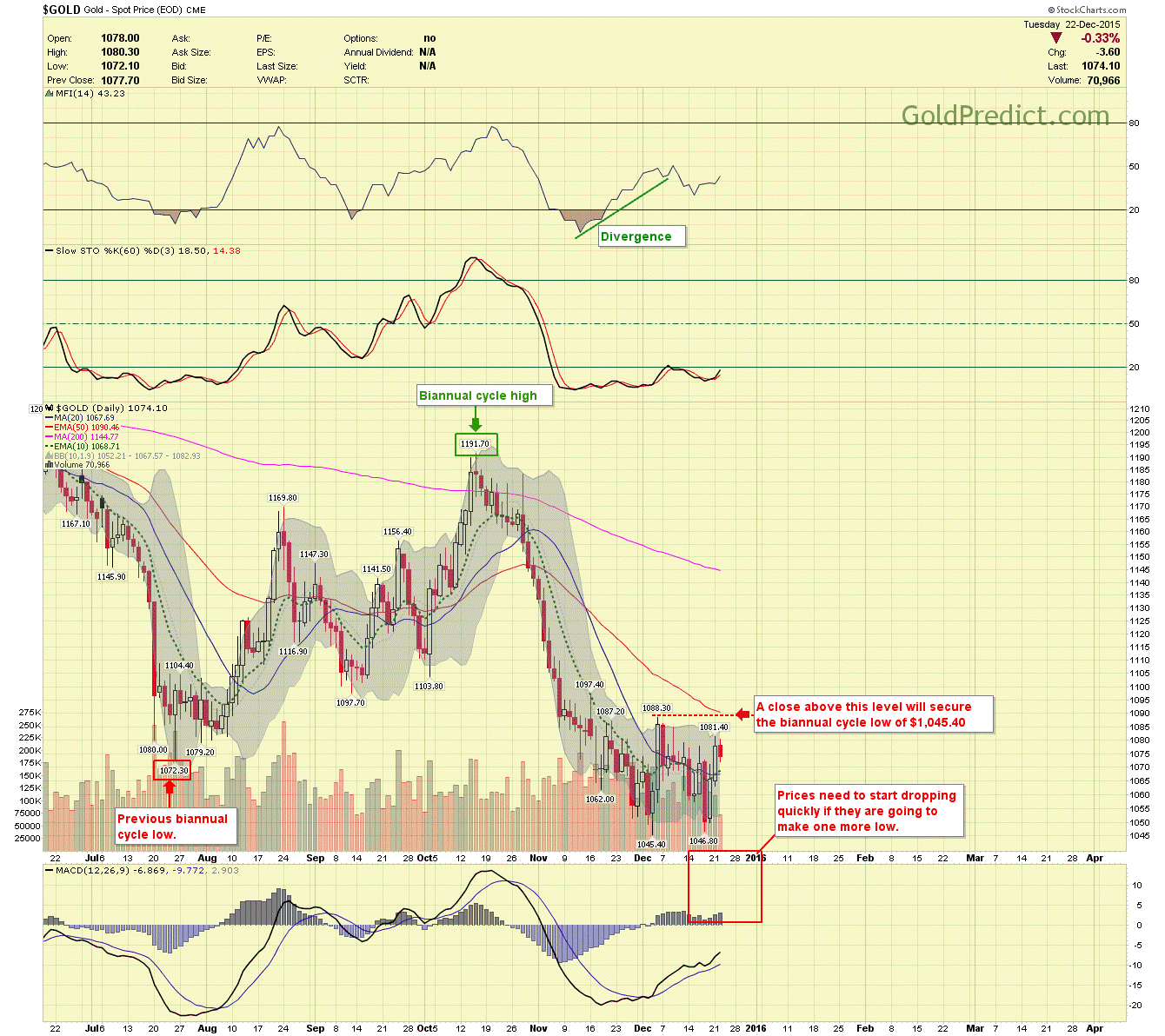

Gold, Silver and Miners are making it difficult to identify the biannual cycle low; if they are still headed a bit lower, they will need to break down soon or they risk running out of time. The dollar has pulled back some and is in jeopardy of breaking the recent cycle low, it needs to turn higher quickly. There is also a chart of the CRB commodity index at the very end.

-US DOLLAR- If the dollar closes below 98 within the next few days the cycle likely topped, and prices should head lower.

-GOLD- Either prices will turn down soon or break above the red dashed line confirming $1,045.40 as the biannual cycle low.

-SILVER- The same as Sunday; there needs to be a solid close above $14.40 to confirm a low or prices will turn down soon.

-GDX- Prices are hanging around and will either drop soon or break above the blue trend line.

-GDXJ- Price needs to break higher or lower for clear direction.

-SPY- Prices climbed to close the gap made Friday but on light volume. Trading is quiet through the Holidays and prices may just keep whipsawing investors to death.

-CRB- The Reuters CRB index measures core commodities, prices have dropped to levels not seen since 1975, hinting of deflation and also that commodities are cheap.

I will put out a brief report Thursday after the close, remember markets close at 1 PM EST.