Prices are continuing towards their respective target areas, and I will be watching for signs of topping. I may have to adjust the target areas as the price structure develops but once we top prices should head lower into the year end. Once we have a confirmed biannual cycle top, I will assess target lows but Gold should retest the $1,170-$1,185 levels again.

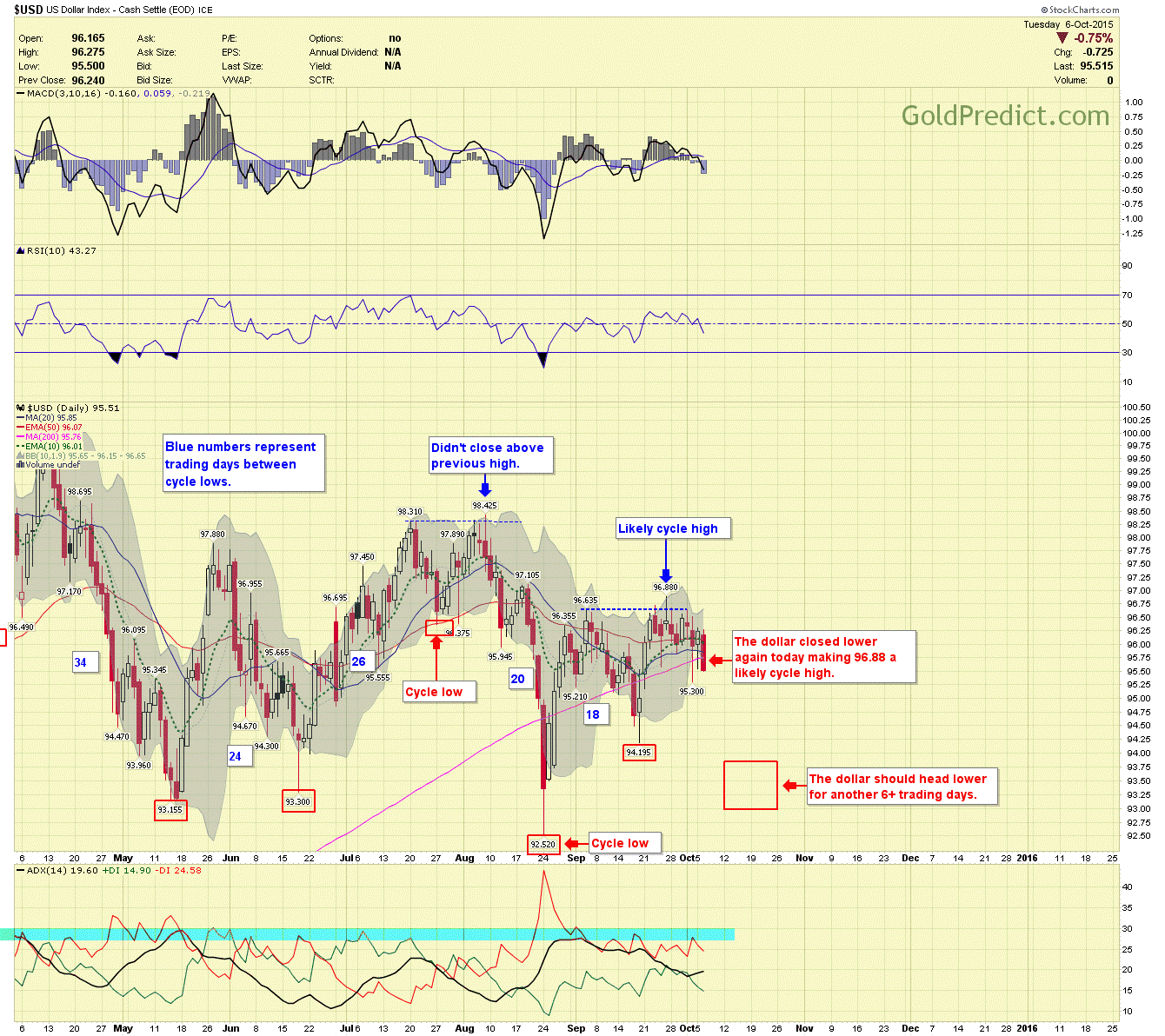

-US DOLLAR- The dollar made a lower close below the 10-day average, and it appears to have topped in this current cycle. It is on day 12, and prices should head lower for 6+ more trading days before finding a bottom.

-GOLD- Price confirmed the $1,103.80 as a common cycle low and we should continue higher toward the 200-day moving average and target box.

-SILVER- Prices are making up for lost time and have rallied hard, they are already at the 200-day average and should target the $16.33 area next which happens to be the 50-week moving average.

-GDX- Price is already at the edge of the target box and still looks relatively strong.

-GDXJ- Prices have been a little weaker for GDXJ, but it is close to breaking the previous high at $21.67 and it is approaching the target area.

-SPY- Stocks are still volatile, and they struggle to make consecutive closes above the 50-day moving average. There is an obvious gap between 195-196 that will likely get filled.

Have a good night.